Major infra projects raised $685 million in fresh finance in Q2, with crypto infrastructure projects leading in obtaining venture money.

Pitchbook data shows that although the total number of deals fell in Q2 of this year, cryptocurrency businesses raised a little more in venture capital funding than in Q1.

Pitchbook said in a study on August 9 that while total money invested increased by 2.5%, the number of deals fell by 12.5% from Q1 to Q2.

This may indicate more incredible promise from institutional investors in the market, according to Pitchbook.

“We anticipate the volume and pace of investments to continue increasing throughout the year, barring any major market downturns, with positive investor sentiment returning to crypto,” Pitchbook stated.

According to Pitchbook, Q2 funding is primarily going to infrastructure projects. Layer-1 platform Monad raised $225 million in a Series A funding round, DeFi protocol BeraChain, which stands for “DeFi Proof-of-Liquidity,” raised $100 million in a Series B round, and Bitcoin restaking platform Babylon raised $70 million in an early-stage round.

Two “mega-rounds” were also mentioned in Pitchbook: blockchain gaming platform Zentry raised $140 million in an early-stage round, and decentralized social media protocol Farcaster raised $150 million in a Series A round at a $1 billion post-money valuation.

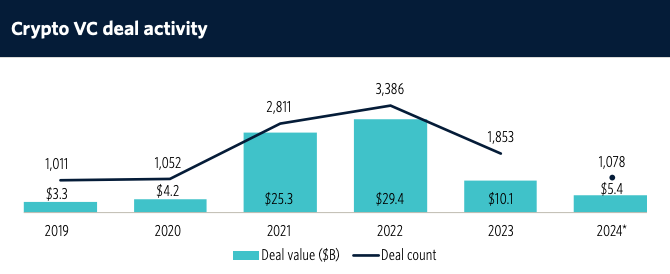

The last 18 months have seen a significant slowdown in fundraising for cryptocurrency businesses compared to 2021 and 2022, when $25.3 billion and $29.4 billion in new capital were raised, respectively.

At present rates, the current year is on track to raise $10.8 billion, with a total investment for businesses reaching $10.1 billion in 2023.

Compared to 2021 and 2022, venture financing for cryptocurrency has significantly slowed down in 2024. Pitching book, the source

The survey also mentioned how the early phases of the cryptocurrency startup funding round saw a rise in competition, but the latter stages saw a decline.

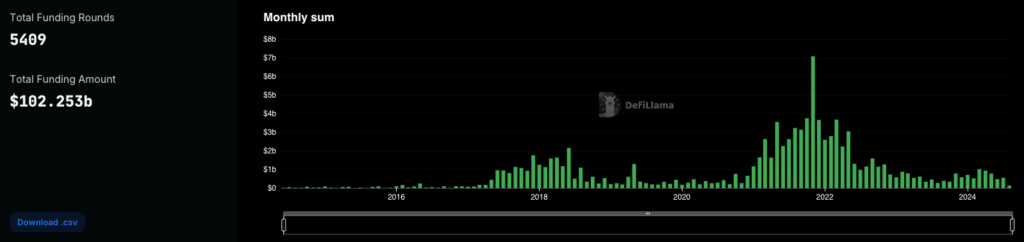

Since June 2014, more than $102 billion in capital has come into the blockchain business over 5,400 funding rounds, according to DefiLlama.

The research was released fewer than three months after venture capital companies Pioneer and Pantera Capital announced plans to seek $1 billion and $850 million, respectively, to launch new cryptocurrency funds.

Since Silicon Valley-based venture capital firm Andreessen Horowitz (a16z) raised a record-breaking $4.5 billion in May 2022, the cryptocurrency market has seen the most significant fundraising round, valued at $1 billion, from Pantera Capital.

According to a16z, it received $7.2 billion in May to invest in several technology areas, such as gaming and artificial intelligence but decided against replenishing its fund dedicated to cryptocurrencies.