Due to liquidations resulting from a hack attempt, the native token of the DeFi system fell by 28% in a single day.

Curve Finance’s founder, Michael Egorov, claims to have paid back 93% of the $10 million in bad debt from the protocol’s soft liquidation earlier in the day.

“The size of my positions was too large for markets to handle and caused 10 million in bad debt,” stated Egorov. “I have already repaid 93% and intend to repay the rest very shortly.”

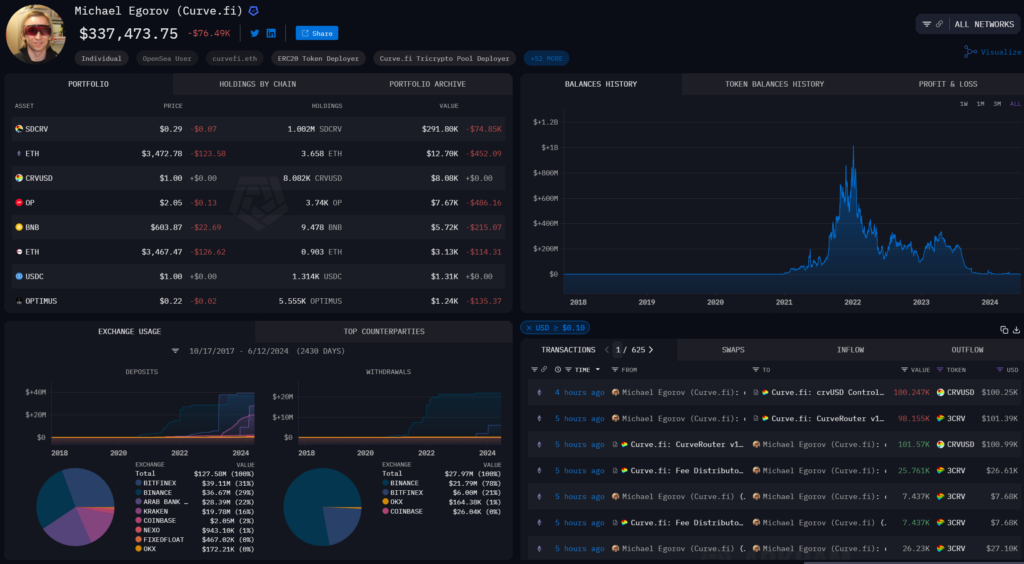

During a recent hacking attempt on June 13, Curve Finance’s soft liquidation mechanism successfully handled a real-world test; yet, amid the commotion, the price of its native CRV token fell by more than 28%. Egorov himself was subject to $140 million in liquidations, according to blockchain analytics company Arkham Intelligence, as a result of “borrowing $95.7 million in stablecoins (mostly crvUSD) against $141 million in CRV across five accounts on five protocols.”

At the height of the hack, Egorov had to pay annualized costs totaling $60 million to keep his borrowings in place. Arkham clarified:

“This is because there is almost no remaining crvUSD available to borrow against CRV on Llamalend. Three of Egorov’s accounts already make up over 90% of the borrowed crvUSD on the protocol. If the price of CRV drops by ~10%, these positions may begin to be liquidated.”

Since then, Egorov has suggested that to restore the price of the CRV token to its pre-event levels, 10% of the tokens that are now in circulation—worth $37 million as of this writing—be burned. The blockchain CEO stated, “Active voters will earn a 3-month APY booster on all platform deposits as a reward.”

This was not the first time Egorov’s borrowings and ownership of CRV affected the protocol in stressful situations.

Egorov’s $100 million borrowings on Curve at the time also resulted in bad debt when Curve experienced a $62 million exploit in August 2023. Eventually, the blockchain executive returned the money.

Currently ranked 19th among DeFi protocols, Curve is a blockchain analytics platform called DeFiLlama. Its contracts contain cryptocurrency assets valued at over $2 billion.