As bitcoin rose to record highs on the basis of new U.S. exchange-traded funds, the world’s No.2 cryptocurrency, Ether ETF stayed in the wings

However, a price rally beyond the all-time high of $4,867.60 set in November 2021 by some market participants is possible as companion ETFs for ether are expected to be released shortly.

“Think about the fact that Ethereum has approximately half the level of spot liquidity compared to Bitcoin,” stated Thomas Perfumo, the director of strategy at the crypto exchange Kraken, about ether trading on exchanges.

“Half the amount of liquidity means that you need less absolute dollars coming into the market to make the same price impact on Ethereum.”

The crypto graveyards are brimming with investors who believe they can accurately predict the choppy, hazardous markets.

In the past few days, the market has been impacted by the potential offloading of tokens from the defunct Japanese exchange Mt. Gox, impacting Bitcoin and ether specifically.

The timing of interest rate reduction by the U.S. Federal Reserve and the forthcoming presidential election could also significantly affect the cryptocurrency market.

In a research note, Jag Kooner, the director of derivatives at Bitfinex, advised market participants to anticipate a resurgence in volatility in both traditional and crypto markets. “Regulatory developments and macroeconomic policies will play a crucial role in shaping market dynamics.”

STATED AND INSECURE

Bitcoin reached new highs in March, reaching as high as $73,803.25, two months after the first spot Bitcoin ETFs began trading. Before the introduction, the price of Bitcoin was $45,947. In contrast, ether has not come close to its all-time high, with a maximum trading price of $4,093.7 in March.

That could be about to change when the ether ETFs are introduced to the market in the coming weeks, according to experts. They have observed that the supply of ether is limited and that inflows into the ETFs could significantly impact the token price more than they do on bitcoin.

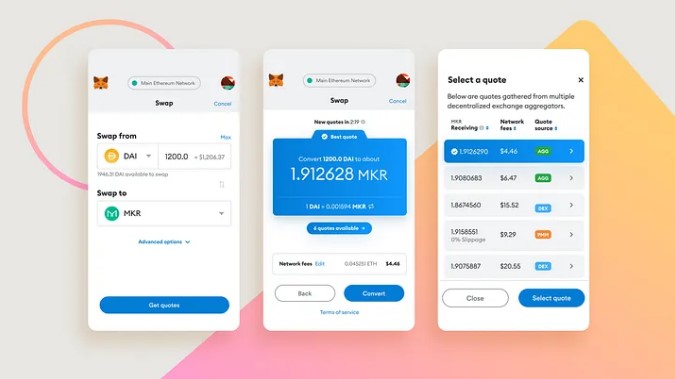

Morningstar Direct anticipates that the new ether ETFs will not generate the same level of investor enthusiasm as the spot bitcoin ETFs, which have amassed nearly $38 billion in assets as of late June.

According to research conducted by Grayscale Investments, a crypto asset manager converting its current ether trust into an ETF, the demand for spot ether ETFs could be between 25% and 30% of that of bitcoin funds.

However, Zach Pandl, managing director of research at Grayscale Investments, suggested that the price impact per dollar of inflows into the ether ETFs could be comparable when scaling down to market capitalization, given that ether’s market cap is approximately one-third of bitcoin’s.

“I do think it’s similar to what we were looking at for Bitcoin earlier this year, where we think there’ll be a substantial amount of new demand for the product, and it will be interacting with a supply picture that is more constrained than I think, is commonly understood,” said the analyst.

In contrast to bitcoin, ether can be staked or sealed up for a specified period of time in exchange for a yield. Pandl estimated that just under 30% of the ether supply is staked, while an additional approximately 10% is secured in smart contracts. He stated that this could potentially increase the price of ether by decreasing the supply accessible for purchase in the new ETFs.

“The price of bitcoin ETFs was influenced by the fact that there was a greater demand for these ETFs than there was a new supply of bitcoin,” stated Matt Hougan, the chief investment officer at Bitwise. “In [ether], the supply situation is even worse.”

The potential impact of the ether ETF on the token’s price is subject to significant variation, with global bank Standard Chartered predicting that ether could reach $8,000 by the end of the year. In May, VanEck, preparing to introduce a spot ether ETF, increased its price target to $22,000 by 2030.

However, some market observers caution that the impact of the new ETFs may have already been factored into the price of ether. Ether has experienced a rise of over 29% this year, even though it has yet to surpass its all-time high.

“Bitcoin and Ethereum are now more highly valued than at the time of the Bitcoin products’ launch earlier this year.” Grayscale’s Panel suggested that this could support a slightly diminished impact.