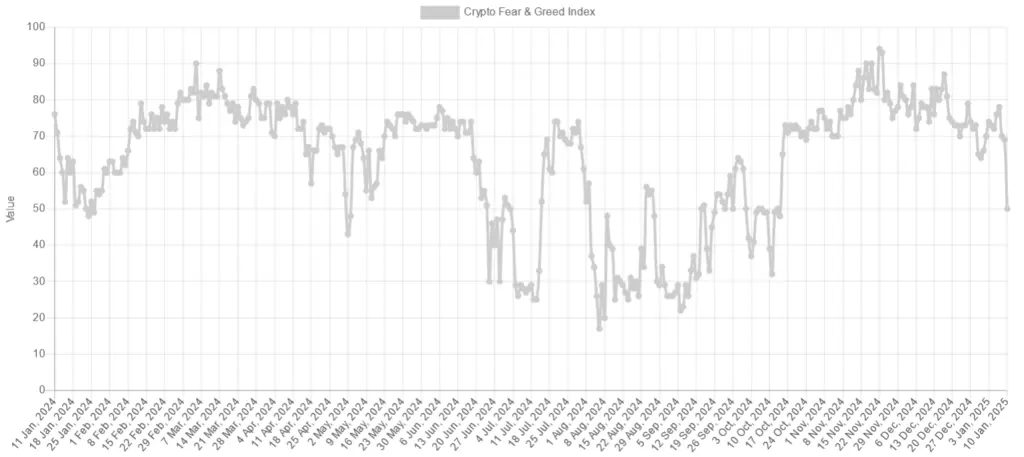

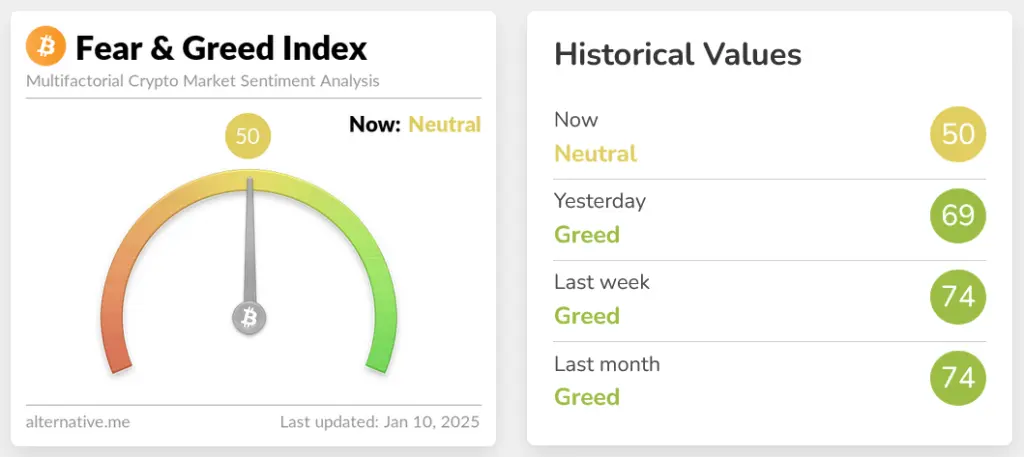

The Crypto Fear & Greed Index, reflecting Bitcoin and overall crypto market sentiment, dropped 19 points in a day to its lowest since Oct. 14.

The Crypto Fear & Greed Index, which is a metric of the sentiment of the broader crypto market and Bitcoin, experienced a 19-point decline in a single day, reaching its lowest level since October 14.

After three months in the “Extreme Greed” and “Greed” zones, the market sentiment dropped to the “Neutral” zone as a result of the index’s plunge to a score of 50 out of 100, which is one of the largest daily decreases in the last few years.

After a report that the US Department of Justice had been cleared to sell $6.5 billion worth of the 198,000 Bitcoins seized from Silk Road, Bitcoin’s price plummeted below $92,000 on Jan. 9. However, no Bitcoin has been sold thus far.

The decline has also been attributed by analysts to the possibility that the US Federal Reserve may tighten monetary policy in 2025, which would have an impact on Bitcoin and the broader crypto market.

In recent months, Bitcoin has remained primarily below $100,000 due to a strengthening US dollar and increasing Treasury yields.

10x Research’s founder Markus Thielen stated on January 5 that the second-largest outflow of roughly $570 million in US spot Bitcoin exchange-traded funds occurred on January 8, suggesting that Bitcoin may experience an even greater retracement.

The Crypto Fear & Greed Index calculates an aggregate score by evaluating market volatility (25%), trading volume (25%), social media sentiment (15%), Bitcoin’s dominance (10%), and trends (10%).

The market was responding favorably to Republican Donald Trump’s presidential election victory and speculation regarding a strategic US Bitcoin reserve in 2025, resulting in the index score reaching a 2024 high of 94 out of 100 on Nov. 22.