Ethereum Foundation sells $18M in ETH during rally, signaling strong liquidity and bullish momentum in the market.

Millions of dollars’ worth of Ethereum have been transferred using a wallet connected to the Ethereum Foundation.

This co-occurred as the price surged, bringing the token closer to its peak.

Ethereum Foundation Sells $18 Million In ETH During Price Increase

According to blockchain statistics, a wallet connected to the Ethereum Foundation sold 4,095.18 ETH for an average of $4,578 per token, or about $18.75 million in DAI.

A series of other sales came before this transaction, including 1,694.8 ETH valued at $7.72 million just hours prior.

At an average price of $4,602, the wallet sold an additional 1,100 Ethereum for $5.06 million.

The first two hours saw the sale of over 2,794 ETH, worth $12.78 million.

The market hardly moved in response to these large purchases.

In contrast to the more erratic responses observed in previous cycles, traders claim that this demonstrates Ethereum’s depth of liquidity and the increasing significance of long-term holders.

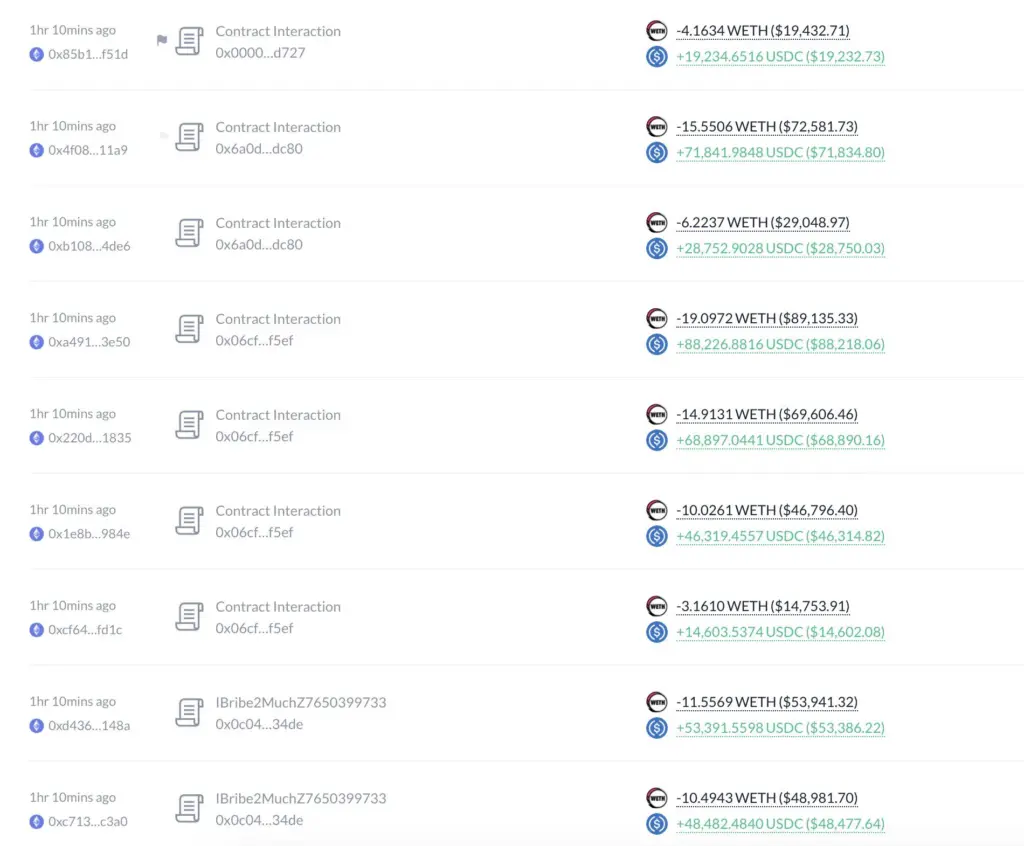

There are other significant sellers outside the Ethereum Foundation.

Nearly 20,000 ETH were sold by a company named “7 Siblings” for approximately $90.4 million USDC at an average price of $4,532.

They gained notoriety for snatching up 100,000 ETH during the August 5 crash of the previous year.

Even after the transaction, they still have about 280,000 ETH, worth $1.3 billion at today’s exchange rates.

Before this, between February 3 and April 7, they had purchased 103,543 $ETH for $229.7 million at an average price of $2,219 per share.

Despite Sell-Off, Ethereum Price Remains Strong, Targets ATH

In addition to a 28.17% weekly rally, the price of Ethereum increased by 8.36% on the last day.

The $4,600 resistance level was recently broken, and signs indicate bullish momentum.

About 113,000 ETH are absorbed daily by spot Ethereum ETFs, which have drawn $523.9 million in inflows.

Following BitMine Immersion Technologies‘ announcement to increase its stock sale target to $24.5 billion, the price almost broke the $4,400 resistance yesterday.

This action should strengthen its already sizable Ethereum reserves.

Similarly, the Ether Machine acquired an extra 10,605 ETH for $40 million, increasing its Ethereum holdings to 345,362 ETH.

Ethereum Foundation claims a recent $97 million private placement was used to finance the purchase.

Furthermore, following a $200 million direct offering at $19.50 per share, SharpLink Gaming disclosed ambitions to expand its Ethereum treasury beyond $2 billion.

The business says the money would be used to buy Ethereum, joining an increasing number of companies placing large bets on the commodity.

Following ETH’s surge above $4,433, co-founder Vitalik Buterin has also regained his status as a “on-chain billionaire,” with his holdings currently worth roughly $1.04 billion.

Fred Ehrsam ($2.93B) of Coinbase, Volodymyr Nosov ($6–7B) of WhiteBIT, and the Winklevoss twins ($2.7B each) are other well-known cryptocurrency figures.

According to experts, the current momentum building could cause the token to soar back to its previous high of $4,878 before the end of the week.