The Securities and Futures Commission of Hong Kong has granted DFX Labs a license for virtual asset services, even though it is not yet permitted to trade

The Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) clearance obtained by Hong Kong-based crypto trading platform DFX Labs has brought the company closer to obtaining a complete operational license in the region.

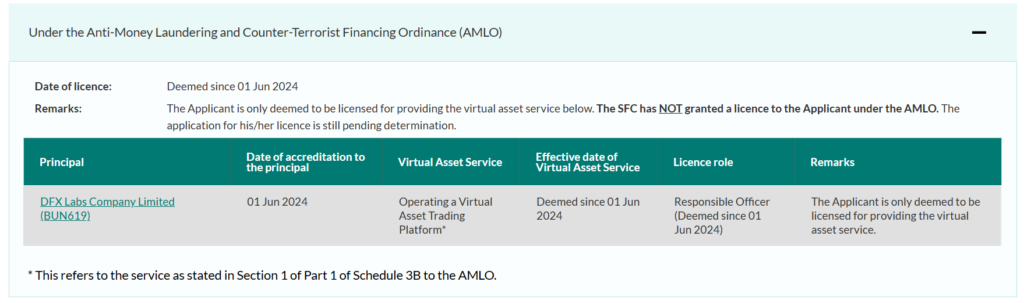

DFX Labs is “deemed to be licensed for the provision of the virtual asset service,” according to public records maintained by the Securities and Futures Commission (SFC) of Hong Kong.

Nevertheless, the platform is not yet authorized to provide crypto trading services, even though DFX Labs maintains an active AMLO license. The documentation indicated that:

“The Applicant is only deemed to be licensed for providing the virtual asset service below. The SFC has NOT granted a license to the Applicant under the AMLO. The application for his/her license is still pending determination.”

A schedule for the issuance of a crypto license in Hong Kong

Simon Au Yeung, the chief operating officer of DFX Labs, was the primary applicant for the Hong Kong crypto license on December 27, 2023. On June 1, the exchange was considered to be licensed.

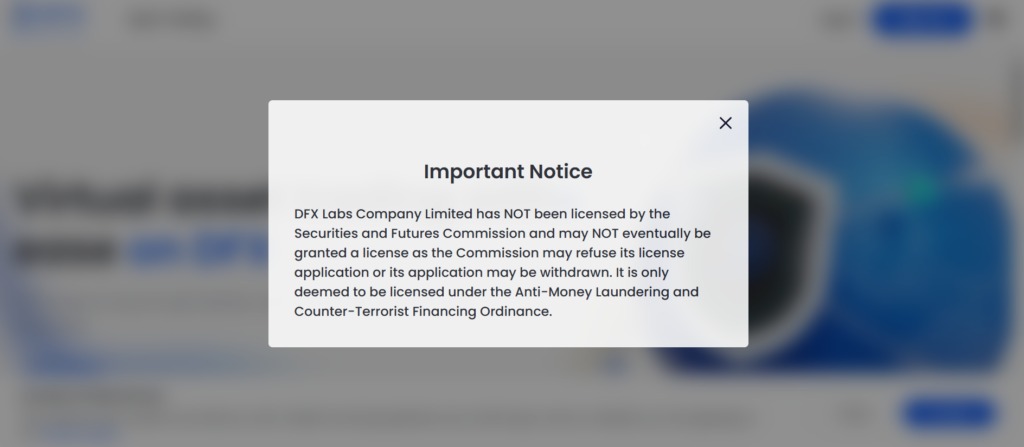

As demonstrated above, the DFX Labs website is currently unavailable to Hong Kong residents due to its status as an unlicensed virtual asset platform.

Hong Kong’s endeavor to attract global entrepreneurs

Three Hong Kong government entities—The Hong Kong Economic and Trade Office in Toronto (Toronto ETO), Invest Hong Kong (InvestHK), and StartmeupHK (SMUHK)—recently collaborated to promote their offshore technology hub for Canadian crypto and Web3 startups at a Toronto conference.

Toronto ETO director Emily Mo emphasized the extant startup-friendly regulations at the event, including Hong Kong’s willingness to collaborate with “pre-commercial specialist technology companies” and lower taxes than in Canada. Additionally, she stated:

“The development of Web3/virtual assets is characterized by a creative mindset.” Currently, Hong Kong and Asia are experiencing a surge in the popularity of fintech, health technology, ecological technology, and property technology.

In May, all crypto exchanges operating without a license in Hong Kong were compelled to cease operations.

Many crypto exchangers that had submitted applications for operational licenses ultimately withdrew their applications. OKX, Huobi HK, and Bybit were the prominent global participants on the list.