The MVRV ratio of Ethereum price indicates a significant degree of caution, suggesting that it may experience a 40% decline before rising to $10K.

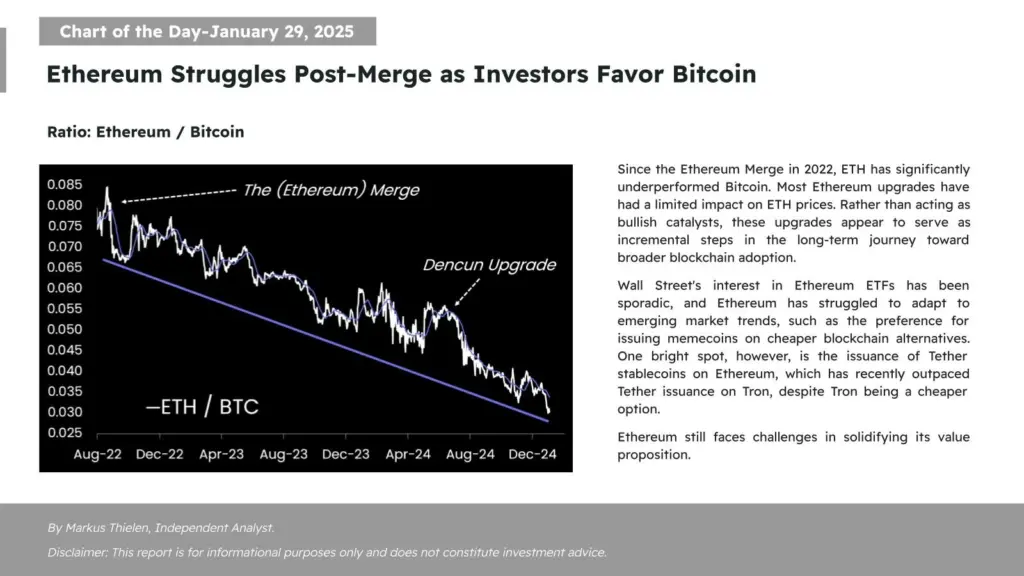

The Ethereum price has been unable to sustain its upward trajectory, as the MVRV on-chain metric data indicates that a 40% crash is imminent if history is to be repeated. The prevailing market sentiment toward the largest altcoin is becoming bearish as ETH struggles under $3,200. However, there are still high expectations for a rally to $10,000. Additionally, the ongoing quantitative tightening may challenge altcoins as Fed Chair Jerome Powell maintains interest rates at their current level.

Popular analysts anticipate a 40% decline in the price of Ethereum

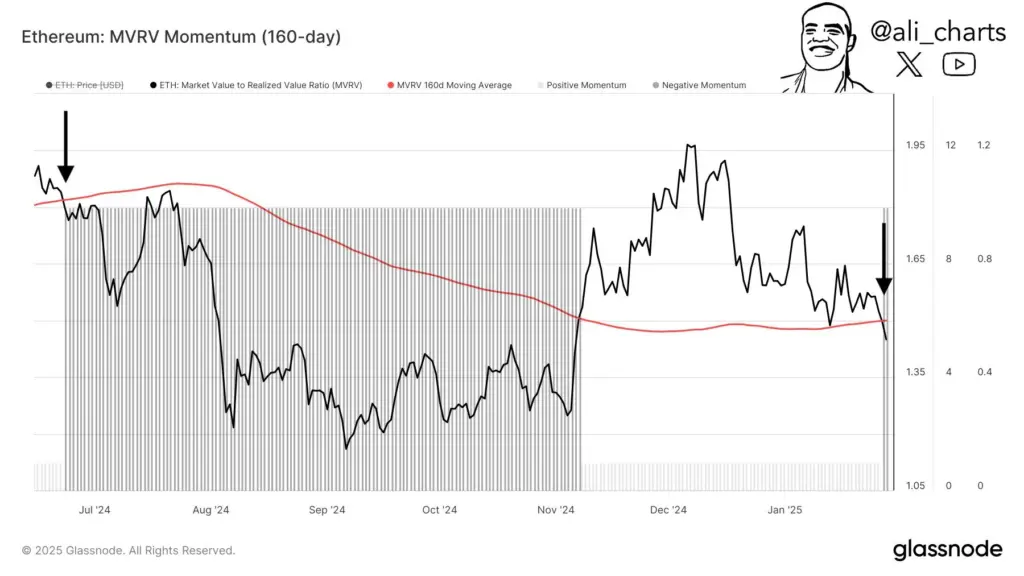

Prominent crypto analyst Ali Martinez has identified a critical trend in the performance of the Ethereum (ETH) market. Martinez has reported that Ethereum’s Market Value to Realized Value (MVRV) ratio has once again declined below the 160-day moving average. In June of the previous year, the Ethereum price experienced a 40% decline, plummeting from $3,500 to $2,100 after it fell below the 160-MA.

Martinez also identified a critical support zone for Ethereum between $2,230 and $2,610. This region is a significant accumulation zone, with 62.27 million ETH in 11.99 million wallets. Market participants closely monitor potential Ethereum price movements as ETH tests these support levels.

The price of ETH may be suppressed as the supply increases

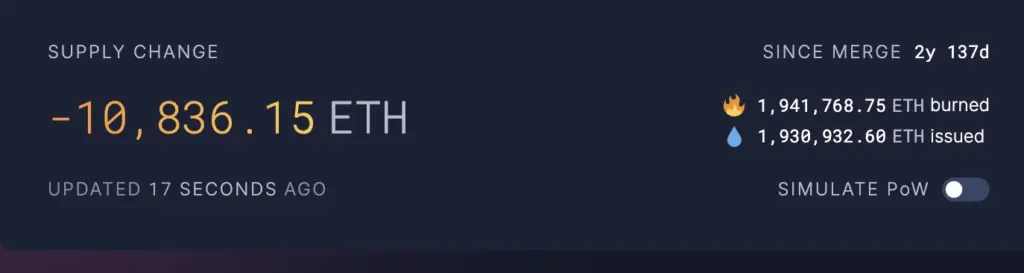

In July of the previous year, crypto analyst Benjamin Cowen issued a cautionary note regarding the increasing supply of Ethereum (ETH). This suggests that the merger for deflationary ETH has been unsuccessful. Cowen estimates that the supply of ETH has increased by approximately 60,000 ETH per month. The price recovery of ETH may be influenced by the increasing supply, which has been a significant source of concern. The analyst reiterated his stance, stating:

“Ethereum supply is <11,000 away from the pre-merge supply, just as monetary policy is starting to change (Bank of Canada just announced they are ending QT)”.

Is the price of Ethereum approaching $10,000 a distant dream?

In recent months, cryptocurrency market analysts have expressed optimism regarding Ethereum’s potential to surpass five figures and experience an additional surge. The market can anticipate an increase in ETH price as long as it remains above $3,000 levels. Nevertheless, the Ethereum price would encounter its initial immediate resistance at $4,000, at which it has previously encountered numerous rejections. Ted Pillows, an analyst, observed:

“Ethereum is forming higher lows on the longer timeframe. $4K remains the most crucial level, and the reclaim of that will send $ETH to new ATH. Once that happens, I’m expecting Ethereum to hit $9K-$10K within 3-4 months. Trump will buy more and more.”

The analyst, who maintained his optimism regarding Ethereum, also observed, “You believed that Trump was purchasing over $200,000,000 of Ethereum to enter a depressing bear market?” It was unanimously agreed that the FOMC meeting was not favorable. Considering the current state of the markets, they are optimistic about Ethereum.

The ETH price is currently trading at $3,186, increasing by 2% as of press time. The daily trading volume has increased by 22% to $24.17 billion. Despite Ethereum’s lackluster performance, crypto market analysts believe that XRP has the potential to overcome Ethereum.