Ethereum trades at $4,666, just 5% from its ATH, as an analyst predicts $5,241 next based on MVRV pricing bands amid a strong market rally.

Ethereum (ETH), which is currently trading at a four-year high of $4,666 and has gained 8.5% over the past day, is again at the forefront of the larger crypto market rise.

With ETH down less than 5% from its peak, analysts anticipate new all-time highs above $4,891, bolstered by several factors such as the Ether ETF inflows and the ETH treasury race.

With Solana (SOL) rising 12.9%, Dogecoin (DOGE) increasing 7%, Cardano (ADA) rising 10%, and Chainlink (LINK) increasing 12%, other altcoins have also joined the surge.

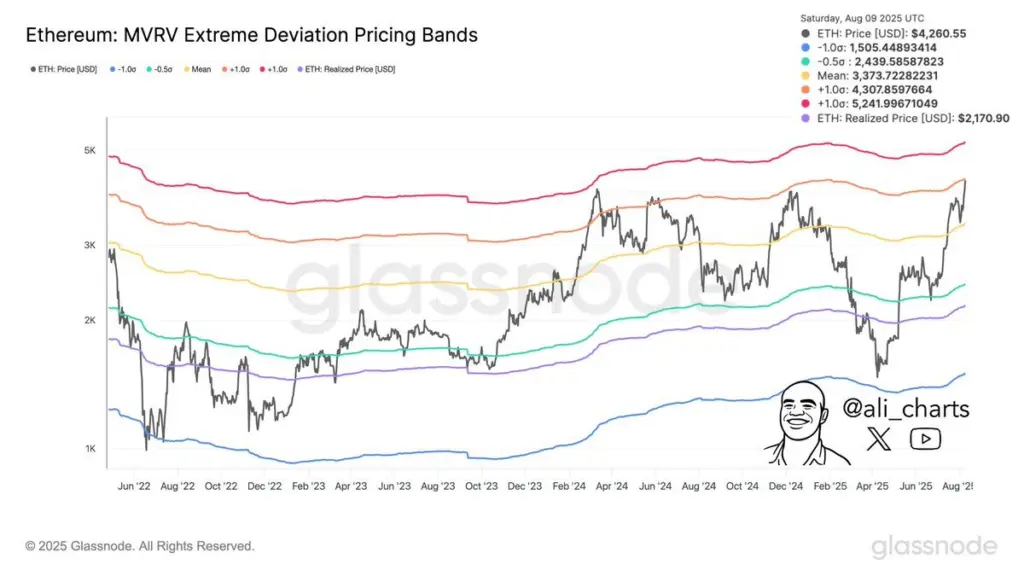

Ethereum MVRV Bands Indicate $5,241 As Next Stop

After a brief period of stability, ETH’s price surged another 8.5% higher after a big breakout from the $4,300 mark.

According to well-known cryptocurrency expert Ali Martinez, the altcoin may continue to rise to $5,241 based on the MVRV pricing bands.

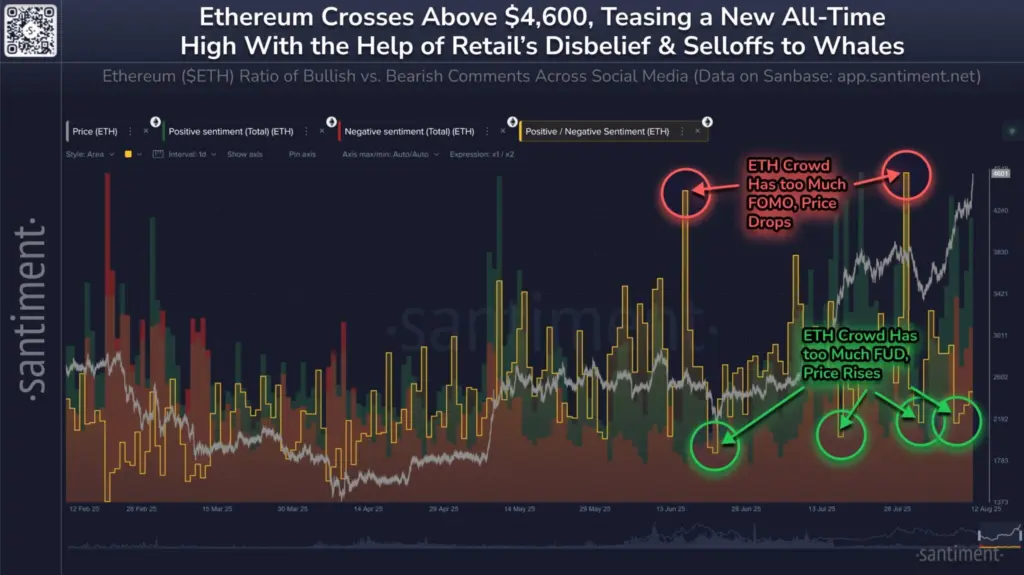

Retail traders have continued to sell as Ethereum gets closer to its all-time highs, according to blockchain analytics firm Santiment.

In the past, ETH prices have tended to fluctuate in opposition to consumer opinion.

Santiment pointed out that previous cases of extreme greed on June 16 and July 30, 2025, resulted in adjustments.

Conversely, corporate players are making large purchases while retail players are selling.

Bitmine Technologies, an ETH treasury company, announced plans to sell $25 billion shares on Tuesday, August 12, to increase ETH holdings.

This is making it harder for the price of ETH to surpass its previous highs.

Additionally, after reaching the $1 billion milestone the day before, inflows into spot Ether ETFs have increased once more, with net flows of $500 million on Tuesday.

Most of the inflows have been led by BlackRock’s ETHA, which has crossed $10.5 billion and demonstrated significant institutional demand.

The Ether ETFs removed 127,403 ETH on Tuesday, while the daily ETH issuance was 2,428 ETH.

This indicates that the ETFs bought almost 52.4 times as much ETH as the network issued today.

Is Crypto Market Rally Being Driven By Altcoin Or ETH Season?

Other altcoins, such as XRP, SOL, BNB, and DOGE, have recorded 10–20% increases during the recent crypto market boom, in contrast to Ethereum’s 30% weekly rally.

This demonstrates unequivocally that ETH has outperformed the other leading altcoins.

According to well-known cryptocurrency expert Benjamin Cowen, the TOTAL 3 market cap (not including Bitcoin and Ethereum) is declining against ETH, suggesting that this is more of an Ethereum season than an altcoin season.

Cowen posted the following message on the X platform:

“ALTs are now down 50% against ETH since April. As I said below, this was ETH season, not ALT season. As long as ETH/BTC goes up, so too will ALT/BTC pairs. But ALT/ETH pairs will likely bleed for about 1-2 more weeks before they get a relief bounce”.

Cowen said, “ETH is probably headed to reach the previous All-Time Highs before a September decline.”

After ETH/USD reaches fresh all-time highs, ALT/ETH pairs will probably rebound.