Ethereum price holds bullish momentum with a bull flag setup, keeping $5,500 in play despite BlackRock’s $254M ETH sell-off.

Despite recent declines, the price of Ethereum has been comparatively stable in recent sessions.

As investors consider positive technical and institutional outflows, the asset consolidates below significant resistance levels.

Market mood is split between those anxious due to intense institutional selling pressure and those who favor a positive breakout.

Ethereum Price Movement: Bull Flag Increases Breakout Pressure

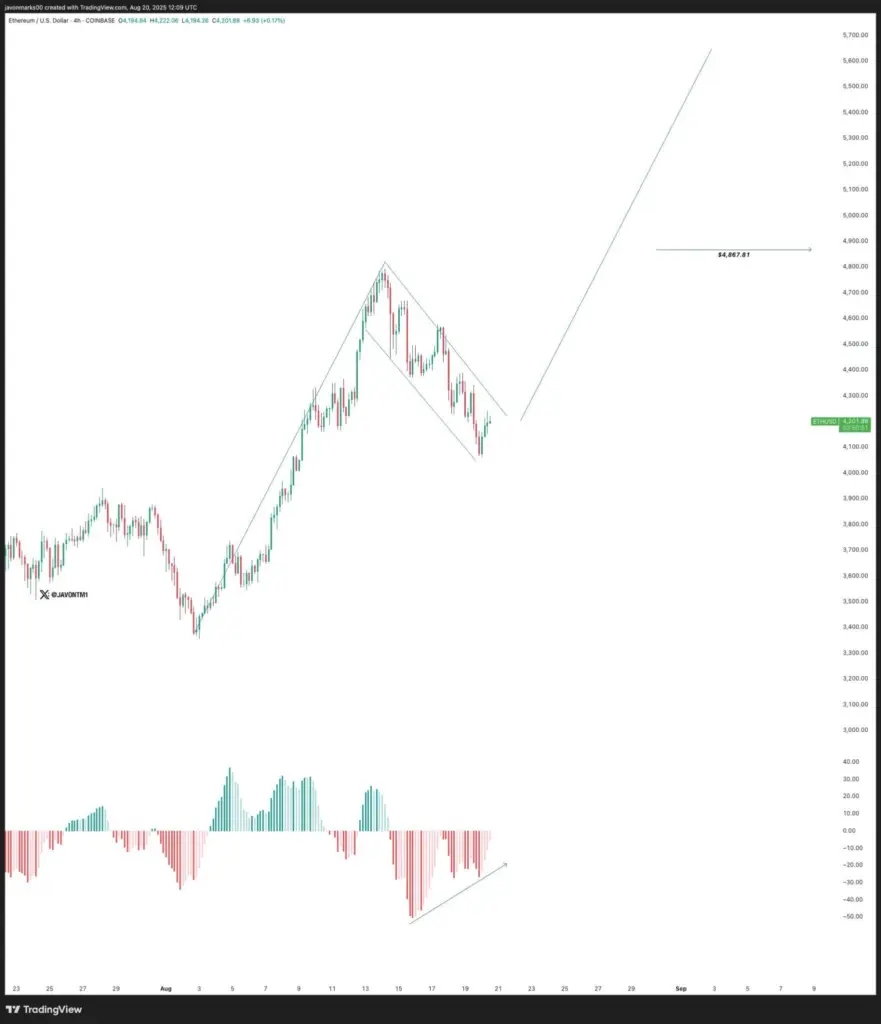

Crypto analyst Javon Marks claims that the price of Ethereum is showing a classic bull flag pattern on the daily chart, indicating that consolidation may soon give way to new momentum.

Price activity has remained within a clear channel during the orderly pullback from the recent highs.

Historically, this pattern has been followed by continuation, which typically leads to higher valuations once the resistance has been broken.

In the immediate run, a well-executed breakthrough can result in a move towards $4,800.

However, if $4,200 is not maintained, the optimistic mood could be damaged, and a further correction could be made.

Anticipating the following pivotal action is defined by this risk-reward balance.

The analysts point out that Ethereum would achieve its all-time highs if a confirmed breakthrough occurred, rising to values exceeding $5,500.

Even when the market is dominated by selling waves, the ability to maintain higher lows during the correction is a sign of strength.

Furthermore, the chart stays bullish as long as the bull flag is there and bullish forecasts are active.

The technical picture points to continuation, even though short-term prudence is still warranted.

Consequently, an Ethereum price projection for 2025 that anticipates an additional increase over present levels is supported by this configuration.

BlackRock’s $272 Million Ethereum Withdrawal Raises Questions

When BlackRock sold more than 59,606,000 ETH, worth roughly $254.43 million, it caused a stir in the market.

Naturally, this action by BlackRock, the world’s most prominent asset management firm, raises concerns about potential short-term pressure on the price of Ethereum.

While some saw the sale as a sign of diminishing demand, others see it as a profit-taking off from the Ethereum boom.

However, the broader technical structure remains intact despite the gloomy picture.

While institutional acts can influence mood, they typically don’t decide long-term orientation.

As a result, the price of Ethereum is still more dependent on retail belief and chart performance than on a single sell-off.

In conclusion, both bullish and bearish forces are at work, and the price of Ethereum is still at a critical juncture.

The technical setup is skewed toward an upside break if resistance is broken soon.

Although it increases pressure, BlackRock’s sale does not preclude long-term optimistic prospects.

As a result, $5,500 remains a fair upward objective.