About half of the early inflows into the Ethereum ETFs on day one, according to analyst Eric Balchunas, went toward funding the Bitcoin ETF.

Exchange-traded funds (ETFs) for Ethereum are already formally trading on stock exchanges, and analysts have released the initial inflow data for the first 15 minutes of trading.

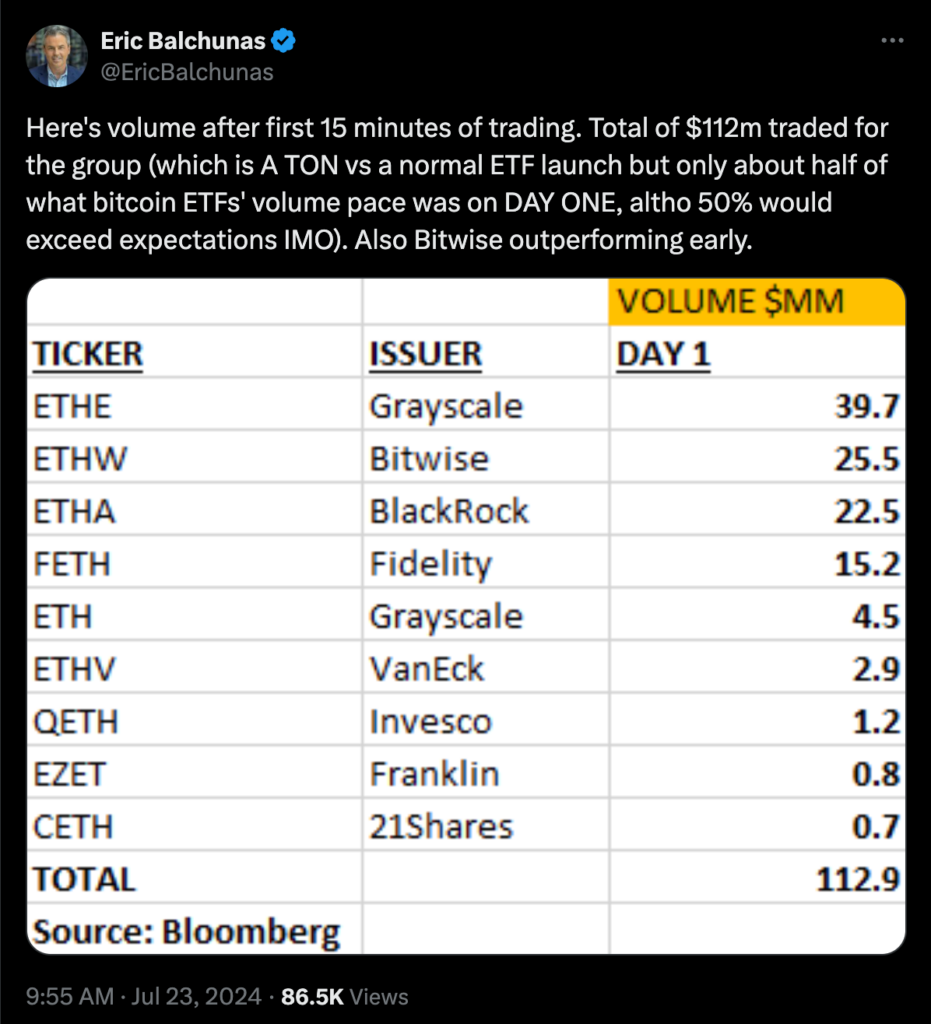

BitWise topped its rivals within the first quarter-hour of trading, generating $25.5 million in capital inflows, second only to Grayscale’s Ethereum Trust, established in 2017, according to senior analyst Eric Balchunas of Bloomberg.

The Bloomberg analyst asserted that during the first fifteen minutes of trading, total inflows into the nine Ethereum investment vehicles amounted to $112 million, substantially exceeding standard offerings.

Balchunas added that even while the inflows into Ethereum ETFs today are around half of what was seen on the first day of the Bitcoin ETF’s launch, the inflows have surpassed forecasts.

Purchase the whisper, market the declaration?

The price of Ether has decreased since the start of the trading day despite the introduction of the eagerly awaited Ethereum ETF and the first $112 million in inflows.

Ether ETH$3,407 started the day’s trading at about $3,540, dropping as low as $3,426. It was able to recover some of its lost territory, and it is now trading at $3,471.

Fierce rivalry between ETF issuers

The nine Ethereum ETF issuers have demonstrated their competitiveness by slashing fees or temporarily doing away with them to draw in investors.

21Shares said in a July 17 Securities and Exchange Commission filing that it would forgo costs for the first six months of trading, following which it would impose a 0.21% management charge.

Similarly, BlackRock advertised an initial 0.12% management fee that would increase to 0.25% after a year or until the assets under management reach $2.5 billion, whichever comes first.

In collaboration with the Protocol Guild, which represents more than 170 Ethereum developers, Bitwise used a novel approach by committing 10% of their spot Ether revenues to fund Ethereum developers.