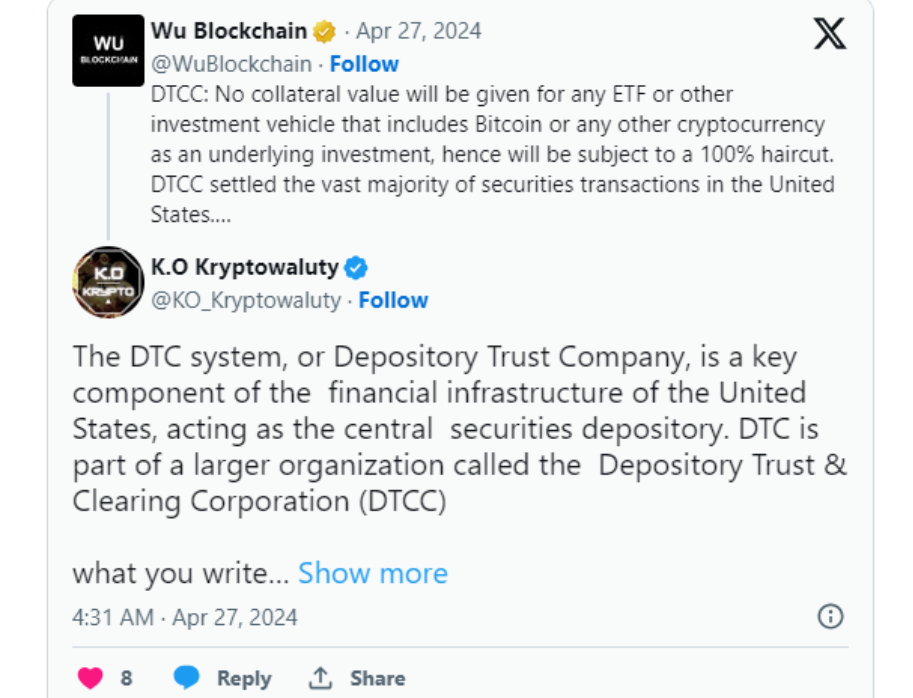

DTCC bars Bitcoin ETFs from being used as collateral in loan agreements but won’t affect retail investors’ ability to buy/sell them through brokers.

The Depository Trust and Clearing Corporation (DTCC), a clearing and settlement services provider for the financial markets, has declared that it will not extend loans secured by exchange-traded funds (ETFs) that have exposure to Bitcoin or cryptocurrencies or allocate collateral to such funds.

As per DTCC’s announcement, the organization will enforce modifications to the collateral values for particular securities on April 30, 2024, as part of the process of renewing its annual line-of-credit facility. This may impact the position values recorded in the collateral monitor.

As a consequence of this notice issued on April 26, no collateral value will be designated to ETFs and comparable investment instruments that hold Bitcoin or other cryptocurrencies as their underlying assets, reducing their collateral value by 100%.

K.O. Kryptowaluty, a cryptocurrency devotee, clarified in an X post that this restriction would apply exclusively to inter-entity settlements within the line of credit system.

A line of credit is an agreement between a financial institution and an individual or entity whereby the creditor can withdraw funds within a specified credit limit. When necessary, the borrower has recourse to these funds and generally only pays interest on the principal amount borrowed.

According to Kryptowaluty, depending on individual brokers’ risk tolerance, the use of cryptocurrency ETFs for lending and collateral in brokerage activities will continue unaffected.

Although DTCC has opposed crypto ETFs, other traditional actors have a different stance. In 2024, Goldman Sachs clients commenced their return to the cryptocurrency market, propelled by a revitalized interest created by the authorization of spot Bitcoin ETFs.

The institutional interest in this investment product has increased since the introduction of spot Bitcoin ETFs in the United States. Assets under management for all U.S.-based Bitcoin ETFs have surpassed $12.5 billion within three months of their inception.

An estimated 75% of new Bitcoin investments in February originated from the ten-spot Bitcoin ETFs authorized in the United States on January 11.

Recent net inflows into the ETFs, however, have declined. Numerous ETF issuers have recently disclosed substantial outflows. Farside Investors reports that spot Bitcoin ETFs experienced a net outflow of $218 million on April 25, following a $120 million outflow on April 24.

Grayscale’s GBTC ETF experienced a significant discharge of $82.4197 million in a single day. Farside data indicates that GBTC transactions have resulted in substantial net outflows of $17.185 billion.