Dogecoin price forms a rare saucer bottom, signaling a possible 84% rally to $0.44 as whale holdings hit an all-time high.

Dogecoin (DOGE) has developed a rounding bottom chart pattern, frequently indicating significant bullish reversals.

At the time of publication, the price of Dogecoin is $0.189, representing a 6% decrease in the past 24 hours, as the broader market experienced losses on June 12.

The daily trading volumes had decreased by $1.4 billion, or 12%, suggesting a decrease in market interest.

Analysis Of Dogecoin Price- Bullish Pattern Emerges

On the weekly chart, the price of Dogecoin has developed a rounding bottom pattern.

This is a reversal pattern that indicates that a trend is on the brink of transitioning to a bullish direction.

This pattern has been developing since December 2024, as noted in this chart.

If this rounding bottom occurs and the DOGE price breaks out from the neckline resistance level, the rally could propel it beyond $0.23 and generate an 84% increase to $0.44.

The probability of a Dogecoin price increase also rises due to the Money Flow Index (MFI) surpassing the 50-point threshold.

The crossover suggests a positive transition in capital inflows to this meme coin as buy-side volumes increase.

The accumulation that precedes a bullish breakout will be indicated by the formation of higher highs and a confirmed crossover above 50.

The MFI crossover above 50 occurs before a verified move above the neckline resistance of this rounding bottom.

This reinforces the possibility of a DOGE escape at a higher level.

Nevertheless, the average directional index (ADX) points downward, indicating that the uptrend toward the resistance level is losing momentum.

This could result in sideways movements in the price of Dogecoin, particularly if the MFI is rejected at 50 again, as it was on May 12.

Key Levels To Monitor

The neckline level of $0.23 is the most critical resistance level to monitor as the Dogecoin price prepares for a potential 84% rally.

This level could determine whether the price surges by 84%.

The zone between $0.31 and $0.35 is the other critical level that requires monitoring.

The historical data indicates that traders profited at this zone in early January, establishing a crucial resistance.

Consequently, Dogecoin must surpass this region before the rally to $0.44, even if it surpasses the neckline hurdle.

In the interim, the bearish outlook will be invalidated by a decline below the support of $0.14 at the rounding bottom.

If this support is breached, the downtrend could be accelerated to the $0.11 zone.

ATH Of Whale Holdings, Dogecoin Subsidiary, Has Reached 24.98 Billion

As the deadline for a spot DOGE ETF approaches, large addresses or whales may already prepare for a significant upward movement.

In the past seven days, addresses with between 10 million and 100 million DOGE tokens have acquired 320 million.

Due to this acquisition, the addresses currently possess 24.98 billion tokens, a record high.

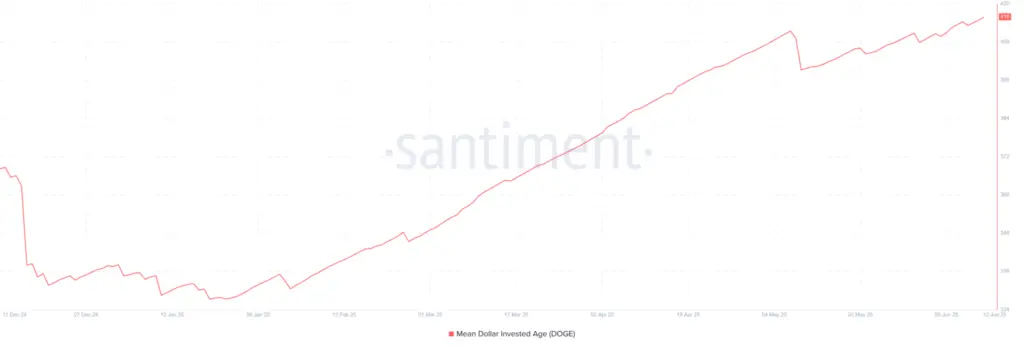

In addition to this gradual accumulation by whales, there has been a rise in the Mean Dollar Invested Age (MDIA) over the past six months.

Investors are not seeking to sell when this metric is increasing, as it indicates that they are confident in Dogecoin’s short-term and long-term price predictions.

As per Sentiment data, this on-chain data indicates a favorable trend for Dogecoin, as it indicates that the meme coin is in an accumulation phase.

This suggests that a breakout rally is probable even though the broader market is experiencing declines.

In summary, Dogecoin’s price has developed a circular bottom pattern, which suggests that the trend may be reversing in a bullish direction.

If the resistance at $0.23 is surmounted, an 84% boost to $0.44 is possible.

In the interim, whales may be preparing for such an action as their token holdings reach an all-time high of 24.98 billion.