As part of its comprehensive framework for Virtual Asset Service Providers (VASPs) operating in the Emirates, Dubai’s Virtual Assets Regulatory Authority (VARA) has revised its marketing regulations. The new rules will be implemented on October 1.

The revised regulations will be more stringent and designed to enhance transparency and consumer protection in the marketing practices of Dubai’s swiftly expanding virtual assets sector and prevent “misleading information.”

The new “Marketing Guidance Document” from VARA is the focal point of these revisions. It offers guidance to VASPs who promote their services in the region.

According to VARA, the online document is intended to assist VASPs in navigating the regulatory landscape and guarantee that their marketing endeavors adhere to the most stringent standards of transparency, ethical conduct, and accuracy.

Rules Apply to All Firms Marketing Virtual Assets in Dubai

Updated regulations are designed to prioritize the protection of consumer interests and prevent misleading information. Regardless of their licensing status with VARA, the laws apply to all entities engaged in marketing virtual assets or related activities in Dubai.

This implies that the same marketing regulations apply to licensed and unlicensed entities, guaranteeing uniform standards throughout the industry.

The regulations encompass various aspects of marketing communications, such as the significance of providing comprehensive and transparent disclosures and the appropriate use of language.

The objective is to guarantee that consumers are adequately informed regarding the risks and opportunities associated with virtual assets.

According to VARA, ethical marketing is a fundamental principle ensuring that this sector’s advertising is legal, transparent, and equitable to potential investors and consumers.

The VARA Excessive Penalties

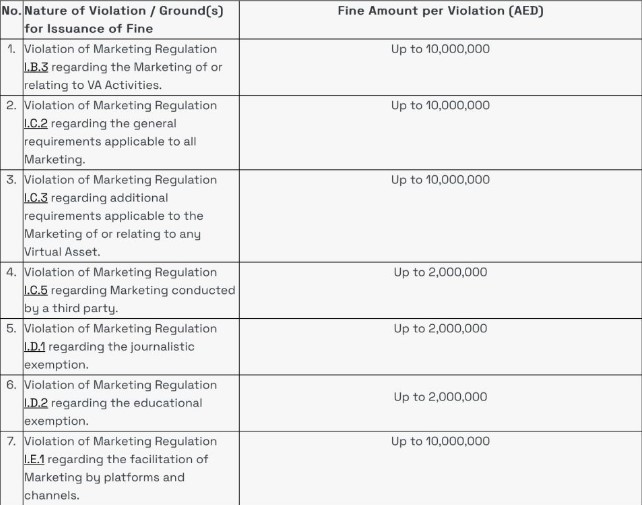

Individuals who violate the new marketing regulations may be subject to substantial penalties of up to 10,000,000 AED ($2.7 million).

Matthew White, CEO of VARA, stated, “VARA is committed to establishing a regulatory environment that not only safeguards consumers but also fosters innovation and growth in the virtual assets sector.”

The recently released guidance document and the updated marketing regulations demonstrate our commitment to maintaining Dubai’s position as a global leader in digital finance.

By offering unambiguous and practical advice, we can assist VASPs in responsibly delivering their services and promoting increased transparency and trust in the market.

During a panel discussion at Korea Blockchain Week, Binance CEO Richard Teng recently commended Dubai and its regulatory framework for digital assets (KBW2024).

Teng’s commentary on the Middle East emphasized the innovative regulatory strategies implemented in Bahrain, Abu Dhabi, and Dubai. He commended Dubai’s establishment of VARA, which is exclusively responsible for regulating the crypto industry.