As part of its diversification plan, the Czech National Bank may purchase up to $7.3 billion worth of Bitcoin, or up to 5% of its reserves.

As part of its plan to diversify its foreign exchange reserves, the Czech National Bank (CNB) might be the first central bank in Europe to invest in Bitcoin.

Aleš Michl, the governor of the Czech National Bank (CNB), will introduce his Bitcoin.

He informed the Financial Times of the BTC$102,411 acquisition plan during the bank’s board meeting on January 30.

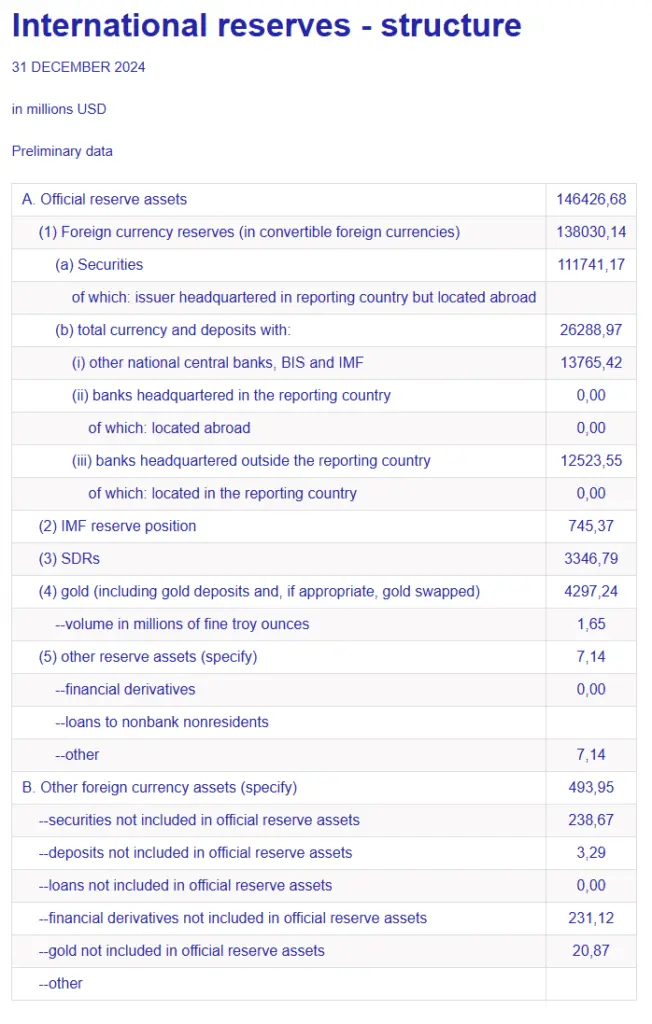

Given that the Czech National Bank has more than $146 billion in total reserves if allowed, the investment might result in more than $7.3 billion in Bitcoin purchases, according to André Dragosch, head of research at Bitwise.

In a post on X on January 29, Dragosch highlighted the proposal’s importance, writing:

“Just to put this into perspective: These BTC purchases alone would be equivalent to around 5.3 months of newly mined Bitcoin supply.”

The announcement was made three weeks after Michael stated that he was considering buying “a few Bitcoin” for diversification and considering Bitcoin as a possible reserve asset.

According to board adviser Janis Aliapulios, the bank stated as of January 7 that it was not contemplating investing in Bitcoin. He also said the bank intended to raise its gold holdings to 5% of its total assets by 2028.

Crypto regulations by the Trump administration will pave the way for the rise of Bitcoin.

US President Donald Trump has increased investor optimism, anticipating greater regulatory clarity for the bitcoin business.

The more benevolent regulatory climate under the Trump administration will accelerate Bitcoin’s growth, Aleš Michl told the FT, adding:

“Those [Trump] guys can now kind of create some bubble for bitcoin, but I think the trend would be an increase without those guys as well, because it’s an alternative [investment] for more people.”

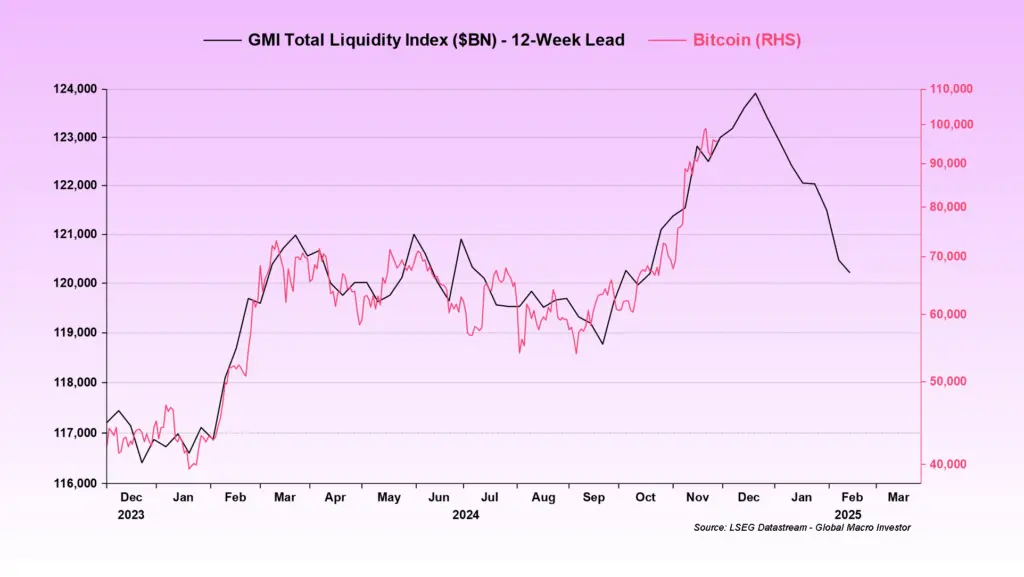

Although Bitcoin’s outlook for 2025 is still bright, the US debt cap of $36 trillion just provided a crucial warning sign for the cryptocurrency’s liquidity, which could cause a brief drop to $70,000 before the subsequent market cycle upswing.

According to Raoul Pal, founder and CEO of Global Macro Investor, Bitcoin is expected to reach a “local top” above $110,000 in January before a potential “interim peak in liquidity” triggers a more significant decline. Pal published his analysis in an X post on November 29.

Analysts are still hopeful for 2025, though, with price projections for BTC ranging from $160,000 to over $180,000.