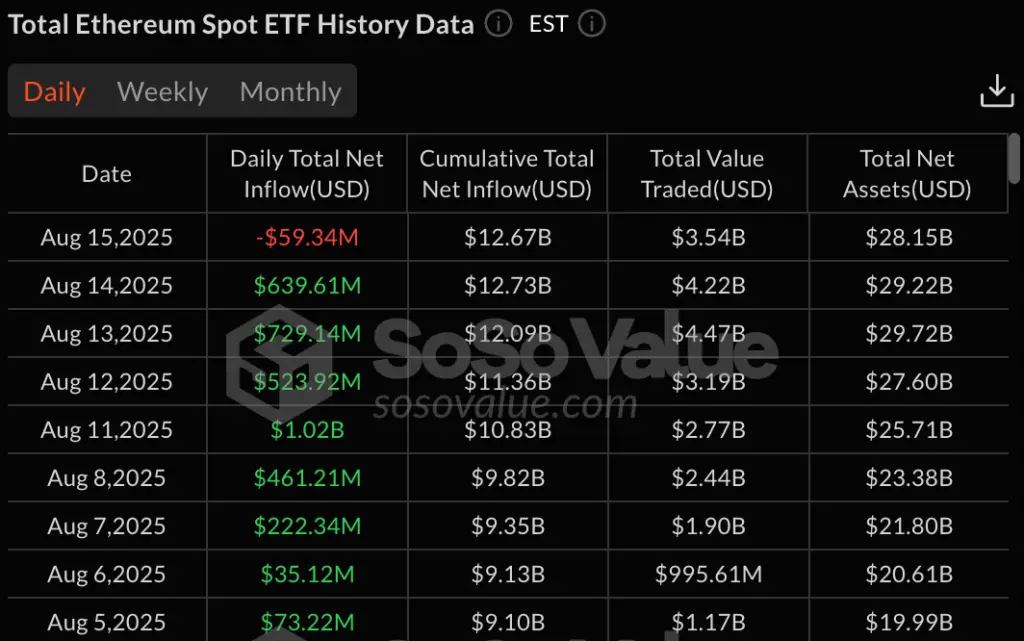

Ethereum ETFs see $59M outflow, ending an 8-day $3.7B inflow streak, as ETH dips from $4,781 high amid market shifts.

The reversal occurs as Ethereum falls from near all-time highs to its current level of approximately $4,450.

BlackRock’s ETHA was the sole major ETF to sustain positive flows, with $338.09 million in single-day inflows, per SoSoValue data. Other major ETFs experienced outflows.

Grayscale’s ETHE was the most popular withdrawal, with $101.74 million in disbursements. Fidelity’s FETH was the second most popular withdrawal, with $272.23 million.

A surge in the price of Ethereum has sparked institutional interest

Ethereum’s recent increase to $4,788 was concurrent with the recent surge in inflows. This brought ETH to within 3% of its all-time high of $4,891.

Institutional investment was attracted to the price surge through ETF products, resulting in cumulative total net inflows of $12.67 billion across all Ethereum ETF products.

BlackRock’s ETHA has amassed $12.16 billion in cumulative inflows since its inception. This renders it the most prominent Ethereum ETF in terms of assets.

Despite the recent outflows, Fidelity’s FETH maintains $2.74 billion in cumulative inflows. This has enabled it to establish itself as the second-largest Ethereum ETF.

VanEck’s ETHV and Franklin’s EZET reported zero daily flows, while smaller ETFs such as ETHW, CETH, and QETH reported varied results.

ETF flows mirror price action

The correlation between Ethereum’s price fluctuations and ETF flows illustrates institutional investors’ reactions to market strength.

The eight-day inflow sequence commenced when Ethereum prices surpassed critical resistance levels and surged as they approached all-time highs.

Current outflows may indicate profit-taking following substantial gains or rotation into other cryptocurrency products.

Retail enthusiasm has been diminished as Ethereum’s value has declined from $4,788 to $4,450. Nevertheless, as reported by Lookonchain, an Ethereum ICO participant transmitted 334.7 ETH after more than a decade of inactivity.

The participant generated a 14,629x return on their investment of $104 in the ICO.