The cryptocurrency market is currently experiencing a period of stabilization following a significant decline on Tuesday, October 22, resulting in the liquidations exhibiting indications of a cooling process

Yesterday, the global crypto market capitalization experienced a $57 billion decline, reaching $2.44 trillion, as per CoinGecko’s data. This comes after the market reached a three-month high of $2.498 trillion the previous day.

The global market cap experienced a 2.5% decline in the past 24 hours, resulting in an additional $7 billion loss.

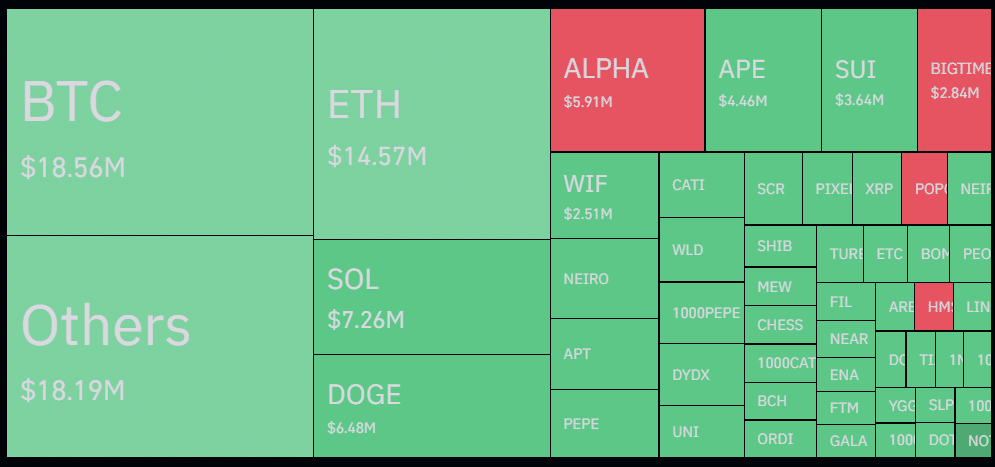

According to Coinglass data, the total crypto liquidations have decreased by 40% over the past day, reaching $121 million, as the Tuesday selloff subsides. Long positions account for 75% of the liquidations, which total $91 million, due to the market-wide downturn.

Bitcoin is currently the most liquid asset, with $18.5 million in liquidations, consisting of $7.5 million in shorts and $11 million in longs, as the price declined below $67,000. At the time of writing, the price of BTC is $66,800, which represents a one-week low.

Ethereum’s long-short ratio was comparatively high, with $11.2 million of its $14.5 million total liquidations being allocated to long trading positions. Despite the bearish sentiment that surrounds it, ETH continues to float above the $2,600 psychological zone.

The greatest single liquidation order, valued at nearly $690,000 in the Solana/USDT pair, occurred on Binance, the largest crypto exchange by trading volume.

The market-wide sentiment turned adverse, resulting in the first day of outflows for spot BTC exchange-traded funds in the United States, according to a report from crypto.news.

Ark and 21Share’s ARKB fund led the net outflow of $79.1 million from these investment products, which totaled $134.7 million.

Conversely, market uncertainty resulted in a net inflow of $11.9 million into ETH ETFs.