Bitcoin ETPs lagged altcoin funds, but CoinShares says ETF hopes drove flows. Ether, too, saw gains as crypto funds stayed net positive.

Despite slight outflows from Bitcoin funds, cryptocurrency investment products closed last week in the green, marking 15 weeks of inflows.

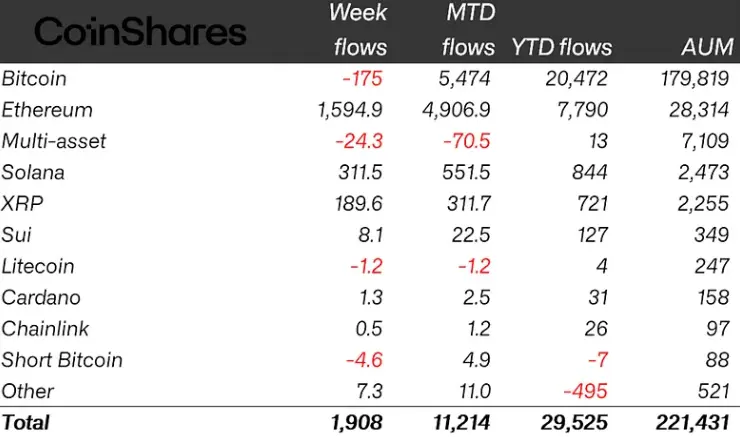

On Monday, the European crypto asset management firm CoinShares reported that global crypto exchange-traded products (ETPs) had inflows of $1.9 billion throughout the trading week that ended on Friday.

According to CoinGecko, the most recent inflows occurred despite increased market volatility.

Bitcoin fell as low as $115,000 by the end of the week while Ether briefly fell below $3,600 on Thursday.

The fresh gains increased overall assets under management (AUM) to $221.4 billion for the first time, while year-to-date (YTD) inflows hit a record high of $29.5 billion.

Inflows this month have already surpassed the previous high of $7.6 billion, which was established in December 2024 after the US election, to reach a record of $11.2 billion.

Inflows Into Ether ETPs Are Second-Largest On Record

With $1.59 billion in inflows, Ether investment products accounted for most of the previous week’s gains.

James Butterfill, head of research at CoinShares, claims that the amount is the second-largest weekly inflow for Ether ETPs ever.

Following Ether ETPs in recorded gains last week were Solana and XRP, which saw inflows of $311.5 million and $189.6 million, respectively.

However, as BTC investment products halted a 12-day inflow streak on July 21, Bitcoin ETPs had slight outflows of $175 million.

Butterfill claims that rather than indicating a wider altcoin season, the flow disparity between Bitcoin and altcoins suggests possible anticipation of altcoin ETFs.

Butterfill stated, “These altcoin inflows may be driven more by anticipation surrounding potential US ETF launches than by broad-based enthusiasm.”

He said there were small withdrawals from several cryptocurrency ETPs, including Litecoin ($1.2 million) and Bitcoin Cash ($0.7 million).

Inflows Decrease By 57% Per Week

Last week, the $1.9 billion in inflows represented a 57% decrease from the $4.4 billion inflows the week before, which were the highest weekly inflows ever.

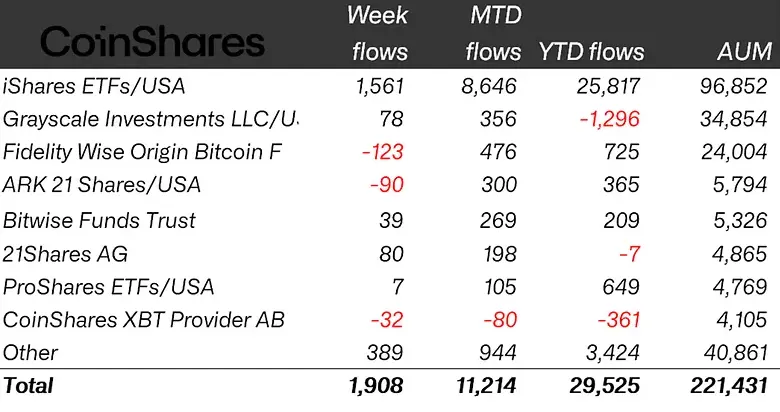

Last week’s gains were driven by BlackRock’s iShares crypto ETFs, which saw inflows of $1.56 billion, down almost 64% from $4.3 billion the week before.

While Cathie Wood’s ARK Invest reduced outflows from $120 million to $90 million, Fidelity Investments increased outflows to $123 million.

With modest inflows of $80 million, European issuer 21Shares recorded the most significant inflows among issuers, following iShares.

Grayscale Investments came next, with inflows of $78 million.

Despite $356 million in inflows, Grayscale’s year-to-date flows are negative, with outflows of around $1.3 billion.

With $25.8 billion in inflows this year, BlackRock accounts for 87.5% of all 2025 crypto ETP inflows.