A crypto whale repurchased ETH after missing out on major gains, having previously sold early and lost an estimated $2.67 million in potential profit.

Before a significant rally, a cryptocurrency whale sold more than 2,500 ETH and then repurchased it at a significantly higher price.

After selling Ether for nearly the same price a month ago, a cryptocurrency trader spent $3.8 million to purchase the commodity at a much higher price.

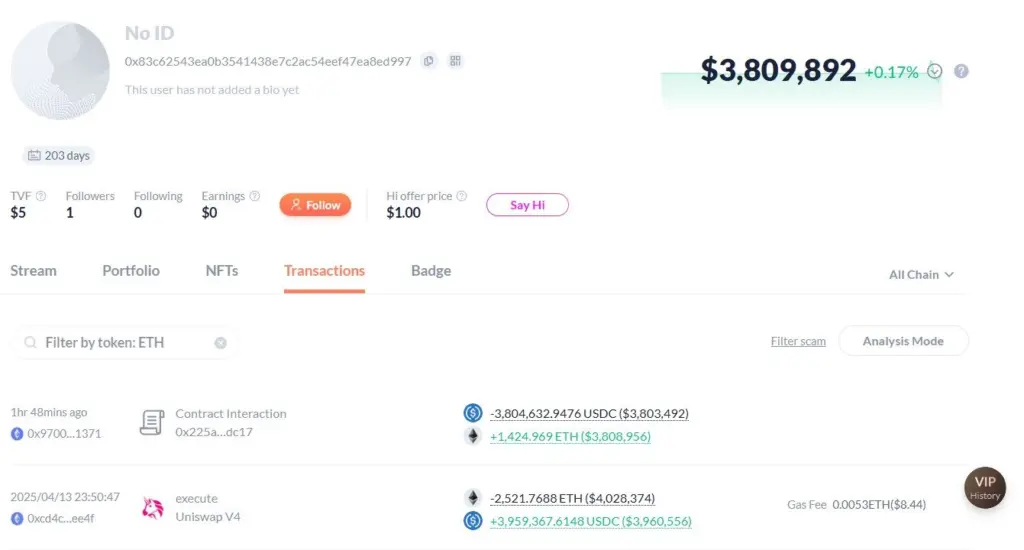

After a significant increase, a crypto wallet spent $3.8 million to buy 1,425 Ether (ETH) at an average price of $2,670 per coin, according to a May 22 report by blockchain analytics company Lookonchain.

In hindsight, the decision to sell 2,522 ETH for $3.9 million on April 13, when the asset was trading at roughly $1,570, appears to have been made at the wrong moment.

Lookonchain commented, “Think twice before selling your bags,” emphasizing the possible profits if the trader kept their Ether rather than selling and repurchasing it at a better price.

The trader forfeits a $2.67 million profit.

The trader lost out on more than 1,000 ETH, or around $2.67 million, in the process of buying back in, as ETH has increased by more than 70% since the sale. If the trader had opted to retain their Ether, the assets would have garnered a valuation of approximately $6.7 million.

As ETH increased in value, it overtook the market capitalization of major corporations such as Alibaba and Coca-Cola.

With a $321 billion market capitalization as of this writing, Ether is the 38th most valuable asset in the world, overtaking pharmaceutical giant AbbVie and edging closer to Bank of America, according to firm data tracker 8marketcap.

Ether’s successful Pectra upgrade rollout was a major factor in its upsurge. The update enhanced the smart wallet functionality, validator user experience, and network scalability. These upgrades likely encourage wider Ethereum mainnet adoption.

With weekly inflows of $205 million, ETH leads cryptocurrency investment products.

In the US, interest in ETH-based investment products has increased with its recent price increase.

According to a May 19 study by digital asset manager CoinShares, $785 million was invested in US cryptocurrency investment products last week. With this event, the total amount for crypto ETPs this year (YTD) has reached $7.5 billion.

Among the cryptocurrency exchange-traded products (ETPs), ETH was the best-performing, drawing in $205 million last week. The amount accounted for 26% of all inflows within that time frame. Additionally, this raised ETH’s year-to-date total to more than $575 million.

According to the CoinShares study, the Ethereum Foundation’s nomination of Tomasz Stańczak as a co-executive director and the resurgence of investor optimism after the Pectra upgrade were the leading causes of the higher inflows.