Entities that are not actively spending or moving their funds are holding a substantial quantity of Ethereum

The most recent CryptoQuant data indicates that the aggregate number of Ethereum (ETH) accumulation addresses has surpassed 19 million.

In comparison to January 2024, the aggregate quantity of Ethereum in accumulation addresses has nearly doubled as of October 18.

This metric was 11.5 million during the first month of 2024. By the conclusion of the year, at least one analyst anticipates that this figure will surpass 20 million.

For what reason? Ethereum ETF approval

“In early 2024, Ethereum Spot ETFs were officially approved, marking a new era. Regulations boosted confidence, making Ethereum mainstream,” the analyst stated.

The CryptoQuant analyst emphasized that Ethereum has expanded to serve both institutions and individuals since the Securities and Exchange Commission approved spot Ethereum exchange-traded funds (ETFs).

It is also anticipated that the value of the accumulation addresses will be comparable to that of the world’s largest enterprises by the end of 2024, when the address holdings reach 20 million ETH, according to the analysis.

The analyst also anticipates that the aggregate value of these holdings will exceed $80 billion, with Ethereum priced at approximately $4,000.

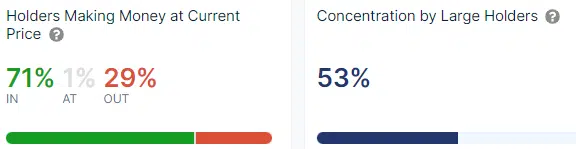

There are 71% of Ethereum holders who are in profit.

Currently, 71% of Ethereum holders are in profit, according to the most recent data from IntoTheBlock.

The data also indicates that 29% of the holders are in a loss, while approximately 1% are in a neutral position.

A more detailed examination of the composition of ETH holders reveals that more than 74% of them have maintained their coins for a period exceeding one year.

Approximately 23% of the holders have maintained their ETH for a period of 1 to 12 months. Less than one month has been held by only three percent of the holders.

In the past 24 hours, the price of Ethereum has increased by more than 2%. At press time, it had also regained the $2,700 level and has increased by more than 10% in the past seven days.