Investors are more cautious and split ahead of Tuesday’s U.S. launch of ether ETFs, contrasting with the enthusiasm that greeted bitcoin ETFs

Nathan Gauvin, CEO of Gray Digital, an asset manager, and Blackridge Investment Management, a $2 billion hedge fund, stated, “The event will be less significant than it is being portrayed.”

Trading in the ETFs issued by nine asset managers, including BlackRock, VanEck, and Franklin Templeton, has resumed on U.S. trading platforms six months after bitcoin ETFs were introduced in January.

According to Steven McClurg, the director of U.S. asset management at CoinShares, the consensus forecast is that ether ETFs will attract approximately 25% of Bitcoin’s flows. However, his estimate is only 10%.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LMDFS7DPPJHX3PDL4ED5ES7WAE.jpg)

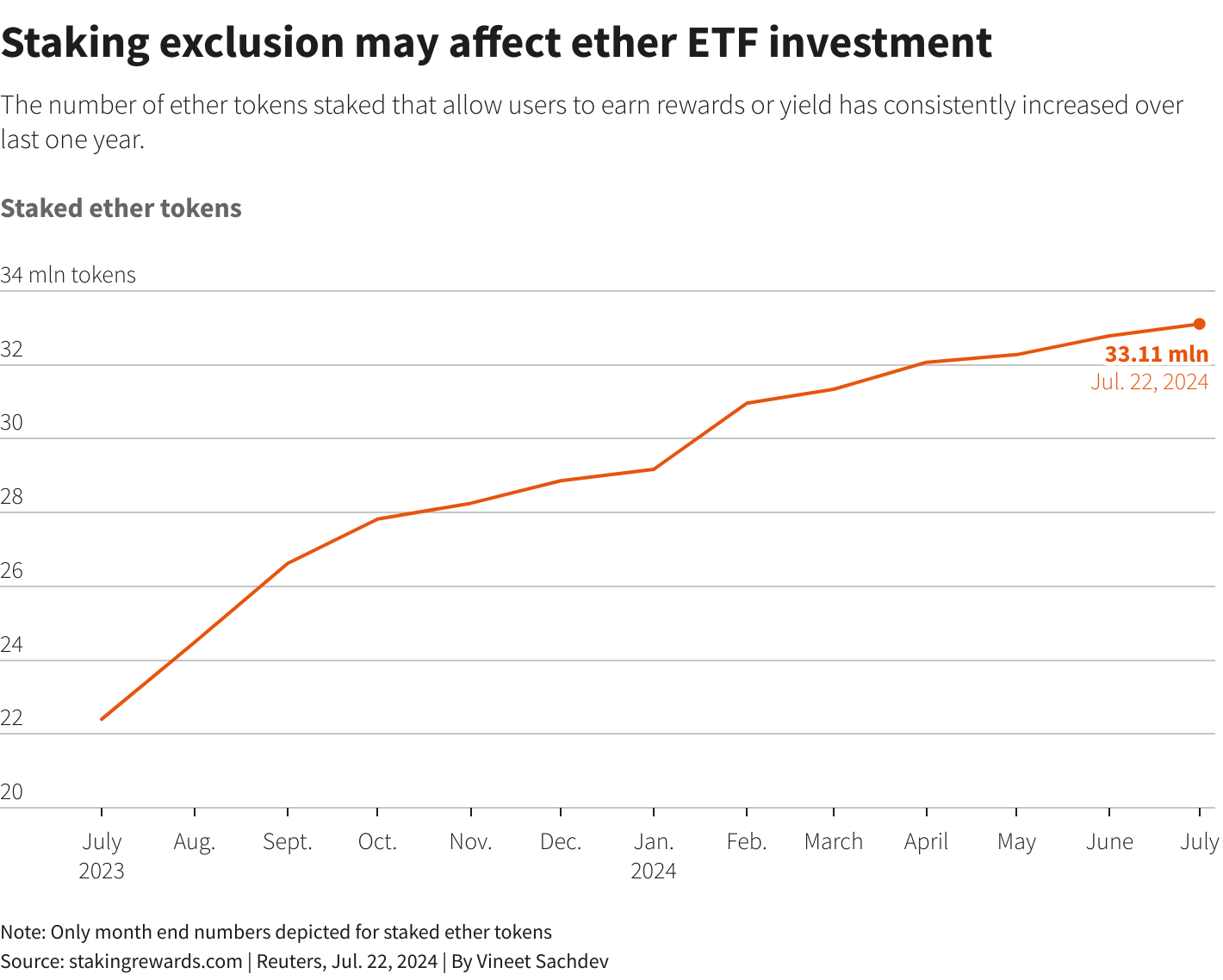

The “staking” mechanism, a critical feature of the Ethereum blockchain that generates ether, the world’s second-largest cryptocurrency after bitcoin, is excluded by the SEC, a significant concern for certain investors.

Staking is a method by which Ethereum users can earn rewards by binding up their ether to assist in the network’s security. The rewards or yield are in the form of newly created ether tokens and a portion of the network transaction fees.

As of July 22, the annual percentage yield on staking Ethereum was approximately 3.12%, as reported by StakingRewards.com. Staking is appealing due to its potential to increase returns.

As it is currently configured, the SEC will only permit ETFs to maintain unstaked, ordinary ether.

McClurg of CoinShares stated, “An institutional investor considering ether is aware that yields are available.” “It’s like a bond manager saying I will buy the bond, but I don’t want the coupon, which contradicts what you’re doing when buying bonds.”

The Securities and Exchange Commission (SEC) regards staking in exchange for tokens as an investment contract, necessitating disclosures and safeguards by U.S. securities laws.

McClurg thinks that investors will continue to stake ether outside an ETF to generate a yield rather than paying fees and holding it in an ETF.

He stated that CoinShares, which manages over $6 billion in assets, will observe the situation’s outcome. “We consciously decided not to get involved in this round for an ETF that’s not staked.”

According to Gauvin of Gray Digital, the ETF will ultimately incorporate staking sometime in the upcoming year. “But this is a midpoint to get there.” The firm is not participating in this launch but will be closely monitored.

‘As if it were a stock that had no dividend’

Chanchal Smadder, the director of products at ETC Group, echoed the sentiments expressed by McClurg of CoinShares, stating that the ETF’s lack of a staking yield is akin to “owning a stock and not having the right to the dividend.”

ETC is the first issuer of crypto exchange-traded products (ETPs) in Germany, with $1.4 billion in assets. ETPs are analogous to ETFs. It has a total of $150 million in ether ETPs, both staked and unstaked.

Smadder stated that the demand for staked ether ETPs is greater than that for unstaked ones. The staked fund has received $51 million in inflows thus far this year, while the unstaked fund has experienced $95 million in outflows.

Smadder did, however, emphasize that illiquidity is a potential danger when staking ether, as validators or stakers must wait in a queue to withdraw their staked ether. He stated that the exit queue processing time could occasionally take eight to nine days.

“With unstacked, the ether is always unlocked and available.”

Nana Murugesan, the president of Matter Labs, a research and development company that assists in the scaling of Ethereum, stated that introducing ether ETFs was less about staking and more of a “watershed moment” in the crypto industry.

Murugesan emphasized that investors’ access to a blockchain that supports numerous applications is of greater significance. “As Ethereum and its adoption grow, the ETF’s value also grows with all the network effects.”

Investors concur that the ether flows are unlikely to approach the bitcoin ETFs captured in the first week of trading, as ether’s market capitalization of $424 billion is significantly lower than that of bitcoin, which is $1.4 trillion.

Morningstar Direct data indicated that Bitcoin ETFs generated nearly $7 billion in assets during their initial three weeks of trading. The ETFs had received a net inflow of $33.1 billion as of the end of June.