Billionaire investor Ray Dalio is recommending a 15% allocation to Bitcoin (BTC), or gold, in investment portfolios.

Legendary investor Ray Dalio has advised a 15% portfolio allocation to Bitcoin or gold, cautioning of an imminent “classic devaluation” of fiat currencies comparable to those of the 1970s or 1930s as the United States approaches what he refers to as the “point of no return” in its debt crisis.

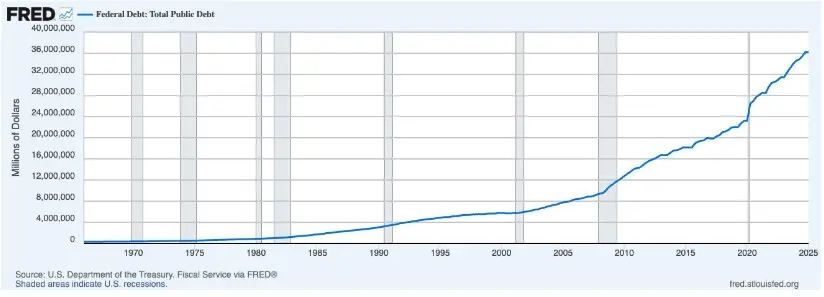

During a Master Investor podcast appearance, the founder of Bridgewater Associates disclosed that the United States government incurs an annual deficit of $2 trillion, necessitating $12 trillion in new debt sales over the next year, despite only collecting $5 trillion in revenue.

Interest payments alone account for half the budget deficit, consuming $1 trillion annually.

Debt Mechanics Reach Unsustainable “Point of No Return”

Dalio cautioned that the debt dynamics have reached unsustainable levels, likening the situation to “observing an MRI and observing plaque buildup” in a patient’s circulatory system.

The government cannot meaningfully reduce expenditure due to fixed obligations, even though federal debt is six times annual revenue.

Noting that gold is the second-largest reserve currency globally, the billionaire expressed a strong preference for gold over Bitcoin.

“If you were neutral on all matters and were striving to optimize your portfolio for the highest return-to-risk ratio, you would invest approximately 15% of your funds in Bitcoin or gold,” Dalio asserted.

Nevertheless, he recognized Bitcoin’s perceived value as a global transaction benefit and alternative currency with a limited supply. However, he questioned its efficacy as a central bank reserve currency due to privacy concerns.

Dalio’s recommendation is issued as Bitcoin trades at approximately $119,000, and technical analysis indicates that the cryptocurrency may be on the brink of a final surge toward cycle highs between $135,000 and $155,000.

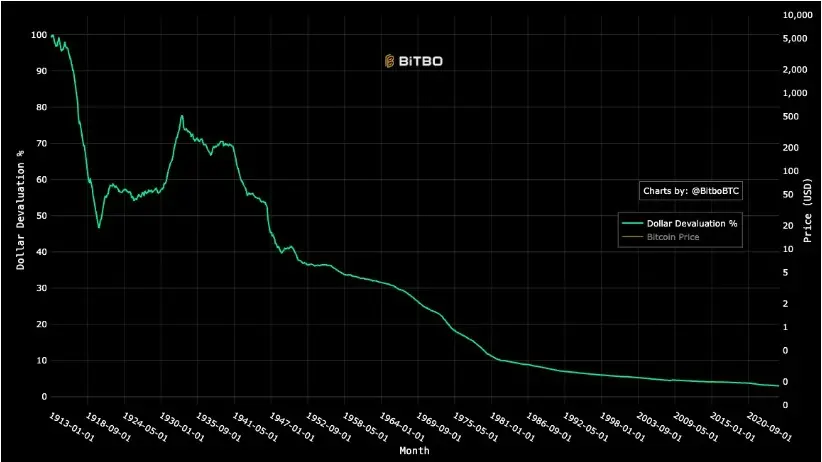

Since the Federal Reserve’s establishment in 1913, the U.S. dollar has lost over 96% of its purchasing power. This decline has been accelerated by the end of the gold standard imposed by President Nixon in 1971.

Currency Devaluation Phase Signaled by Debt Crisis Mechanisms

The United States is confronted with an unprecedented fiscal challenge that necessitates the issuance of $12 trillion in debt over the next year. This amount is divided into $1 trillion in interest payments, $2 trillion in new borrowing, and $9 trillion in debt rollovers.

Dalio underscored that the decline of previous reserve currencies, such as the British pound and Dutch guilder, was preceded by comparable patterns.

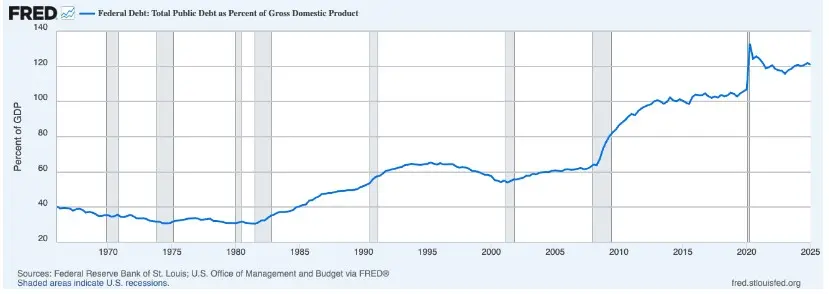

The fiscal deficit of 7% of GDP is the highest among industrialized nations, and the federal government debt has reached 125% of GDP.

Dalio suggested a “3% solution,” which necessitated immediate action to reduce the deficit from 7.5% to 3% of GDP using a combination of tax increases and expenditure cuts.

The debt-doom loop induces a vicious cycle by compelling affluent individuals to relocate due to increased taxation, which impacts capital flows.

The top 10% of earners pay approximately 75% of income taxes. Therefore, losing 5% of this population could eliminate 35% of tax revenue.

Dalio expressed skepticism regarding the political will to implement the requisite fiscal discipline, even though the United States effectively reduced its budget deficit by 5% of GDP between 1991 and 1998, according to historical precedents.

The mechanics suggest that the debt accumulation will exceed manageable levels if no corrective action is taken.

Central banks worldwide experience similar pressures, resulting in coordinated currency debasement rather than competitive devaluations.

The classic devaluation scenario that Dalio describes is anticipated to occur as all major fiat currencies decline compared to tangible assets such as gold.

Technical Analysis Indicates the Peak Target of the Bitcoin Cycle

The current price of Bitcoin is within a three-year ascending channel, and it has completed two significant segments, with gains of +106% and +197%, respectively.

Technical analysis indicates that a prospective third leg, which is expected to reach $155,500 by October, indicates a similar mathematical progression within the established channel structure.

The weekly chart suggests that Bitcoin is currently challenging the upper boundary of its long-term ascending channel, which is approximately $119,500.

A breach above this level can initiate a rapid ascent toward $135,000 within 1-2 weeks.

With effective retests at the 0.236 Fibonacci level, the 1W MA50 has provided essential support throughout the advance, confirming channel integrity.

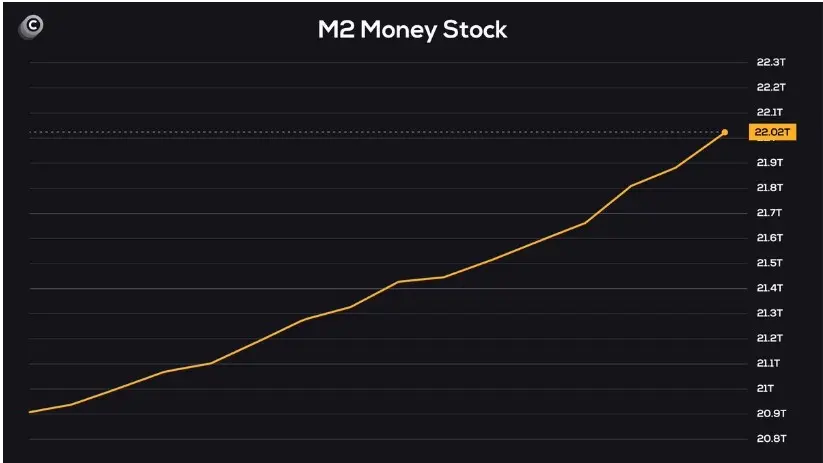

It is important to note that the M2 money supply expansion has reached $22.02 trillion, the fundamental foundation for Bitcoin’s value proposition as monetary debasement intensifies.

The macroeconomic justification for the sustained appreciation of Bitcoin as a hedge against currency devaluation is derived from the exponential growth in the money supply.

The 365-day moving average is approaching levels that have historically indicated significant cycle tops, which suggests that the current cycle may reach its peak between late August and early September, according to MVRV ratio analysis.

The 2021 cycle exhibited a double-top pattern approximately six months apart, and similar temporal patterns were observed in 2025.

The market sentiment has been enhanced by the resolution of the U.S.-EU trade agreement, as Bitcoin has recovered toward $119,000 due to the reduction in tariffs from 30% to 15%.

If the Federal Reserve’s dovish rhetoric encourages the further development of risk assets, this week’s meeting could serve as an additional catalyst.

Bitcoin is poised for a final rally toward $135,000-$155,500 within the next 2-4 months, provided that it surpasses the $119,500 resistance.