The Ethereum price has surpassed $4,000, with significant ETH whale activity and wallets holding 100,000 Ether, which accounts for 57.35% of the total supply.

In the past 24 hours, the price of Ethereum has once again experienced a significant increase, surpassing $4,000 and increasing its weekly gains to over 9%. The substantial ETH whale accumulation, supported by optimistic on-chain metrics, coincides with the breakout above this critical resistance. According to market analysts, Ethereum is expected to achieve a new all-time high shortly.

Amid robust whale accumulation, Ethereum prices have experienced a surge

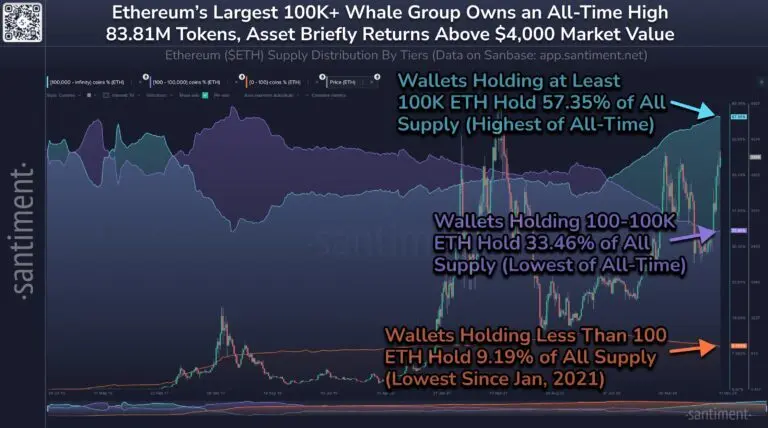

The total number of Ethereum whale wallets, which hold at least 100,000 ETH, has reached 104, according to the blockchain analytics platform Santiment. Their combined holdings are now worth a staggering $333.1 billion, representing 57.35% of the total ETH supply. Additionally, 92% of Ethereum holders are currently profitable.

Conversely, wallets that contain between 100 and 100,000 ETH have experienced their lowest share of the supply in history, which is 33.46%. Similarly, wallets that contain less than 100 ETH and are smaller in size maintain a 9.19% balance, a low point that has yet to be reached in nearly four years. According to Santiment, the concentration of ETH among major stakeholders is a long-term bullish signal that has the potential to propel the Ethereum price to all-time highs of approximately $5,000.

The recent closure of Ether, which is above the $3,800 support on the weekly chart, as noted by crypto analyst Venturefounder, confirms the upward trend. Ethereum’s “cup and handle” pattern is currently in progress, indicating a bullish trend. The subsequent significant price targets are a retest of the all-time high (ATH) at $4,900, followed by milestones at $5,349, $6,457, and $7,238. The venture founder anticipates that this upward trajectory will be realized by the conclusion of Q1 2025 at the latest.

The analyst also observed that Ethereum might “blast off and never look back,” nabbing investors off guard despite the widespread skepticism. A bullish long-term Ethereum price target of $15,937 is maintained by Venturefounder, who anticipates this milestone will be achieved by May 2025.

Ethereum has outperformed Bitcoin and other altcoins, such as Solana, on a 30-day chart, as reported by Glassnode. In the same period, the price of BTC increased by 17.49%, whereas ETH increased by 26.99%. It is also noted that there is a clear transition from Solana to Ethereum in the top altcoins. The SOL price has risen by 1.69% over the past 30 days.

ETH-BTC Demonstrating Strength

The ETH/BTC is again demonstrating strength, as the recent Ethereum price outperformance compared to Bitcoin has occurred. Analyst Venturefounder observes:

“Nothing has changed for ETH/BTC. 2016-2017 bottom reversal pattern is repeating. Bottom is already made. Could be anytime now for the liftoff”.

Additionally, Matthew Sigel, VanEck’s director of digital assets, observed that the ETH/BTC pair is poised to experience a parabolic trajectory similar to 2020.

At the time of publication, the price of ETH was $4,005, representing a 1.34% increase, and it had a market capitalization of $482 billion. The 24-hour liquidation has increased to $80 million, with $54 million being short liquidations.