Decentralized Finance (DeFi) is no longer just a niche concept for blockchain enthusiasts; it has evolved into a revolutionary force, redefining the global financial ecosystem.

In 2025, the disruption caused by Decentralized finance (DeFi) is more visible than ever, challenging the traditional banking sector like never before.

Understanding Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a financial ecosystem based on blockchain technology that aims to eliminate intermediaries like banks and brokers. Unlike traditional financial systems, DeFi runs on decentralized networks, allowing for direct peer-to-peer transactions.

This innovative system empowers users by giving them complete control over their assets and financial decisions using transparent and secure blockchain protocols.

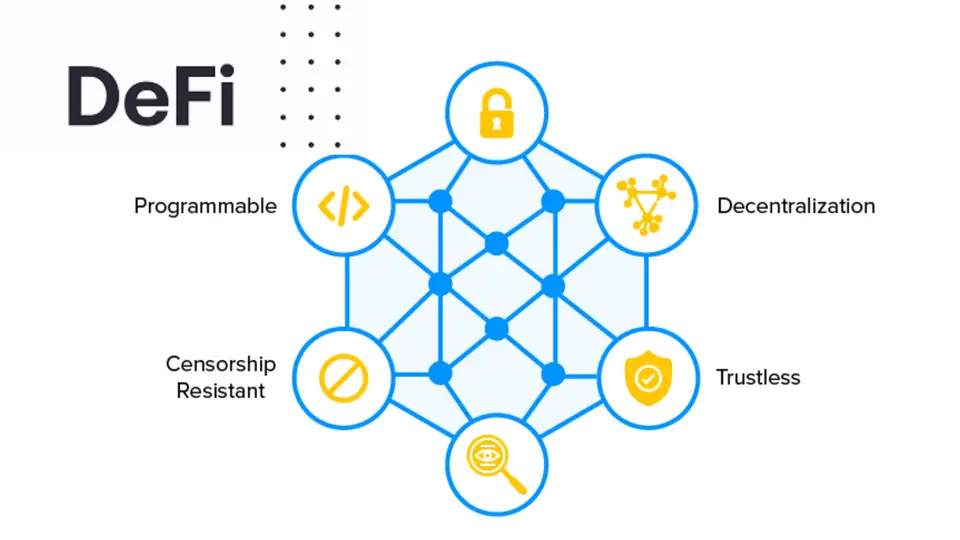

Core Principles of DeFi

Decentralization: Unlike centralized banking systems, Decentralized finance (DeFi) platforms use distributed blockchain networks such as Ethereum and Binance Smart Chain. This decentralization eliminates the need for centralized control, which improves security and lowers the risk of system failure.

Transparency: All transactions on Decentralized finance (DeFi) platforms are recorded on public ledgers, providing complete visibility to all participants. This transparency fosters trust and accountability throughout the ecosystem.

Accessibility: DeFi democratizes financial services by making them available to anyone with an internet connection and a digital wallet, eliminating traditional banking barriers such as geographic or socioeconomic restrictions.

How DeFi works

Decentralized finance (DeFi) uses smart contracts, decentralized applications (dApps), and blockchain technology to automate and secure financial transactions:

- Smart Contracts: These are self-executing contracts whose terms are directly written in code. Smart contracts eliminate the need for intermediaries while ensuring secure, automated lending, borrowing, and trading processes.

- Decentralized Applications (dApps): DeFi uses dApps to provide user-friendly interfaces for lending platforms, decentralized exchanges (DEXs), and yield farming protocols.

- Blockchain Networks: DeFi platforms run on blockchain networks, which provide the foundation for secure, immutable, transparent transactions. Ethereum remains the leading DeFi network, but other blockchains, such as Solana, Avalanche, and Polygon, are gaining popularity due to their scalability and low fees.

By combining these components, DeFi establishes a borderless, efficient, and inclusive financial system, paving the way for a future where traditional banking is no longer the only option.

The State of DeFi in 2025

Rapid Growth

In 2025, Decentralized finance (DeFi) has established itself as a transformative force in the global financial ecosystem. Key statistics highlight its remarkable growth:

- The total value locked (TVL) in DeFi protocols has surpassed $500 billion, thanks to increased adoption across various blockchain ecosystems.

- DeFi transaction volumes have reached an all-time high, with daily trades exceeding $10 billion, indicating a growing interest in decentralized exchanges (DEXs) and lending platforms.

- The global DeFi user base has risen to over 250 million thanks to increased access in emerging markets and more user-friendly interfaces.

Technological Advancements

The technological landscape of Decentralized finance (DeFi) in 2025 is defined by significant innovations that address previous limitations:

- Layer 2 Scaling Solutions: Platforms such as Optimism, Arbitrum, and zkSync have reduced transaction fees and increased processing speeds, allowing DeFi protocols to handle millions of transactions per day without congestion.

- Interoperability: New cross-chain bridges and interoperability protocols, such as Polkadot and Cosmos, have facilitated seamless transactions across multiple blockchain ecosystems. This has eliminated fragmentation while increasing the functionality of DeFi services.

- Developments in DeFi Protocols: Smart contracts have grown in strength, with features such as programmable compliance that allow them to meet regulatory requirements while maintaining decentralization. Furthermore, automated yield optimization tools and next-generation liquidity pools have increased user profitability and efficiency.

Adoption Trends

DeFi’s acceptance in 2025 spans demographics and industries, establishing it as a mainstream financial innovation:

- Retail Users: The simplicity of DeFi apps and lower entry barriers have prompted millions of people, particularly in unbanked and underbanked areas, to adopt decentralized financial services.

- Institutional Investors: Hedge funds, pension funds, and asset management firms are increasingly allocating portfolios to DeFi due to high yields and diversification potentials.

- Government Adoption: Governments are cautiously adopting DeFi, incorporating blockchain solutions into public finance, and exploring the use of decentralized stablecoins for cross-border transactions. Nations such as Singapore and El Salvador have paved the way by formalizing partnerships with leading DeFi initiatives.

As 2025 unfolds, DeFi continues to redefine traditional finance through rapid expansion, technological innovation, and widespread adoption. It not only challenges existing banking systems but also opens up new global opportunities for financial inclusion and efficiency.

How Decentralized Finance (DeFi) is Disrupting Traditional Banking

1. Lower Costs

DeFi is transforming financial services by reducing the costs associated with traditional banking operations. Banks rely on physical infrastructure, administrative layers, and intermediaries, which result in high fees and slow transaction processing.

DeFi operates on blockchain networks powered by smart contracts, which reduces overhead costs.

- Reduced Fees: Cross-border transactions via DeFi are significantly cheaper than traditional bank transfers, which can cost between 5% and 10%. DeFi solutions frequently reduce this to under 1%.

- Operational Efficiency: Automated smart contracts eliminate the need for human intervention, minimizing errors and labor costs while increasing transaction speed and accuracy.

2. Improved Accessibility

DeFi has provided financial services to the unbanked and underbanked populations by eliminating barriers such as credit scores, geographical restrictions, and access to physical bank branches.

- Global Inclusion: DeFi platforms enable anyone with internet access to borrow, lend, or invest without the need for government identification or a bank account.

- 24/7 Financial Services: Unlike banks, which have limited operating hours, DeFi platforms are decentralized and always available, allowing users to access funds or perform transactions at any time.

3. Disintermediation

Traditional banking relies on intermediaries for all financial services, including lending and payments, which increases costs and processing times. DeFi eliminates middlemen by allowing peer-to-peer (P2P) interactions.

- Direct Lending and Borrowing: Platforms such as Aave and MakerDAO enable users to lend and borrow directly, with interest rates set dynamically by supply and demand.

- Instant Transactions: In contrast to the lengthy settlement periods required by banks, blockchain technology allows for near-instant transactions, including cross-border payments.

4. Innovative Financial Products

DeFi has introduced new financial tools and products that traditional banks cannot provide due to their reliance on centralized systems.

- Yield Farming and Staking: By locking their assets in liquidity pools or staking them on DeFi platforms, users can earn much higher returns than traditional savings accounts with low interest rates.

- Tokenized Assets: DeFi enables fractional ownership of real-world assets such as real estate or artwork, allowing users to invest with small amounts of capital.

- Decentralized Exchanges (DEXs): Platforms like Uniswap and SushiSwap use liquidity pools to enable seamless, automated trading without the need for intermediaries such as brokers.

5. Better Financial Autonomy

DeFi empowers users by giving them complete control over their funds, as opposed to traditional banks, which store customer assets. This decentralization provides users with greater transparency and freedom when managing their finances.

Decentralized Finance is disrupting traditional banking by lowering costs, improving accessibility, eliminating intermediaries, and offering innovative financial products. It also paves the way for a more inclusive, transparent, and efficient global financial system.

DeFi Use Cases Transforming Banking

Decentralized Lending and Borrowing

Platforms such as Aave, Compound, and MakerDAO are redefining the credit market by allowing for decentralized lending and borrowing without the use of traditional financial intermediaries.

- How It Works: Users can earn interest by lending their digital assets to liquidity pools, while borrowers provide collateral to obtain loans.

- Key Benefits: These platforms provide dynamic interest rates and instant loan approvals, eliminating the need for credit checks. Borrowers can get loans in minutes, as opposed to the lengthy approval processes that traditional banks require.

- Example: Aave’s flash loans, which allow users to borrow funds without requiring collateral as long as they repay the loan in the same transaction, are particularly innovative for arbitrage and other short-term financial needs.

Cross-Border Payments

DeFi has streamlined international payments, offering faster, cheaper, and more transparent solutions than traditional banks.

- Low Transaction Fees: While traditional banks charge high fees for international transfers, DeFi platforms handle cross-border transactions at a fraction of the cost.

- Near-Instant Settlements: DeFi networks process payments in real-time, eliminating the multi-day delays caused by bank systems such as SWIFT.

- Example: Stablecoins such as USDC and DAI are increasingly being used for global remittances, offering a stable and dependable alternative to volatile fiat exchange rates.

Saving and Investment

DeFi platforms provide innovative savings options that outperform traditional banks in terms of return and accessibility.

- High Yields: DeFi savings accounts offer significantly higher returns through staking, yield farming, and liquidity mining. Yearn.Finance, for example, aggregates investment opportunities in order to maximize user returns.

- Global Access: With no minimum deposit requirements, these accounts are open to anyone with an internet connection, promoting financial inclusion.

- Example: A user can deposit stablecoins on platforms such as Celsius or Anchor Protocol and earn up to 10% APY, which is significantly higher than the 0.1%-1% rates offered by most traditional banks.

Decentralized Insurance

Decentralized finance (DeFi) is challenging traditional insurance by providing decentralized and automated alternatives that increase efficiency and lower costs.

- Smart Contract Insurance: Platforms such as Nexus Mutual and Etherisc use smart contracts to generate transparent, trustless insurance policies that automate claims processing.

- Accessibility: Decentralized insurance platforms enable users to pool resources and insure one another, reducing the need for large corporate insurers.

- Example: Nexus Mutual provides smart contract risk insurance, which protects DeFi users from vulnerabilities such as hacking or coding errors.

Decentralized Finance (DeFi) is transforming lending, payments, savings, and insurance, disrupting traditional banking’s core pillars. Its innovative use cases pave the way for a more inclusive, efficient, and accessible global financial system.

Challenges Facing DeFi in 2025

1. Security Risks

Despite its revolutionary potential, Decentralized Finance (DeFi) faces persistent security threats that jeopardize user trust.

- Smart Contract Vulnerabilities: Bugs in smart contract code can result in devastating exploits. For example, the Poly Network hack in 2021 stole over $600 million, indicating how a single flaw can compromise millions.

- Hacking Risks: As DeFi expands, it becomes a more attractive target for cybercriminals. Protocols must invest in rigorous audits and real-time monitoring to reduce risks.

- Phishing and Fraud: Users are frequently targeted by fake websites or malicious links, emphasizing the importance of better education and awareness about secure practices.

2. Regulatory Uncertainty

Regulation continues to be a significant barrier to DeFi’s widespread adoption and growth.

- Global Differences: Countries have different attitudes toward DeFi. While the United States debates stricter oversight, countries such as Singapore and Switzerland promote innovation.

- Compliance Challenges: Many DeFi platforms do not follow Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines, leaving them open to regulatory scrutiny.

- Chilling Effect: Fear of unexpected crackdowns or restrictive regulations may deter institutional investors, stifling the sector’s growth.

3. Scalability Issues

DeFi’s reliance on blockchain infrastructure creates scalability issues that limit its ability to meet rising demand.

- Network Congestion: Popular networks such as Ethereum frequently experience high transaction volumes, resulting in increased gas fees and slower processing times. During busy periods, transaction fees can skyrocket, discouraging smaller users.

- Layer 2 Solutions: While Layer 2 scaling technologies such as Optimism and Arbitrum aim to address these issues, their adoption is still slow, and interoperability with other chains remains difficult.

- Competition from New Chains: Emerging blockchains such as Solana, Avalanche, and Polkadot provide greater scalability, but they risk fragmenting the DeFi ecosystem.

4. User Experience

To achieve mainstream adoption, DeFi platforms must resolve significant entry barriers for non-technical users.

- Steep Learning Curve: Many DeFi interfaces are still overly complex, making it difficult for beginners to navigate features like liquidity pools and staking.

- Risk of Human Error: Simple mistakes, such as sending funds to the incorrect wallet or failing to understand transaction fees, can result in financial loss.

- Limited Customer Support: Unlike traditional banks, DeFi platforms typically lack direct support channels, requiring users to resolve issues on their own.

As Decentralized finance (DeFi) grows in 2025, addressing these challenges is critical to its long-term viability. Overcoming security vulnerabilities, clarifying regulations, increasing scalability, and improving user experience will pave the way for a more resilient and inclusive financial ecosystem.

Platforms that address these issues head-on will set the tone for the next wave of decentralized innovation.

Comparing DeFi to Traditional Banking

Efficiency

Decentralized Finance (DeFi) outperforms traditional banking in terms of speed and cost efficiency, transforming the way financial transactions are conducted.

- Transaction Speeds: Transaction speeds vary depending on the blockchain; DeFi platforms process transactions in minutes or seconds. Traditional banks, in contrast, may take days to settle cross-border payments due to intermediaries and legacy systems.

- Operational Costs: DeFi eliminates intermediaries, lowering costs such as service charges and wire fees. Platforms like Uniswap, for example, allow users to trade assets for low fees, whereas traditional banks charge higher transaction fees to cover operational costs.

Control and Ownership

Decentralized finance (DeFi) presents a paradigm shift in financial control, giving users direct ownership of their assets.

- Decentralized Control: DeFi uses smart contracts to facilitate peer-to-peer transactions without the need for banks or custodians. Users retain complete control over their funds, reducing the risks of bank closures or mismanagement.

- Transparency: Blockchain-based DeFi systems use public ledgers to ensure transaction transparency. Traditional banks, on the other hand, operate in opaque systems that provide users with little visibility into fund management.

- Personal Financial Sovereignty: DeFi encourages self-custody via wallets such as MetaMask and Ledger, whereas traditional banks require users to trust institutions with their assets.

Global Reach

Decentralized finance (DeFi) is democratizing access to financial services by cutting the geographical and bureaucratic barriers that traditional banks impose.

- Borderless Finance: DeFi platforms enable seamless cross-border transactions without the need for correspondent banks or currency conversions. Users can access services from anywhere, resulting in a truly global financial ecosystem.

- Inclusivity for the Unbanked: Traditional banks frequently exclude unbanked populations due to documentation requirements or low income. In contrast, DeFi platforms require only internet access and a crypto wallet to enable underserved communities to participate in global finance.

- Freedom from Bureaucracy: DeFi eliminates lengthy approval processes and institutional gatekeeping, allowing for immediate access to loans, savings, and investments. Traditional banks, on the other hand, require a significant amount of paperwork, credit checks, and regulatory delays.

When compared to traditional banking, it is clear that DeFi provides transformative benefits in efficiency, control, and accessibility.

While traditional banks continue to play an important role in many areas, the rise of DeFi signals a new era of financial innovation, providing users with greater autonomy and global reach.

This evolution indicates a future in which decentralized systems and traditional finance can coexist or compete, reshaping the global financial landscape.

The Future of Decentralized Finance (DeFi) and Traditional Banking

Collaborative Models

As the financial ecosystem evolves, traditional banks and decentralized finance (DeFi) platforms may form partnerships to develop hybrid solutions.

- Bridging the Gap: Banks are looking into ways to integrate blockchain technology to modernize their infrastructure while also leveraging DeFi innovations such as smart contracts and tokenization.

- Examples of Collaboration: JP Morgan and Goldman Sachs have already experimented with blockchain-based settlement and asset management applications. This trend is expected to continue as banks recognize DeFi’s potential to improve efficiency.

- Hybrid Solutions: Collaborative models could lead to services such as bank-backed decentralized savings accounts, low-cost cross-border payments, and tokenized bonds for institutional investors.

Regulatory Evolution

The evolution of global regulatory frameworks will heavily influence the trajectory of DeFi’s growth.

- Clarity and Standardization: Governments around the world recognize the need to regulate DeFi without stifling innovation. By 2025 and beyond, clearer regulations are expected to provide compliance guidelines while fostering investor and user trust.

- Sandbox Initiatives: Regulatory sandboxes, such as those established in Singapore and the United Kingdom, enable DeFi platforms to operate in a controlled environment, encouraging innovation while protecting consumers.

- Increased Global Coordination: As DeFi spreads across borders, regulators might work to establish global standards to address issues such as money laundering and tax evasion while supporting cross-border DeFi applications.

Mass Adoption

Technological advancements and improved user experiences will be critical to DeFi’s mainstream adoption.

- Enhanced User Interfaces: Simplifying DeFi platforms and integrating them into existing financial apps can shorten the learning curve, making DeFi more accessible to non-tech users.

- Mobile Accessibility: With the rise of mobile wallets such as Trust Wallet and MetaMask Mobile, DeFi has become more accessible, particularly in emerging markets where smartphones are common.

- Integration of AI and Machine Learning: By 2025, AI-powered analytics could assist users in navigating DeFi platforms, managing risks, and optimizing investment strategies.

- Institutional Participation: As institutional investors become more involved in DeFi, the sector’s legitimacy and stability will likely improve, encouraging retail adoption even more.

Collaboration and mutual adaptation will be key to the future of DeFi and traditional banking. As banks adopt blockchain technology and DeFi embraces regulatory compliance, hybrid solutions can emerge, combining the best of both worlds.

With clearer regulations and technological advancements, DeFi is on track to become a mainstream financial system, disrupting traditional banking and paving the way for a more inclusive and efficient global economy.

Conclusion

While decentralized finance (DeFi) has enormous potential to disrupt traditional banking, the road ahead is not without its challenges. Regulatory uncertainty, security risks, and scalability issues must all be addressed before DeFi can achieve broad adoption and long-term growth.

However, as technology advances and collaborative models emerge between traditional financial institutions and DeFi platforms, DeFi is poised to reshape global finance by increasing inclusivity, transparency, and efficiency.

As DeFi evolves in 2025, now is the time to discover its potential and stay ahead of the curve. Begin by researching and exploring different DeFi platforms to better understand the opportunities they offer.

Keep up with regulatory developments and technological advancements that will shape the future of decentralized finance.