Despite the Ether ETF approval by the US Securities and Exchange Commission SEC, the prices of Bitcoin and Ethereum are still dropping.

For at least a time, the celebration may be postponed for cryptocurrency bulls. The prices of Bitcoin (BTC) and Ether have decreased over the last 24 hours despite the historic approval of multiple Ethereum (ETH) exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC) on May 23, 2024.

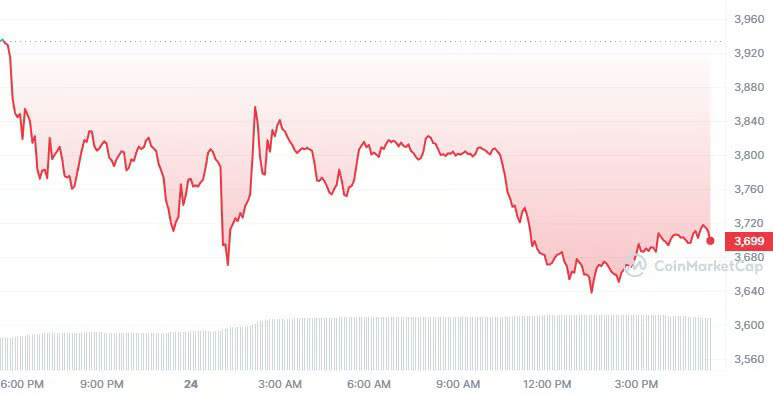

This price decline seems to be a textbook example of the strategy known as “buy the rumor, sell the fact.” Following the SEC’s decision to approve Ethereum ETFs, Ethereum, which had increased by 20% in the week before the clearance, saw a 5.87% loss, while Bitcoin saw a 3.53% decline. Additionally, the market capitalization fell by 1.19% to $2.44 trillion.

Ethereum Price Decline Following Approval of ETF

Senior market analyst at FxPro Alex Kuptsikevich said, “This pullback shouldn’t be a surprise.” “It wouldn’t surprise us if the price dropped to around $3000, regaining a significant consolidation zone. Large institutional investors can begin accumulating an ETF position at these levels.

Kuptsikevich draws attention to the comparable price movement in January 2024 after the first Bitcoin ETF was approved. Before seeing a notable uptick, the price of bitcoin fell by 19%.

Although Ether ETFs have made significant progress with the SEC’s approval of the 19B-4 forms, it’s crucial to remember that these funds still need to be cleared to trade. Before investors can buy shares, each S-1 filing must still receive approval from the SEC.

Still, the approval process is proceeding. Eight ETF proposals from well-known financial institutions, including BlackRock, VanEck, Fidelity, Franklin Templeton, Bitwise, ARK Invest 21Shares, Invesco Galaxy, and Grayscale, have received approval from the SEC. These ETFs are anticipated to list on significant exchanges such as the Cboe BZX, NYSE Arca, and Nasdaq.

Long-Term Hope Remains

Experts remain optimistic about Ethereum’s future and the cryptocurrency sector as a whole despite the recent price decline. For example, Standard Chartered predicts that Ether ETFs may draw as much as $45 billion in investment in their first year. QCP Capital believes that institutional investors’ increasing interest in direct purchases and futures could cause Ether’s price to surge by more than 60% shortly.

The recent decline in Ethereym’s price following the green light for the Ether ETF demonstrates the erratic character of the cryptocurrency industry. But it’s crucial to remember that this is only one chapter in Ether’s development. Institutional players will be investing more due to these ground-breaking ETF approvals.