Ethereum Price breaks 30-day range, tops $2,800 for the first time since Feb. 25 as open interest hits $41B; eyes now on a potential $3,000 rally.

Today, June 11, Ethereum (ETH) broke free from a 30-day consolidation range and surpassed $2,800 for the first time since February 25.

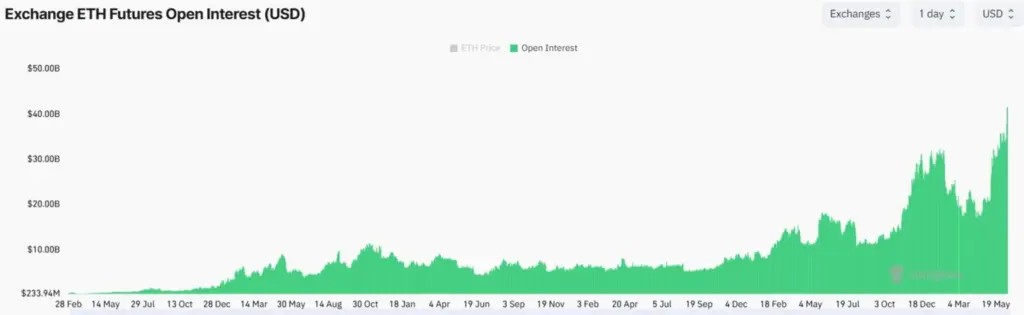

In the interim, open interest has reached a record high of $41 billion as speculative trading interest increases.

Amidst a bullish technical outlook, which is bolstered by surging derivatives market activity and $30 billion in daily trading volumes, what is the future of the Ethereum price? Will it ultimately surpass $3,000?

Ethereum Price Surpasses 30-Day Range

The price of Ethereum has been fluctuating within a narrow consolidation range for the past 30 days, following a significant increase in May.

Buyers and vendors could not reach a consensus on the price range, which spans from $2,400 to $2,700.

Nevertheless, ETH has now exited this consolidation range, indicating that a significant shift may be underway.

The breach was marked by a robust green candle that closed above the upper boundary of the range.

This boundary is currently providing essential support.

Buyers’ confidence will be further bolstered if Ethereum’s price can maintain an upward trajectory beyond this threshold.

The 61.8% Fibonacci level of $3,070 is the initial objective of the subsequent uptrend.

After surpassing this psychological resistance level, the price of ETH may eventually exceed $4,000 due to avarice and FOMO.

The 50-day SMA’s convergence above the 150-day confirms that the Ethereum price rally is still extant following the range breakout.

A bullish signal may be forming in the minds of buyers as they await a firm crossover before the buy-side volumes increase.

The momentum surrounding Ethereum remains favorable, as the RSI is currently at 65.

Nevertheless, it is alarming that the Relative Strength Index had shifted to the downside at the time of publication, indicating that purchasers are likely anticipating the SMA crossover.

Nonetheless, the RSI has the potential for further growth, as evidenced by its elevation above 70 in November 2024 and May 2025 before its reversal, despite its current level of 65.

ATH Of Open Interest: $41 billion

The open interest of Ethereum has reached a record high of $41 billion, indicating that leveraged traders are increasing their positions in anticipation of a significant price increase.

This increase also shows that capital flows into ETH futures and perpetual contracts, a phenomenon that typically precedes increased volatility.

The direction of a sustained move that frequently occurs in response to a surge in open interest is contingent upon accumulating long or short positions.

According to Coinglass data, the long/short ratio of ETH is 1, which indicates a somewhat balanced market positioning.

Nevertheless, 55% of traders on Binance are long purchasers, while 44% are short sellers.

The Ethereum price may be susceptible to a long squeeze, resulting in a rapid decline if long positions accumulate due to the optimism pervasive in the broader crypto market.

In the same vein, a short squeeze, which is typically bullish, could result from an increase in short positions.

What Will Happen To Ethereum Price Next?

The Ethereum price’s breakout from a month-long consolidation range has signaled a significant trend shift that could lead to a sustained uptrend.

A rally to $3,000 may be imminent, as the price is currently trading above the $2,680 resistance that has remained robust since early May.

The probability of an Ethereum rally to $3,000 in the near term is also supported by a significant increase in open interest, which has recently reached a new all-time high of $41 billion.

This indicates a high level of speculative trading activity in the ETH derivatives market, which may surge volatility shortly.

Therefore, the most probable course of action for the Ethereum price in the future is a sustained upward rally, provided that the purchasers who were passive during the consolidation range begin to accumulate.

Nevertheless, the rally may be terminated if the upper boundary of this range cannot serve as support.