Eric Trump urges short sellers to avoid betting against Bitcoin and Ethereum, citing their strong rally past $117K and $4,100.

Eric Trump has cautioned traders against shorting Bitcoin and Ethereum. His comments were made as the Ethereum price approaches its peak, fueled by high-profile endorsements and corporate treasury acquisitions.

A Warning for Bears from Eric Trump

Eric Trump celebrated a significant increase in the price of Ethereum on X today. He declared it “a moment that brought a smile to my face” to observe short sellers being forced out of their positions.

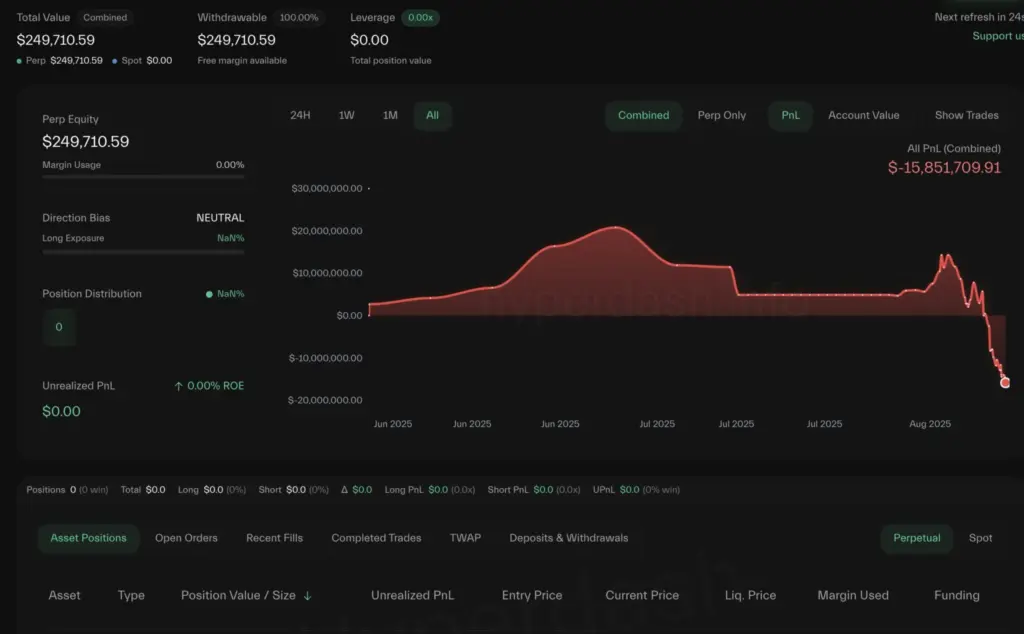

It is important to note that a high-profile trader experienced over $15 million in losses as the Ethereum price surpassed $4,200, which resulted in the complete liquidation of his holdings, as per Lookonchain data. In a mere 24 hours, over $120 million in short positions were eliminated, according to CoinGlass figures.

The Ethereum surge occurred after corporate treasuries accumulated the token in substantial quantities. ETH is held by public companies worth over $11.7 billion, as previously reported. BitMine Immersion Technologies is the field leader, with 833,000 ETH valued at approximately $3.2 billion. The company’s objective is to control 5% of the circulating supply.

Eric’s bullish outlook has been previously expressed, and he is known for his strong opinions on cryptocurrency, particularly Ethereum. He advised his followers to purchase Ethereum during the most recent crypto market collapse, specifically during the dip.

Ethereum’s institutional demand rises dramatically

Ethereum has experienced an 8% increase in the past 24 hours, surpassing Bitcoin’s 1.19% increase, as CoinMarketCap data indicates. The action extends a 49% monthly rally that evolving supply dynamics have driven.

On August 9, spot Ethereum ETFs in the United States recorded the most significant single-day surge since July, with $864 million in inflows. BlackRock’s ETHA ETF alone attracted roughly $189 million.

SharpLink Gaming, which maintains 345,000 ETH, is closely followed by the Ether Machine, which has holdings valued at $2 billion. Cosmos Health, which is listed on Nasdaq, recently disclosed a $300 million financing agreement to establish an Ethereum treasury strategy. Standard Chartered’s Geoffrey Kendrick characterizes this action as providing investors with “regulatory arbitrage” benefits.

In July, 2.1 million ETH was deposited into the purses of large-scale investors, also known as “mega whales.” The available market supply is decreasing, as 28% of all ETH is staked and ETFs are tying up even more.

The emergence of Ethereum from a multi-month symmetrical triangle pattern is a bullish signal from a chartist’s perspective. In the short term, Bitcoin’s dominance could be reduced by a “monumental vertical move” if a weekly close surpasses critical resistance, according to crypto analyst MMCrypto.