Ethereum jumps 42% in five days, overtaking Coca-Cola and Alibaba in market cap as investor momentum lifts the crypto market.

Following Ethereum’s adoption of the Pectra upgrade, which enhanced layer-2 scaling and validator functionality, Ether’s market capitalization jumped 42%, overtaking Alibaba and Coca-Cola.

Five days after Ethereum’s Pectra upgrade was successfully introduced on its mainnet, Ether’s market valuation jumped 42%.

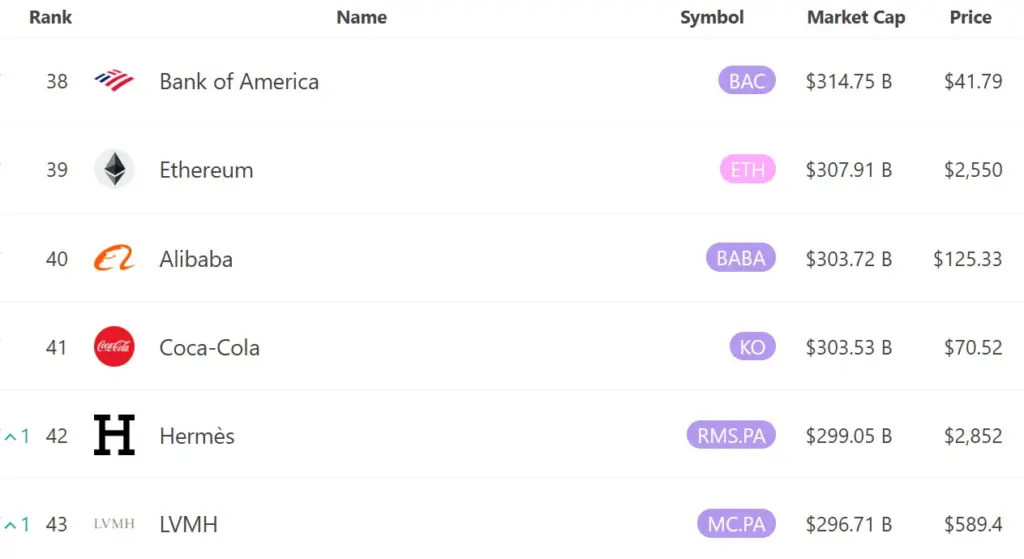

The firm data tracker 8MarketCap displayed Ether on May 12.

ETH, at $2,563, is now the 39th-largest asset in the world by market capitalization, surpassing both Alibaba and Coca-Cola. At the time of writing, ETH’s market value was over $308 billion, and its price was over $2,550.

In contrast, the market capitalization of Coca-Cola is $303.5 billion, with its stock trading at about $70. Alibaba’s market value is $303.7 billion, and its stock is now trading at around $125.

A network upgrade that enhanced the storage of layer-2 scaling data, improved the validator experience, and upgraded the smart account wallet experience preceded the recent price movement of ETH.

Ethereum upgrades Pectra on the mainnet.

Pectra was initially planned for March 2025, but delays occurred due to technological issues that surfaced during testing.

Ethereum’s Holesky testnet made the update available on February 24. When the network update failed to complete after deployment, the engineers looked into the problem and fixed it. When Pectra was deployed to the Sepolia testnet on March 5, developers ran into issues exacerbated by an attacker who led to the mining of invalid blocks.

Before launching the update to the mainnet on May 7, Ethereum core engineers developed a new testnet named “Hoodi” to further prepare for the deployment.

The update allows externally owned accounts (EOAs) to function as smart contracts to pay for gas and other expenses with non-ETH coins. To make things easier for big stakers, the validator staking limits were also raised from 32 ETH to 2,048 ETH. To improve layer-2 network scalability, the upgrade also increased the quantity of data blobs each block can hold.

The price of ETH has increased since the upgrade. According to CoinGecko, Ether traded for roughly $1,786 on May 7. At its peak on May 12, Ether’s value increased by 42% to $2,550.

Security experts warn of dangers following the Pectra upgrade.

However, the upgrade introduced new security vulnerabilities. Cybersecurity experts have cautioned that attackers may utilize a new transaction type after the upgrade to take control of EOAs without users signing on-chain transactions.

Arda Usman, a Solidity smart contract auditor, previously warned that these flaws could let hackers withdraw money via off-chain signed messages.