Ethereum’s MVRV signals sell as short-term profits spike, hinting at profit-taking with ETH at $4,800 amid high market volatility.

The Market Value to Realized Value (MVRV) ratio indicates that short-term holder profitability is increasing, which has resulted in a sell signal for Ethereum (ETH). What is the future of the Ethereum price as the risk of profit-taking increases? Will short-term holders compel the price to fall below the $2,410 support level?

The Ethereum MVRV Indicator emits a sell signal

The 60-day MVRV ratio is increasing and exhibiting a widening spread compared to the 180-day MVRV. The 60-day MVRV was 8.26% at the time of publication, indicating that short-term holders are resting on substantial unrealized gains. Conversely, the 180-day MVRV is 0.65, indicating that mid-term holders are operating at a minimal profit.

In late April, the spread between short-term and long-term holders began to broaden, coinciding with substantial price increases in Ethereum amid increasing ETF inflows. The 60-day MVRV has surpassed the 180-day MVRV, indicating that speculators who purchased within the past 60 days outperform long-term holders.

Typically, the FOMO of traders who purchased into the rally is accentuated by the appearance of this MVRV crossover. The risk of profit-taking may result in short-term pullbacks even though the Ethereum price has broken out from a 30-day consolidation range.

Mid-term holders who have held ETH for the past 180 days may also sell, as the MVRV has turned positive after being negative between February and May 2025.

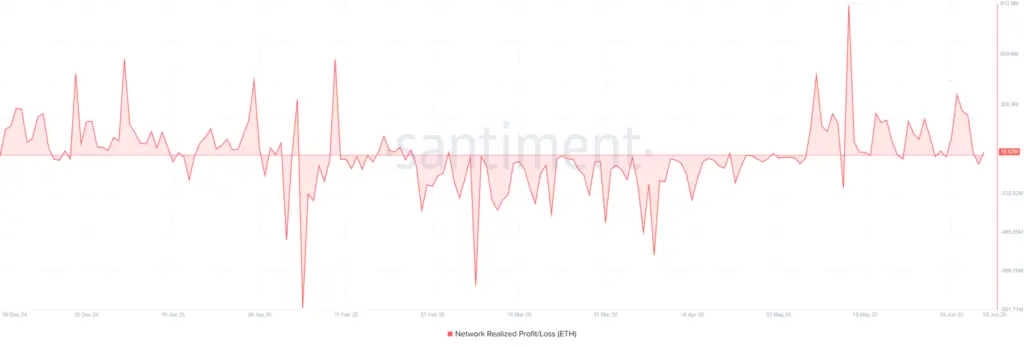

The minor spikes in the Network further heighten the probability of continuous profit-taking Realized Profit/Loss metric within the positive region. This indicates that certain speculators may be selling to accumulate profits.

The recent surges in realized profits and the high short-term holder profitability are bearish indicators suggesting that Ethereum’s price may decline in the near term.

Ethereum’s Price Predictions for Investors

The price of Ethereum could decline below the $2,410 support level as the risk of profit-taking increases. At press time, ETH is trading at $2,739, which is only 13% above this support level, according to CoinMarketCap data. If there is no bullish catalyst to facilitate the same rally observed in April and May, ETH may breach this support, increasing the probability of a downtrend to $2,000.

Furthermore, the bullish sentiment is losing strength, as indicated by the AO histogram bars. This could result in the Ethereum price failing to defend the $2,410 support level and entering a downtrend.

Nevertheless, despite the ongoing correction, CoinGape identified three chart patterns that elucidate the potential for ETH to rise to $4,000. The risk of profit-taking may be mitigated, and a decline below $2,410 may be prevented if an additional rally occurs.

In summary, the MVRV indicator has issued a sell signal, which indicates that the Ethereum price is susceptible to a decline to $2,410. This correction may be precipitated by short-term holders who acquired securities within the past 60 days and seek to realize their gains.