Spot Ether ETFs faced nearly $200M outflows Monday, as unstaking rose and investors shifted focus from Bitcoin to ETH.

Spot Ether funds began the new week with a big sell-off.

On Monday, they lost almost $200 million, continuing a trend that began last week.

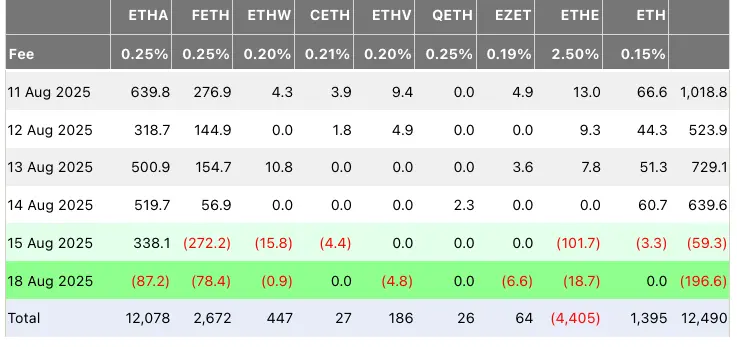

Spot Ether exchange-traded funds (ETFs) lost $196.7 million, their second-biggest daily loss since they started.

SoSoValue says that the most significant amount of money left the market on Monday was only $465 million on August 4.

After Friday’s $59 million loss, the latest money going out brings the two-day total to $256 million.

Still, the outflows were small compared to the record $3.7 billion inflows over the last eight trade days, with some days seeing more than $1 billion in inflows.

$87 Million Is Leaving BlackRock’s ETHA

Farside data shows that the most money left BlackRock and Fidelity’s Ether ETFs on Monday, totaling $87 million and $79 million, respectively.

Fidelity’s Ethereum Fund (FETH) saw losses of $272 million on Friday, a big part of the daily outflows of $59 million.

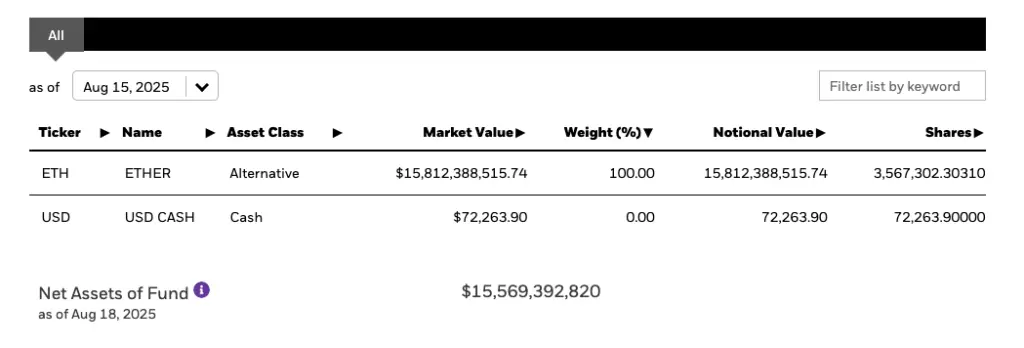

BlackRock now has more Ether than any other group of institutions.

Official statistics for the iShares Ethereum Trust ETF (ETHA) show that as of Friday, the fund had about 3.6 million ETH worth $15.8 billion.

ETHA’s shares’ dollar value has decreased by 1.5% since then, to $15.6 billion on Monday.

CoinGecko says that the price of ETH has dropped about 6.5% during this time.

Every Time Ether Unstaking Queue Hits New High

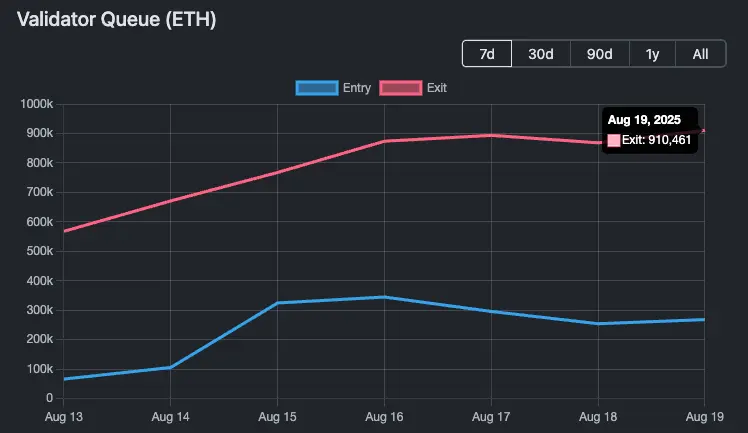

There are record outflows from Ether ETFs and volatile ETH prices simultaneously.

The Ether unstaking queue is also growing, which is the amount of Ether ready to be withdrawn from staking pools by Ethereum validators.

A website called ValidatorQueue keeps track of the validators waiting on the Ethereum proof-of-stake (PoS) network.

On Tuesday, the validator’s exit line hit an all-time high of 910,000 ETH, about $3.9 billion.

Validators must wait at least 15 days and 14 hours to get their ETH back.

Some people who follow the crypto market have pointed out the bad things that could happen because of the growing ETH unstaking wait and warned of an impending “unstakening.”

Coin supporter Samson Mow wrote on X last Thursday, “The unstakening is coming, but the flippening will never happen.”

He also said that the price of ETH against BTC might go back to “0.03 or lower.”

TradingView says that Ether was worth 0.036 BTC at the time of writing.

Bitcoin ETFs Lose Ground To Ether ETFs

Over the past few weeks, inflows into spot Ether ETFs have been higher than those into Bitcoin ETFs.

This shows that investors are becoming more interested in ETH over BTC.

Hildobby, a data analyst at Dragonfly, said that as of Monday, the ratio of BTC supply to BTC kept in ETFs was 6.4%.

For ETH and Ether ETFs, the ratio was only 5%.

“If the current growth rate keeps up, the ETH-ETF will have more of the total supply contained by September than the BTC-ETF,” the expert said on Monday.