Crypto trader loses $68 million in address poisoning scam (WBTC).

In an address-poisoning scam, an unidentified merchant lost $68 million worth of Wrapped Bitcoin (WBTC) in a single transaction.

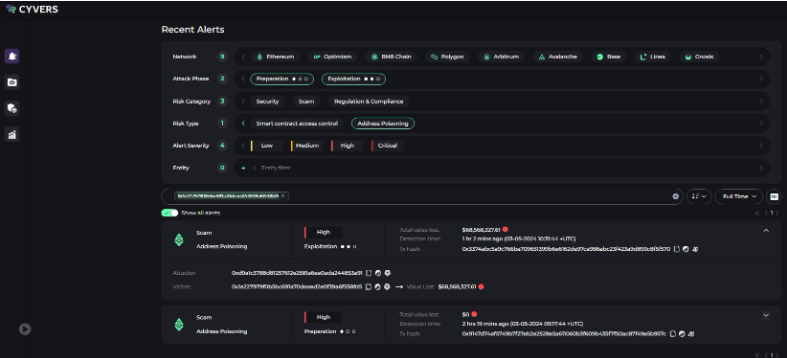

The $68 million theft was initially disclosed in a May 3 X post by on-chain security firm Cyvers:

“Are we mistaken, or has someone truly lost $68 million worth of $WBTC? Our system has detected another address falling victim to address poisoning, losing 1,155 $WBTC.”

CoinStats reported that the target wallet, “0x1E,” has lost more than 97% of its overall assets, which are valued at more than $67.8 million.

Address poisoning, also known as address spoofing, is a malicious tactic that exploits merchants’ laxity and haste in conducting business. Scammers deceive victims into transferring their digital assets to illegitimate email addresses.

Crypto Scams Reach an All-time Low of $25 Million in April

Scams persist in undermining public confidence in the cryptocurrency sector. In April, investors lost a minimum of $33 million worth of digital assets due to the fraud case involving the ZKasino gambling platform. On April 29, Dutch authorities apprehended a suspect in connection with the ZKasino fraud.

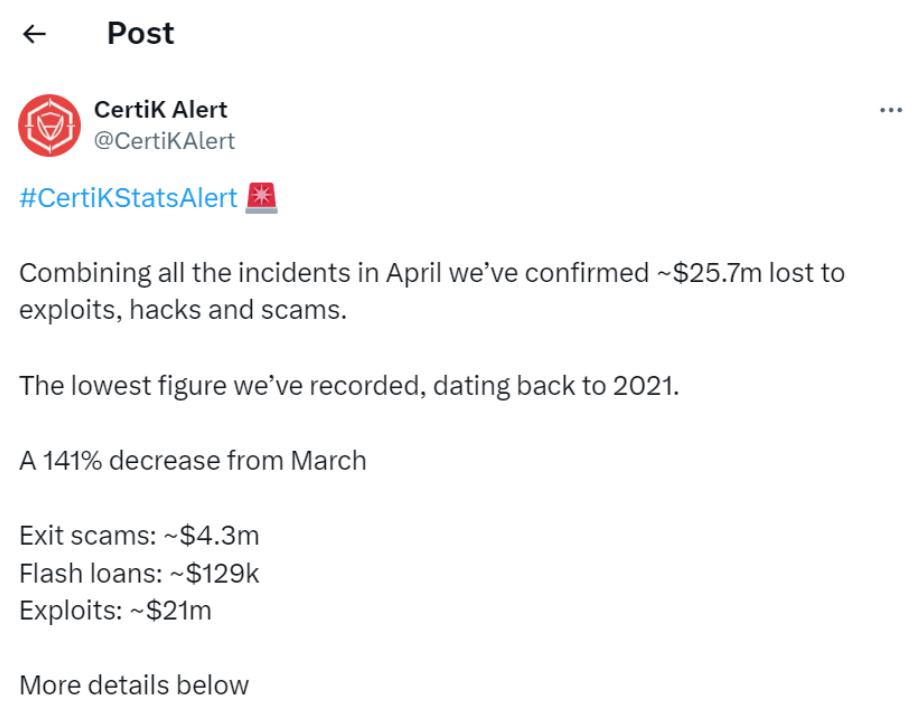

Despite the ZKasino incident, the total amount of cryptocurrency lost to scams and breaches in April was only $25.7 million. This is the lowest figure in history since 2021, when CertiK, an on-chain intelligence firm, began monitoring the data.

According to the report, losses attributable to breaches, exploits, and scams decreased 141% compared to the previous month. The decline is primarily attributable to the absence of compromised private keys. Only three private critical breaches occurred in April, whereas over eleven attacks utilized compromised private keys in March.

The $33 million ZKasino fraud is not accounted for in CertiK’s figures. While the report acknowledges that the initiative is currently “controversial,” it has not yet classified it as a fraudulent scheme.

Investor apprehension was heightened on April 22 when ZKasino transferred every 10,515 Ether deposited by customers into the Lido staking protocol. The report from CertiK stated that the company would revise its figures should it be verified that ZKasino was a malicious actor.