Michael Dell, the founder and CEO of Dell Technologies, has sparked interest with a peculiar message that implies his company may consider investing in Bitcoin BTC $64,244

Dell tweeted on June 21, “Scarcity creates value,” a phrase frequently linked to Bitcoin due to its supply limit of 21 million tokens and the increasing demand for it. Michael Saylor, a prominent proponent of Bitcoin as a corporate treasury asset, promptly became aware of his remark.

Dell’s subsequent repost of Saylor’s reply, which included an image of Cookie Monster consuming Bitcoin, sparked market speculation that he may invest in the cryptocurrency in the future through his personal investment portfolio or his company.

Dell’s Bitcoin tweet follows his $2.1 billion cashout.

Dell’s recent financial transactions are an advantageous foundation for this prospective Bitcoin investment.

For example, Dell Technologies’ stock has increased nearly fivefold since its return to the public market in December 2018. Dell’s net worth has increased from $40 to $145 per share in the past 18 months, quadrupling his wealth to approximately $120 billion. This achievement has elevated him to the 14th wealthiest individual in the world.

Dell has received $2.1 billion in cash and retained 58% of the company’s ownership in 2024. In other words, he has an excess of capital that he can allocate to the Bitcoin market, particularly in light of the increasing U.S. debt, which may have a detrimental effect on the value of the U.S. dollar in the future.

What would happen if Dell Technologies’ portfolio experienced a 1% increase in Bitcoin?

Joe Consorti, an analyst at the Bitcoin Layer, a global macro research firm, contends that Bitcoin can benefit from corporations such as Dell Technologies, as they have the potential to accumulate excess cash as a result of the emergence of cost-cutting artificial intelligence technologies.

“Outsized returns on their reserves during this AI boom will provide a further buffer for capital allocation during a time when spending and scaling in computer manufacturing haven’t been this rapid or hotly contested in decades,” according to him.

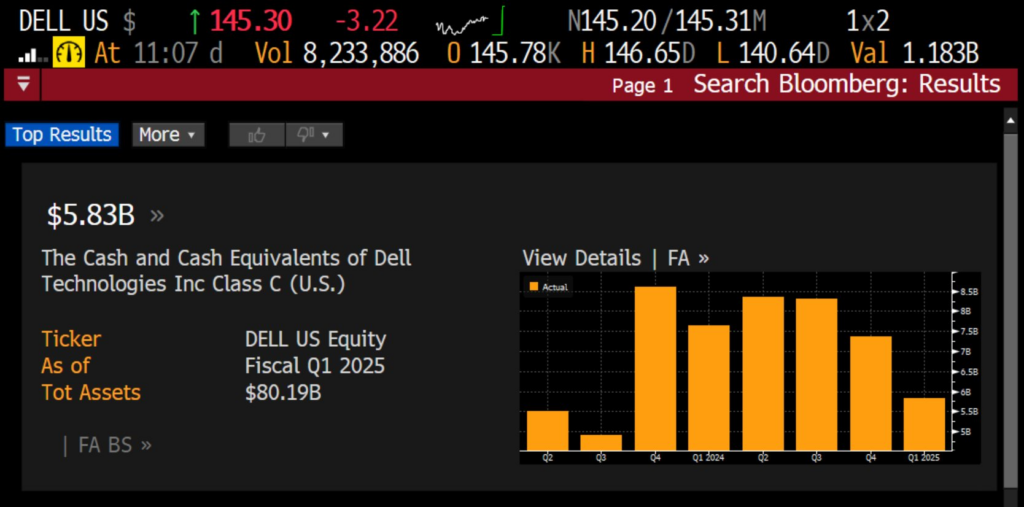

“Dell is sitting on $5.83 billion in cash to make that happen.”

Holding even a small percentage of the balance sheet in Bitcoin—such as 1%—could provide corporates with a substantial competitive advantage.

For instance, Dell Technologies could conceivably witness a $118.7 million increase in its investment in Bitcoin within a year if it allocates 1% of its $5.83 billion cash reserves to the cryptocurrency, which equates to $58.3 million. This is based on the historical annualized returns of Bitcoin over the past decade, approximately 103.5%.

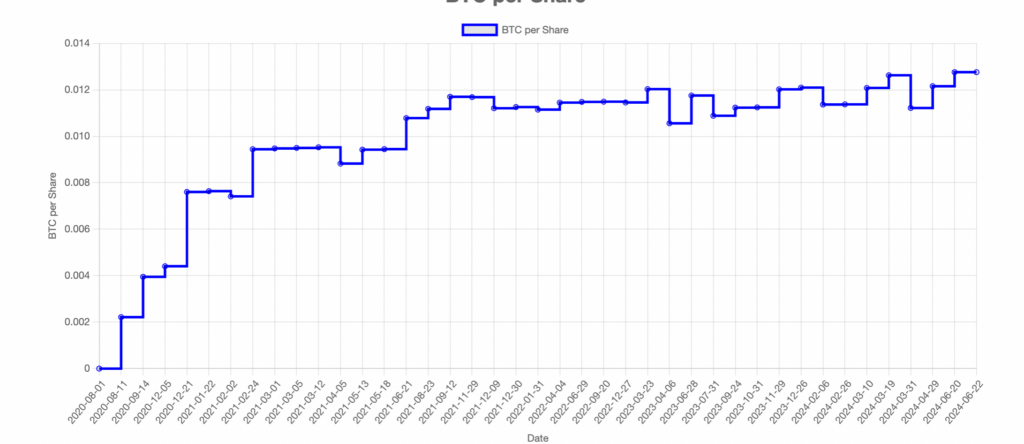

Historical data indicates that corporations can derive substantial advantages from investing in Bitcoin. For example, MicroStrategy, which is owned by Saylor, has generated an astonishing profit of approximately $6.33 billion as a result of its strategic BTC acquisitions in recent years.

Simultaneously, prominent investors such as Warren Buffett have refrained from purchasing Bitcoin. Buffett would have increased Berkshire Hathaway’s returns from 214% to 240% over five years if he had allocated even 1% of its net portfolio to Bitcoin, hypothetically.

“Bitcoin is the best asset to position yourself in for outsized risk-adjusted returns over any multi-year timeframe,” according to Consorti.

“You’re simply not working in the best interest of your shareholders if you ignore this without reason.”