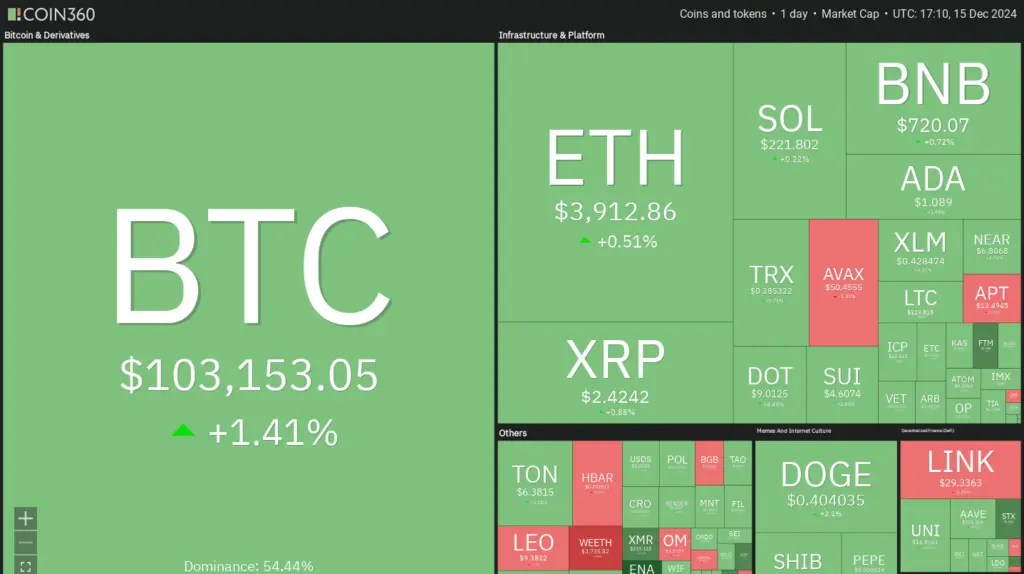

Charts indicate that ETH, LINK, AAVE, and BGB will be the first to break out as Bitcoin bulls strive to elevate BTC’s price above the $104,088 all-time high.

Bitcoin has experienced a significant recovery from its weekly lows and is currently on the verge of surpassing its all-time high of $104,088. VanEck anticipates that the cryptocurrency bull market will peak in the first quarter 2025. Subsequently, the asset manager anticipates a 30% decline in Bitcoin and a more severe retracement of up to 60% in altcoins. The recovery is expected to commence in the fall, with “major tokens regaining momentum and reclaiming previous all-time highs by the end of the year.”

Danny Marques, a researcher in the Bitcoin mining industry, was another individual who expressed optimism. Marques researched Bitcoin’s three previous bull cycles. Marques anticipates that Bitcoin could reach a value of $173,646 to $461,135 in 2025, provided that there is no macroeconomic downturn similar to that of 2020.

Bitcoin is not the sole entity; analysts anticipate Ether will attempt to catch up in 2025. Bybit analysts informed Cointelegraph that Ether is demonstrating resilience in the derivatives market and has the potential to reach a “new all-time high” in Q1 2025.

In the short term, if Bitcoin breaks and continues to trade above $104,088, certain altcoins can charge a premium. We will examine the top five cryptocurrencies that possess a robust chart structure.

Analysis of the Bitcoin price

The gradual ascent of Bitcoin toward the $104,088 overhead resistance suggests the absence of aggressive selling by the bears.

There is a minor drawback in the form of a negative divergence in the relative strength index (RSI), which suggests that the bullish momentum is waning. To facilitate a decline to the 50-day simple moving average ($88,705), sellers must lower the price below the 20-day exponential moving average ($97,985).

A break and close above $104,088 will indicate the resumption of the uptrend. The BTC/USDT pair can increase in value to $113,331 and, subsequently, to $125,000.

Upon reaching the resistance line near $107,000, the pair is anticipated to encounter stiff resistance. If buyers surmount the resistance, the pair will gain momentum and ascend to $113,331.

Bears sell on rallies if the price breaks below the moving averages and declines from the current level or the resistance line. The pair may experience a decline to the support line, which is a critical level to monitor. If the bears cause the price to fall below the support line, the pair may decline to $86,700.

Analysis of the price of Ether

Ether is encountering substantial resistance in the $4,000 to $4,094 range; however, the bulls have not conceded much ground to the bears. This is a positive development.

The RSI’s negative divergence implies that the uptrend is slowing down despite the upsloping moving averages, suggesting an advantage to buyers. The ETH/USDT pair may retrace to the downtrend line if the 20-day EMA ($3,723) is breached—such as postponing the commencement of the subsequent upward trajectory.

Conversely, a positive sentiment will be indicated if the price rises from the current level or the 20-day EMA. This increases the likelihood of a break above $4,094. If this occurs, the pair may experience a significant increase to $4,500.

The RSI is just above the midpoint, and the moving averages on the 4-hour chart have flattened out, suggesting a potential range-bound action in the near term. The pair may stabilize between $4,094 and $3,500 for an extended period.

To increase the probability of a break above $4,094, buyers must raise the price above $4,000. The pair could subsequently increase in value to $4,500. Conversely, the bears will gain an advantage if the price falls below $3,500.

Price analysis of chainlinks

The bears are selling above $30, as evidenced by the long wick on the December 13 and December 14 candlesticks, despite Chainlink’s uptrend.

The $27.41 level is a critical support for monitoring the downside. The likelihood of a break above $31 will be enhanced if the price rises from its current level or bounces off $27.41 with force. The subsequent leg of the uptrend for the LINK/USDT pair could commence at $34.50 and reach $38.30.

If the price falls below $27.41, this optimistic perspective will be invalid immediately. That could result in the pair plummeting to the 20-day EMA ($23.87), critical support that the bulls must safeguard.

The 4-hour chart indicates that the up move is losing momentum, as the RSI exhibits a negative divergence. A break and close below the 20-EMA will suggest that the bears are attempting to make a comeback. The 50-SMA is a critical support for the bulls to maintain, as failure to do so could result in a decline to $23.

Buyers must promptly push and sustain prices above $31 to avert a severe correction. The pair is expected to accelerate toward $34.50 if they do so.

A price analysis of Aave

On December 10, Aave rose from the 20-day EMA ($283) and surpassed the near-term resistance of $300 on December 11.

The bulls have not conceded much ground to the bears even though the AAVE/USDT pair is currently facing selling near $400. This implies that the bulls are maintaining their positions in anticipation of the upward trend’s continuation. The pair could experience a significant increase in value, reaching $450, if buyers drive the price above $400.

The 38.2% Fibonacci retracement level of $330 is the initial support on the downside. The probability of an upward breakout is maintained if the price bounces off this support. Conversely, a decline below $330 could result in the pair reaching the 20-day exponential moving average ($283).

In the near term, the 20-EMA is a critical support that the bulls must defend, and the pair has rebounded from it. The bulls will attempt to elevate the pair above the $400 resistance if the price remains above the 20-EMA.

Alternatively, if the price declines and falls below the 20-EMA, it will indicate that buyers are accumulating profits. The bulls are expected to purchase the pair in large quantities if the pair falls to the 50-SMA.

Price Analysis of Bitget Tokens

Bitget Token (BGB) has been experiencing a robust upward trend; however, the rally experienced a decline from $3.50 on December 12, indicating that traders were taking profits.

The bulls are endeavoring to halt the decline at $3. Should the price increase from its current position, the BGB/USDT pair will once more endeavor to surpass the overhead resistance of $3.50. The rally could reach $4 if that occurs.

In contrast to this assumption, the bears will attempt to pull the pair to the 20-day EMA ($2.43) if the price remains below $3. Such a significant pullback elevates the likelihood of a range formation in the near term.

The bulls are attempting to initiate a rebound from the 50-SMA; however, the recovery is anticipated to encounter selling at the downtrend line. The probability of a price break below the 50-SMA increases if the price experiences a significant decline from the downtrend line. This could initiate a decline to $2.40.

Conversely, if the price surpasses the downtrend line, it may indicate that the pullback has concluded. The pair can potentially increase in value to $3.34, and subsequently, it could reach the overhead resistance of $3.50. The pair may initiate the subsequent leg of the uptrend if this level is breached.