Spot Ethereum ETFs see $13.5M in inflows as Abraxas Capital buys $500M worth of ETH in one week, and Ethereum price targets $3200.

As Ethereum (ETH) prices continue to exhibit robust momentum, Ethereum ETF inflows have surged again, with an additional 9% increase in the past 24 hours. Furthermore, Abraxas Capital’s acquisition of over $500 million in Ethereum (ETH) in a single week has underscored the potential for substantial gains in the future. Market analysts anticipate a minimum of an additional 20% increase to $3,200, and potentially even more to $4,000.

Ethereum ETF Inflows Experience Another Increase

The spot Ether ETF has experienced an increase in inflows once more, with a total of $13.5 million incoming on Tuesday. According to data from Farside Investors, Grayscale’s mini-Ether ETF experienced the most inflows, totaling $7.4 million. VanEck’s ETHV experienced net inflows of $3.0 million, and Franlink’s EZET contributed $3.1 million.

Asset manager BlackRock submitted an amendment for its spot Ethereum ETF last week, proposing an in-kind creation and redemption process. This action follows a meeting with the SEC’s Crypto Task Force and evidences increasing institutional interest in Ethereum. The amendment will allow authorized participants to exchange Ethereum (ETH) for ETF shares directly during the creation and redemption procedure if it is approved. This will facilitate the seamless transfer of capital between ETH and its respective ETFs.

The pace of institutional inflows into Ethereum is increasing

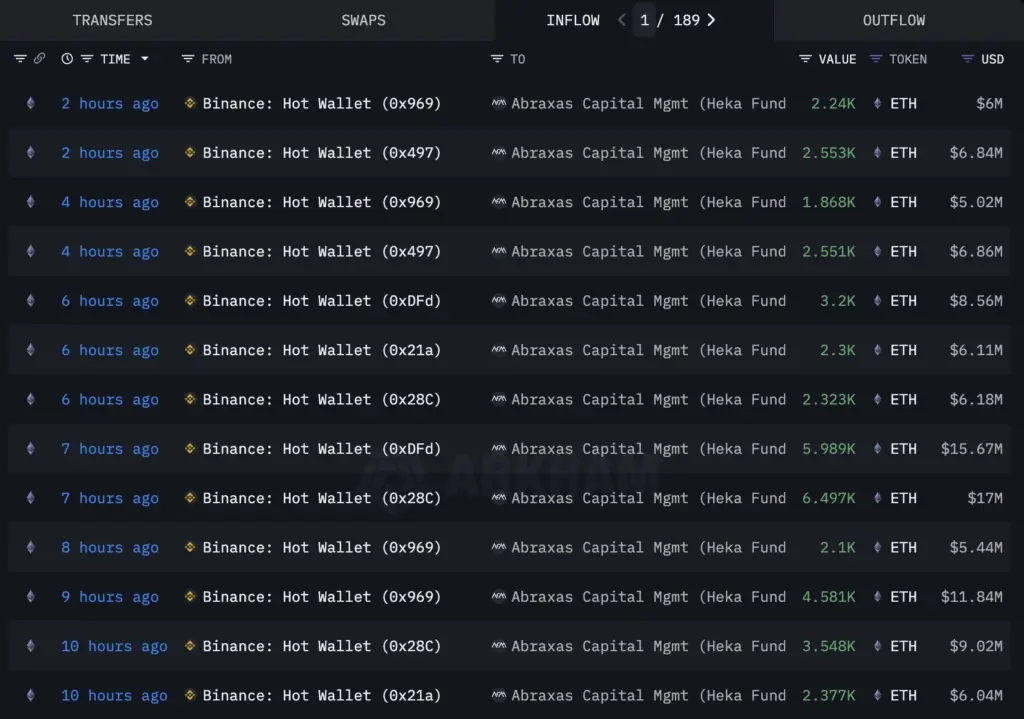

Abraxas Capital has driven a substantial increase in institutional inflows into Ethereum over the past week. Arkham Intelligence’s on-chain data indicates that the organization borrowed USDT yesterday to augment its Ethereum (ETH) holdings, which were trading at approximately $2,460. The asset has experienced a 10% increase since that time, reaching the $2,700 level.

In the past week, Abraxas Capital has amassed a total of 242,652 ETH, which is valued at $561 million. This accumulation suggests that the market is once again experiencing optimistic momentum.

What is the future trajectory of the Ethereum price?

The price of Ethereum has continued to increase by 9.5% in the past 24 hours, reaching $2,700 while on an irrepressible rally. The daily trading volume has also increased by 19%, reaching $36.75 billion, indicating significant interest among traders. The open interest in ETH futures has also increased by 14% to $32.61 billion, as indicated by the Coinglass data.

Ethereum (ETH) has closed its Daily CME gaps at the ~$2,530 and ~$2,630 levels, as indicated in the green zone below, according to crypto analyst Rekt Capital.

If Ethereum ETF inflows persist, a daily close above this range could enable Ethereum to transform the gap into a new dynamic support zone. Rekt Capital observed that this development could establish a basis for continuing the upward trend. Based on the image above, ETH is expected to fill the next breach at $2,900-$3,033, after which it could rally to $3,200. Analysts anticipate the subsequent price target will be $3,600 amid robust ETH accumulation.