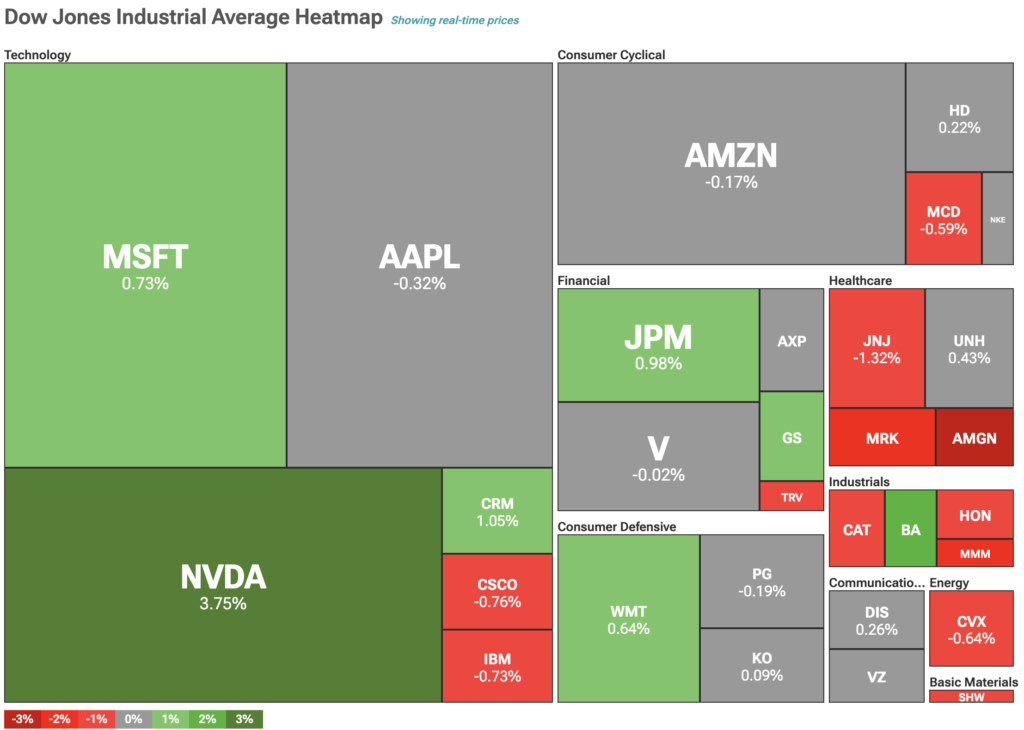

Nvidia shares climb nearly 4% after securing a major AI chip deal with Saudi Arabia’s Humain; Dow Jones edges lower amid mixed market sentiment

On Wednesday, U.S. equities were slightly mixed as chipmakers experienced substantial gains due to new agreements with Saudi Arabia.

The Dow Jones traded lower by approximately 0.25% on Wednesday, while the S&P 500 remained unchanged. Stocks were divided. The Nasdaq, which is heavily weighted toward technology, increased by 0.75%, or 142.58 points, to 19,150.

This performance was preceded by a robust performance earlier in the week as investors responded to the suspension of reciprocal tariffs between the United States and China. The recent publication of April inflation figures, which were at their lowest levels since 2021, further bolstered the optimistic sentiment.

Chipmakers are the driving force behind the Nasdaq’s upward

The lower inflation data and the easing of trade relations influenced the bullish sentiment in the markets. Tech stocks, particularly chipmakers, were among the most successful, as they capitalized on a recently concluded agreement between Saudi Arabia and U.S. companies.

At an investment forum on Tuesday that U.S. President Donald Trump attended, Saudi Arabia disclosed billions in agreements with semiconductor manufacturers. Following the announcement, Nvidia, the world’s largest chipmaker, experienced a 3.75% increase in stock price, closing at $134.85 per share.

On Wednesday, the dollar index declined by 0.21% to 100.80 points despite the optimistic sentiment in equities. Gold, which was trading at $3,182.22, experienced substantial losses of 1.91% at the same time. The divestment from the dollar and gold suggests that investors seek greater stock market returns.

Bitcoin (BTC) experienced a 0.66% decline to $103,378 compared to gold. However, the digital gold thesis for Bitcoin is not the sole explanation, as crypto prices began to rise days before the stock markets when Bitcoin first broke $100,000. Instead, crypto prices are probably consolidating and cooling off, which implies that the same may occur in equitiesshortlye.