Ethereum’s validator exit queue nears 1M ETH ($4B) as withdrawals rise from top liquid staking platforms.

The Ethereum validator exit line has grown to almost 1 million ETH, about 4 billion ETH.

This is because more people are staking their coins and withdrawing them, which has caused the price to rise recently.

Validator exits have been going up over the past few weeks. This is primarily because of the top three liquid staking platforms: Lido, EthFi, and Coinbase.

Because of this, the price of ETH has dropped more than 10% since it was rejected at $4,800 last week.

Ethereum Validator Is Rising

As more Ethereum holding withdrawals and validator exits happen, investors are becoming more wary of the trend.

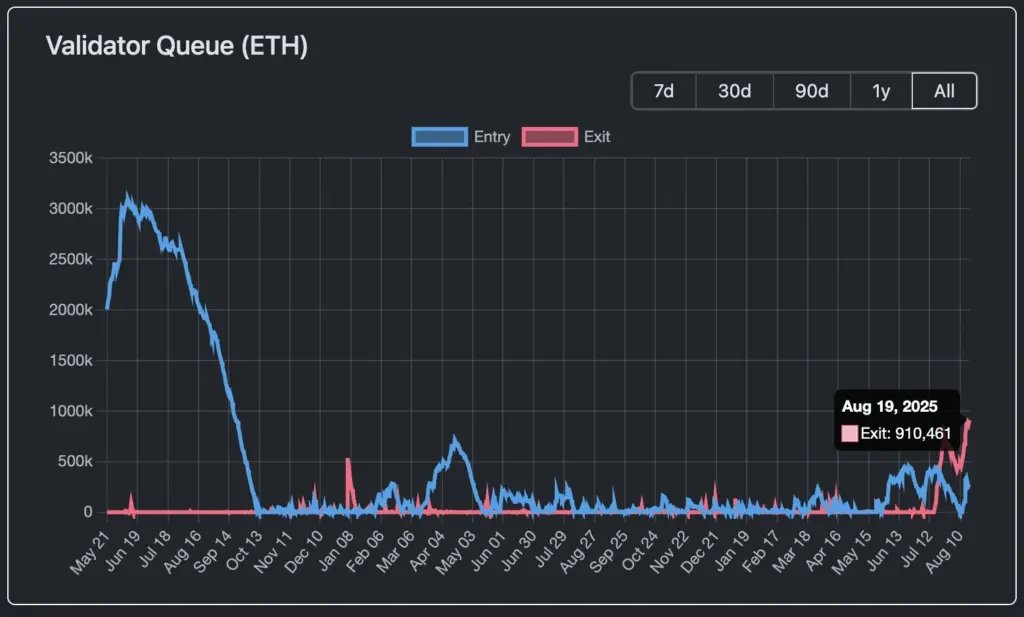

The validator exit queue has grown in just two weeks from 640,000 ETH to more than 910,461, worth a massive $3.9 billion.

The Validator Queue data shows a 15-day wait for the ETH exit, with 1.08 million active validators.

About 29.45% of all the available ETH, or 35.3 million ETH, has already been invested.

A lot fewer people want to get out of ETH, though, than want to stake it again. The market for ETH stakes is now 258,951 ETH, worth $1.09 billion.

The growing line of unclaimed ETH says that much money is being taken out to make money.

So far, most of the selling pressure from validator exit has been absorbed by large amounts of money going into spot Ethereum ETFs and ETH treasury firms buying a lot.

Everyone Is Looking At Staking For Ether ETFs

Analysts of cryptocurrency also think some buyers may be freeing up capital to re-enter the market through stake Ether ETFs.

This could cause them to move their stocks around without leaving the ETH market completely.

Last month, BlackRock, an asset manager, requested to add staking to the iShares Ethereum Trust (ETHA).

Although the SEC’s final approval deadline is April 2026, Bloomberg ETF analyst Seyffart suggests the decision could arrive by October this year.

The net flows into Ethereum ETFs have also decreased over the last two trading days.

Sources from Farside investors show that on August 18, the net losses were $196.6 million, with $87 million coming from BlackRock’s ETHA and $78 million from Fidelity FETH.

The price of ETH has also been under selling pressure, and it has dropped 15% since its weekly high.

Ethereum is currently finding support at $4,200, and the daily number of trades has fallen to $45 billion.