According to Ki Young Ju, CEO of CryptoQuant, institutional demand for Bitcoin has been on the rise since the beginning of the year

The U.S.-based spot Bitcoin exchange-traded funds have experienced a net inflow of approximately 278,000 BTC since their inception in January, as indicated by Young Ju’s X post. Retail investors account for 80% of the inflows.

Nevertheless, whale addresses that held at least 1,000 BTC—excluding crypto exchanges and mining pools—experienced a 670,000 BTC inflow in the past year.

According to the CEO of CryptoQuant, a prominent market analysis platform, the demand for self-custodial wallets within institutions is “twice as high as at retail.”

The preponderance is under the control of whales

The data from IntoTheBlock indicates that whale addresses, which contain a minimum of 1,000 BTC, are the location of nearly 40% of the Bitcoin supply.

Metaplanet, a Japanese investment firm, is the most recent addition to the list. On October 28, Metaplanet increased its Bitcoin holdings by 156.7 BTC, bringing the total to 1,018 BTC, which was valued at over $70 million at the time of the report, according to crypto.news.

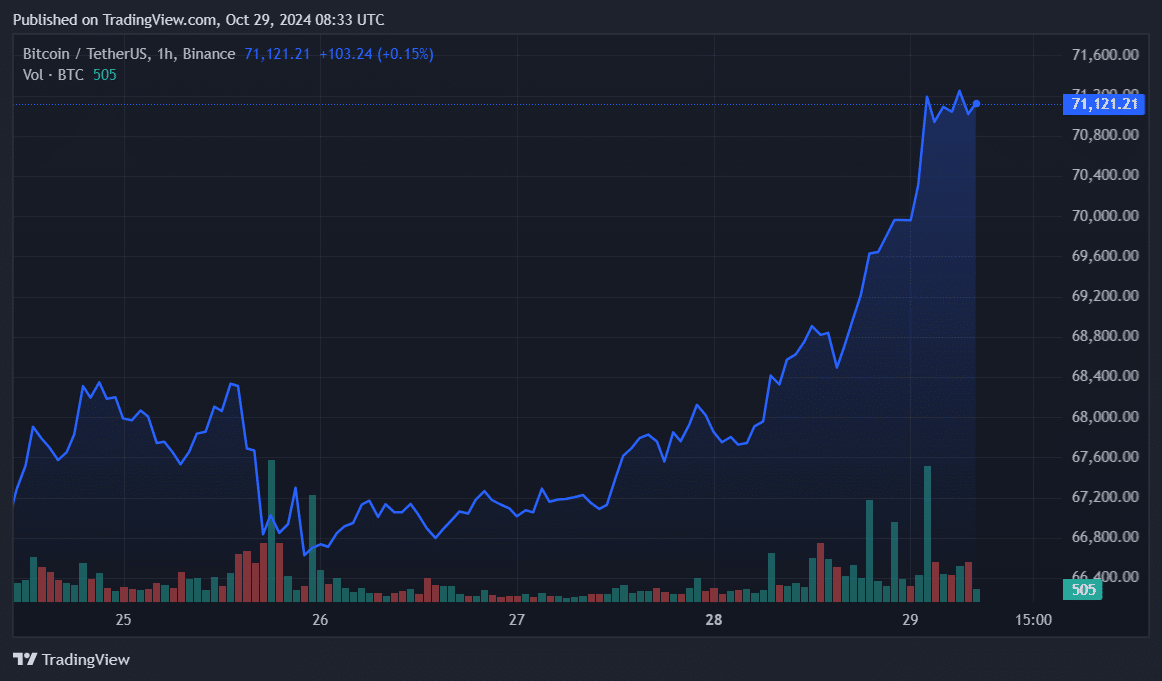

Bitcoin has increased by 4% in the past 24 hours and is currently trading at $70,950 at the time of this writing. Earlier today, the asset briefly reached a five-month high of $71,475. BTC is currently only 3.5% from its all-time peak of $73,750.

The daily trading volume of the premier cryptocurrency increased by 123%, reaching $47 billion. The recent price increase has resulted in Bitcoin’s market capitalization surpassing $1.4 trillion.

ITB reports that over 99% of Bitcoin holders are currently profitable. This could suggest a potential price correction, as it could suggest short-term profit-taking.