Although their monthly volume is significantly below its all-time peak, crypto VCs resume activities.

Venture capital (VC) funding cycles are amid a resurgence and full tilt of the cryptocurrency bull market.

Aquarius, a cryptocurrency venture firm, unveiled a $600 million multi-strategy liquidity fund on May 16. The fund’s primary objective is to assist blockchain foundations and ecosystem initiatives in augmenting on-chain liquidity.

Aquarius personnel stated to Cointelegraph that “Bitrise Capital, numerous leading miners, family offices, and influencers” support the strategy fund.

Furthermore, the $600 million strategy fund will support early-stage data layer initiatives, blockchain infrastructure, decentralized finance, artificial intelligence, the Bitcoin ecosystem, and modular architecture as they collaborate to develop market-ready products.

Aquarius wrote, “As the first institutionalized fund of its kind, it assists numerous blockchain foundations and ecosystem projects in meeting their liquidity requirements and systematically manages on-chain liquidity.”

Lin Yang, a venture capitalist based in Singapore, established Aquarius in 2018. Yang has provided financial support for noteworthy initiatives like Conflux and investments in burgeoning Web2 sectors, including advanced manufacturing, new energy, and finance. On May 8, the company transferred its headquarters to New York.

As the bull market gains momentum, substantial funding is allocated to crypto ecosystem initiatives.

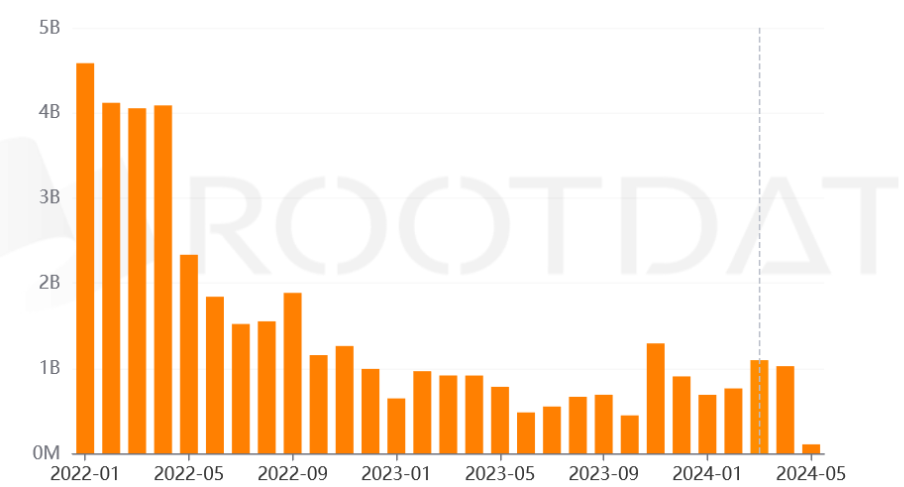

Cointelegraph reported on May 6 that venture capital funding for cryptocurrencies surpassed $1 billion for the second consecutive month this year.

In 161 investment transactions, $1.02 billion in funding was raised in April, compared to $1.09 billion in March; these figures have not been observed since late 2022.

Securitize, a platform for digital securities, raised $47 million in a new round of strategic funding sponsored by BlackRock earlier this month. In addition to stablecoin issuers Paxos and Circle, blockchain developers Aptos Labs were also among the investors.

Joseph Chalom, BlackRock’s global chief of strategic ecosystem partnerships, will join the Securitize board of directors. He described the investment as “another phase in the progression of our digital assets strategy […] which will assist in fulfilling the forthcoming demands of our clientele.”

For the launch of its mainnet in April, Puffer Finance, a liquid staking initiative built on Ethereum’s layer-two solution EigenLayer, secured $18 million in Series A funding from Coinbase Ventures and Kraken Ventures, among others.

The technology of Puffer Finance enables Ethereum validators to decrease their initial capital requirement from 32 ETH for individual stakes to just 1 Ether ETH ticker, a reduction of $2,928. Unbelievably, the protocol has surpassed a locked-in total value of $1.4 billion since its February debut.

The market has undergone significant transformations since it was one year ago.

Tony Cheng, a partner at Foresight Ventures, a Singapore-based cryptocurrency investment firm, advised in September 2023 that projects should do whatever is necessary to endure.

“At the time, he explained, “If you are short on capital and don’t have enough time to get by for the next year or so, you should be taking capital and taking as much as you can get because that money might not be available in two to three months.”

Bitcoin BTC tickers down $64,705 and has gained over 300% since falling below $16,000 in November 2022, when it was affected by the sudden collapse of cryptocurrency exchange FTX.

This increase has been fueled by the approval of spot Bitcoin exchange-traded funds worldwide and the gradual repayment of creditors’ funds held on the defunct exchange.

Early in 2018, some venture capitalists anticipated the current bull market would witness another ICO surge surpassing its previous peaks.