Crypto stocks like Circle and Coinbase slid 7–12% ahead of Powell’s Jackson Hole speech as Fed rate cut hopes fade.

Before Jerome Powell’s Jackson Hole address on Friday, August 22, Crypto stocks such as Circle (NYSE: CRCL) and Coinbase (NASDAQ: COIN) had experienced significant selling pressure.

Both equities dropped 7–12% in the last week as economic uncertainty increased and expectations of a Fed rate reduction declined at the September FOMC meeting.

The Wall Street party for cryptocurrency companies has been dwindling lately.

Coinbase, Circle, Two Crypto Stocks, Are Under Pressure

Bears have taken over after the short IPO party, and the Circle (NYSE: CRCL) stock has been moving sideways, down more than 55% from its June highs of $300.

As investors ride the volatility, the CRCL stock was trading at $131.80 at the end of Thursday.

This is despite the company’s successful Layer-1 Arc blockchain launch in Q2.

According to recent reports, corporate officials, including CEO Jeremy Allaire, have sold in large quantities.

Circle announced intentions for a secondary offering of 10 million shares valued at $1.4 billion just two months after its initial public offering.

Jeremy Allaire, the CEO, and other current stockholders will sell eight million of these.

According to reports, Allaire alone sold 357,812 shares for $45.5 million.

This company announcement has heightened concerns regarding management’s confidence in the existing valuation.

According to well-known expert Ali Martinez, the CRCL stock has broken down from the support levels, setting $100 as the next objective.

An additional 25–30% drop from current prices would be represented by the lower Fibonacci extension levels, which are between $96 and $100.

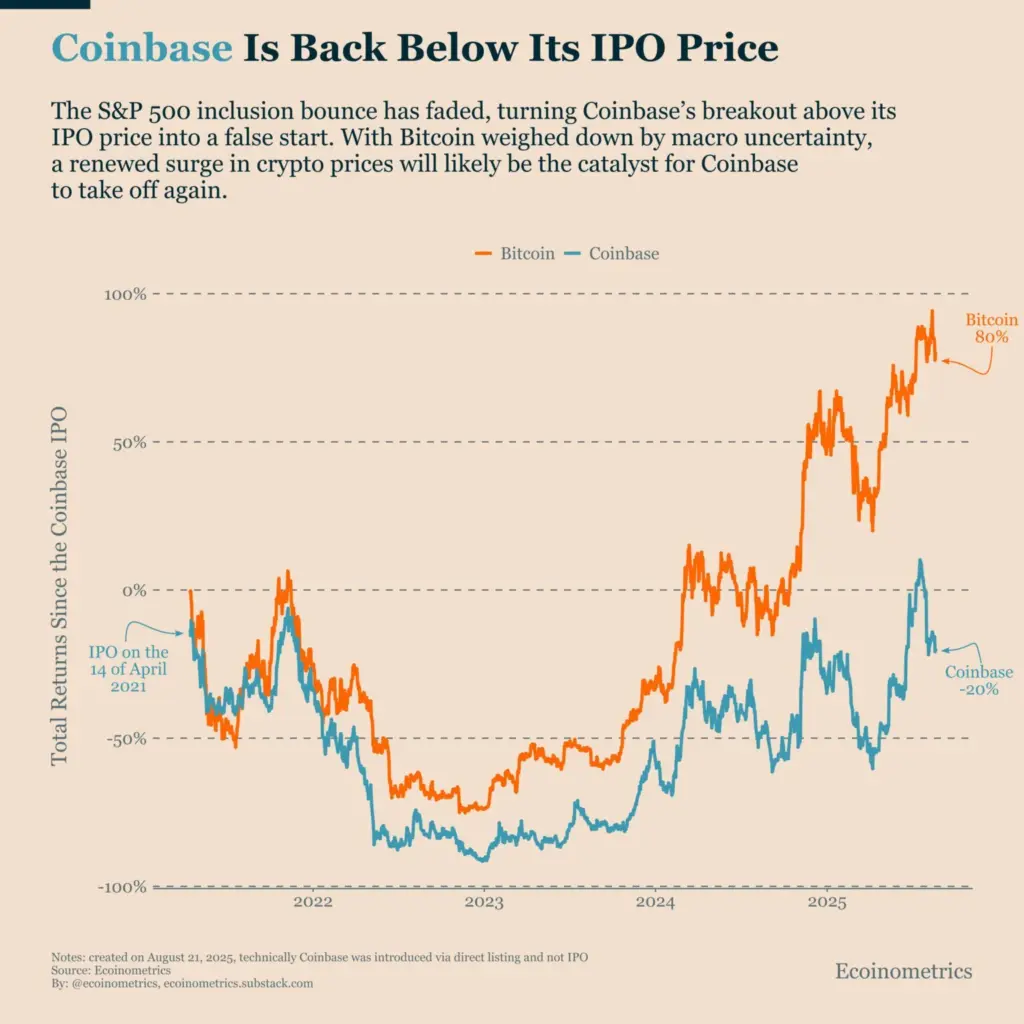

Coinbase Stock Drops Below Its Pre-IPO Level

Coinbase (NASDAQ: COIN), another Crypto stocks, has experienced selling pressure and has dropped 25% in the last month.

After the recent slump, the COIN stock fell below its initial public offering (IPO) price.

The previous month’s breakout above the IPO price appears to have been a false start, as the impetus that propelled advances since May has waned.

Despite this decline, Coinbase signed a significant $2.9 billion agreement in August to acquire Deribit, a platform for cryptocurrency derivatives.

According to blockchain analytics firm ecoinometrics, Crypto stocks trades in lockstep with Bitcoin.

Coinbase has lost its upward momentum due to BTC being impacted by macro uncertainty.

Powell’s Radar Jackson Hole Speech

The current Jackson Hole meeting will feature a speech by Federal Reserve Chairman Jerome Powell on Friday, August 22.

Powell’s announcement of a change in monetary policy is the focus of all market experts.

However, the Fed’s likelihood of a rate decrease at the September FOMC has dropped to 70%.

Powell is in a tough place since inflationary pressure still hovers above the unemployment statistics.