El Salvador’s NextBridge raised $30M via tokenized U.S. Treasury notes, joining BlackRock and Franklin Templeton in this growing trend.

NextBridge, a platform in El Salvador, has successfully concluded a $30 million token sale that is secured by United States Treasury notes.

Bitfinex Securities, the sister company of stablecoin issuer Tether, concluded the offering in November with the initial subscription of USTBL tokens.

El Salvador anticipates that each token will represent a proportional share of the assets under management, with a total issuance of $200 million in US Treasury securities.

The USTBL token was developed on the Bitcoin blockchain and operates via the layer-2 protocol Liquid Network.

Michele Crivelli, the originator of NexBridge, has stated that the token is eligible for trading on the secondary market.

However, redemptions will not be feasible until March 2025.

“We will provide various redemption mechanisms; the initial mechanism will be directly managed by the exchanges where the USTBL is accessible,” Crivelli stated to Cointelegraph.

“We intend to enable dynamic redemptions and subscriptions directly in the order book.”

The National Commission for Digital Assets, El Salvador’s digital assets agency, supervises the USTBL token by the country’s securities laws.

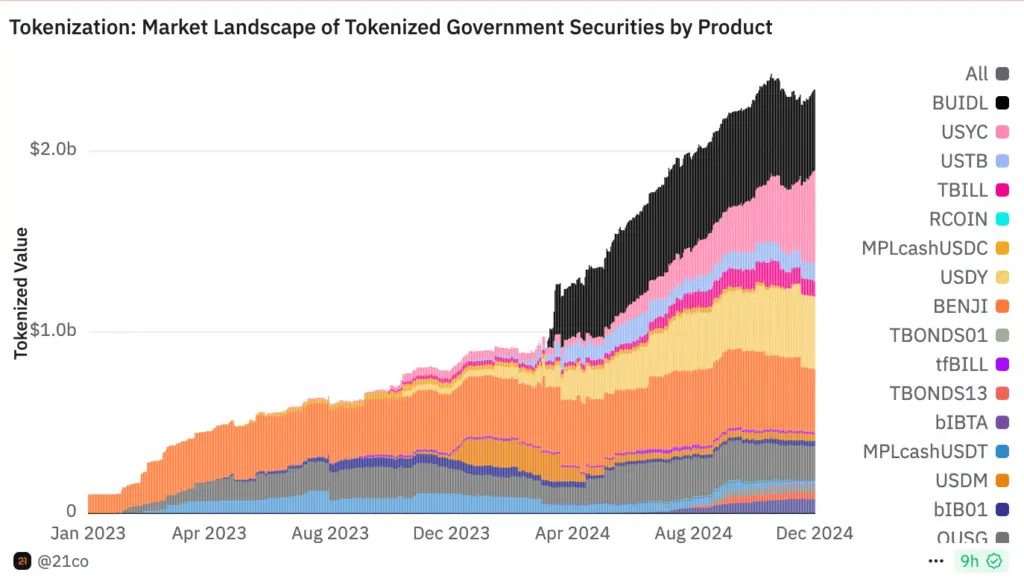

NextBridge’s product is now included in the expanding market of tokenized T-bills. OpenEden, BlackRock, and Franklin Templeton are among the competitors that have introduced comparable products in 2024.

Since its establishment in March, BlackRock’s USD Institutional Digital Liquidity Fund has amassed over $447 million in assets under management.

Tokenized Treasurys are a blockchain-based digital representation of US Treasury securities.

The tokenization of these assets increases liquidity, facilitating the purchase and sale of these assets, and decreases settlement times.

This enables global investors to expose themselves to digital assets that are supported by the US government.

The value of government securities on-chain is currently $2.3 billion, which is lower than the market expectation of $3 billion by the end of the year, as indicated by data available on Dune Analytics.

The potential for tokenization extends beyond government securities and other financial products.

Real estate and agricultural products are among the applications of illiquid assets on the blockchain.

Forecasts from the Global Financial Markets Association (GFMA) and Boston Consulting Group indicate that the global value of tokenized illiquid assets may increase to $16 trillion by 2030.