Ethena’s ENA token surged 37%, with analyst Arthur Hayes’ recent $1 million investment fueling speculation on whether the rally will continue.

This week, Ethena’s $ENA has experienced a 37% price increase, defying the sideways routine of crypto. However, the next step of the rally remains uncertain. Traders are currently monitoring the market for confirmation or an abrupt reversal, as buyers are experiencing a loss of momentum at a critical resistance level following a sudden breakout.

The token’s momentum is consistent with the broader protocol’s development, which includes significant ecosystem expansions and new capital inflows. However, technical indicators indicate that the explosive move may require additional propellant to maintain its upward trajectory.

Ethena Expands DeFi Reach with Major Partnerships and $360M Treasury Boost

Ethena has incorporated $ENA into the DeFi ecosystem by forming partnerships with reputable protocols such as Aave, Curve Finance, and Uniswap. This integration has opened up new staking and yield farming opportunities, further aligning incentives for token holders.

Ethena, a synthetic dollar protocol on Ethereum that is crypto-native, enables the minting of USDe through delta-neutral hedging strategies. This approach provides a scalable, censorship-resistant dollar exposure that bypasses traditional banking dependencies.

Ethereum and TON have attracted a Total Value Locked (TVL) of $7.726 billion due to the protocol’s distinctive offering, indicative of a robust capital commitment and yield-bearing opportunities. These milestones reinforce the protocol’s status as one of the most prominent DeFi stablecoin networks.

It generated $433.32 million in annualized fees, which equates to $97.8 million in annualized earnings for the treasury. Furthermore, the liquidity of $ENA on Uniswap V3 amounted to $18.76 million, which guaranteed market depth for governance token trading.

Ethena announced a $360 million treasury initiative on July 22, 2025, to purchase secured tokens to improve treasury resilience and protocol stability. Additionally, the company intends to list its stock on the Nasdaq.

Subsequently, the project collaborated with Anchorage Digital to introduce USDtb, a stablecoin valued at $1.5 billion, federally regulated per the new GENIUS Act.

In addition to these bullish actions, Arthur Hayes, the co-founder of BitMEX, increased his wallet holdings by 2.16 million ENA (approximately $1.06 million), increasing his total to 7.76 million ENA. This action served to boost market optimism further.

Analysts have interpreted these activities across the protocol as a strategic pivot toward institutional integration and regulatory alignment, thereby expanding Ethena’s ecosystem reach.

Given that Ethena’s market capitalization has surpassed $4.2 billion and USDe has surpassed $7.5 billion in circulating value, the protocol’s diversified revenue streams and expanding institutional footprint indicate that $ENA is well-positioned to sustain its current momentum, provided that markets remain receptive to its evolving governance and fee-sharing mechanisms.

$ENA/USDT Tests Breakout Stability as Buy-Side Aggression Wanes

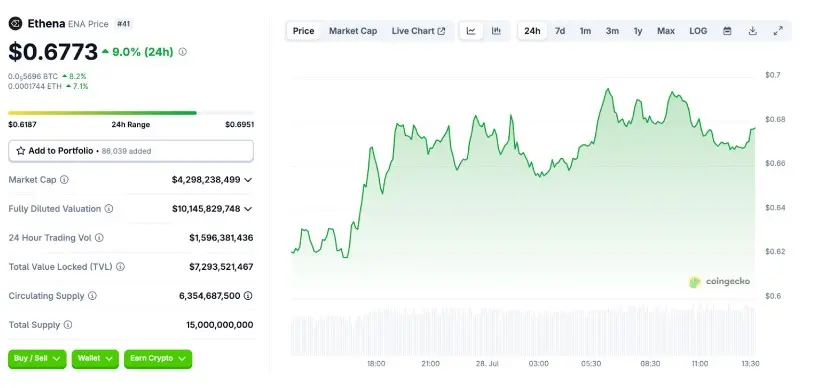

$ENA/USDT has successfully breached the upper boundary after weeks of methodical ascension within a rising parallel channel. However, the escape does not proceed at the same intensity as initially anticipated.

The sustainability of this advance is being called into question, as it has stalled just beneath the $0.69 handle, following a clean move above resistance.

Buyers were initially in charge. The order flow demonstrated robust demand, with a cumulative volume of 119M and positive deltas. However, the situation significantly transformed between $0.67 and $0.69.

Sellers have entered the market, as two consecutive 4-hour wicks have displayed negative deltas (-5.69M and -5.17M). Additionally, the volume is decreasing. This is not mere hesitation; it is genuine opposition.

The price is still trading above the channel at the chart level, albeit by a small margin. The candles are currently contracting, and their extended filaments suggest that they have been rejected.

Concurrently, the MACD lines have begun to converge near the top. At the same time, the RSI has maintained a level of just over 70 for three consecutive sessions, suggesting that overbought conditions have persisted for an extended period.

There is currently no invalidation. However, the appearance has transformed. What was once an explosive breakout now appears to be more akin to a levitation act—buyers are maintaining the price, but there has been no increase to indicate a genuine regime change.

This could rapidly transition into a corrective phase if bulls cannot regain the initiative through a robust volume re-entry. The last genuine demand cluster is in the $0.63–$0.60 zone, which would be exposed to $ENA if it drifts back into the channel.

The breakout may be legitimate; however, the absence of follow-through implies that the market is already second-guessing it.