The price of ETH plummeted to a multi-month low; however, traders think that the correction has concluded, as indicated by ETH derivatives data

On July 5, Ether (ETH) fell below $3,000 for the first time in 50 days, trading at $2,989. This decline was a component of a more extensive cryptocurrency market correction, significantly influenced by Bitcoin (BTC) at $56,439.

Some traders are concerned that the crypto bull run may have ended, and despite the impending launch of a spot Ethereum exchange-traded fund (ETF) in the United States, the price of Ether could continue to tumble.

Following the crypto market correction, Ether’s price plummeted below $3,000

The total market capitalization of cryptocurrencies fell below $2 trillion on July 5, a threshold that has yet to be observed since February 26. The 18% decline in Ether from $3,450 to $2,815 reflected the sector’s 16% decline over three days, with no specific cause other than the general deterioration in sentiment toward cryptocurrencies. Analysts contend that this decline was precipitated by elevated selling pressure on Bitcoin.

On July 7, the Mt. Gox insolvency estate transferred 47,229 Bitcoin valued at $2.6 billion to a new address. This action is a component of the process to commence the repayment of creditors, as a portion of the Bitcoin was transferred to a live wallet at the Bitbank exchange.

This has prompted apprehension regarding the potential adverse effects on the price of Bitcoin, as the currencies, which have been confined for more than a decade, have the potential to generate a selling pressure of up to $4.5 billion.

In addition to this pressure, the German government has transferred 7,583 BTC to exchanges since June 19, totaling $415 million. Furthermore, the German authorities possess 42,274 BTC, valued at over $2 billion. This is a cause for concern. The fear, uncertainty, and doubt (FUD) that these substantial transactions have sparked have resulted in liquidating $936 million in leveraged long positions over three days. This includes $235 million in Ether futures.

Traders are apprehensive that the 2024 cryptocurrency bull run may have ended, particularly because the S&P 500 index achieved a new high on July 5. The stock market responded favorably to the United States’ announcement of a 4.1% increase in the unemployment rate for June. The appeal of fixed-income investments is diminished when the central bank encourages interest rate cuts in response to a weakened economy.

The metrics of ether derivatives do not indicate a significant degree of hedging.

Ether and other cryptocurrencies could not maintain their optimistic momentum despite the scenario favoring risk-on assets. Sure, market participants think that the introduction of a spot Ethereum ETF in the United States could have a beneficial effect on Ether’s price.

However, the ability to predict potential inflows needs to be improved, particularly in light of the absence of investor interest in the sector. In light of these circumstances, derivatives metrics indicate that Ether traders have become less optimistic.

To account for the extended settlement period, Ether’s monthly futures contracts are typically traded at a 5%–10% premium in neutral markets over ETH spot markets.

On July 5, the annualized ETH futures premium, which was 11% the previous week, decreased to 8%, according to the data. Even though this level is not particularly concerning, it is important to note that traders still anticipated a positive effect from the impending spot Ether ETF launch.

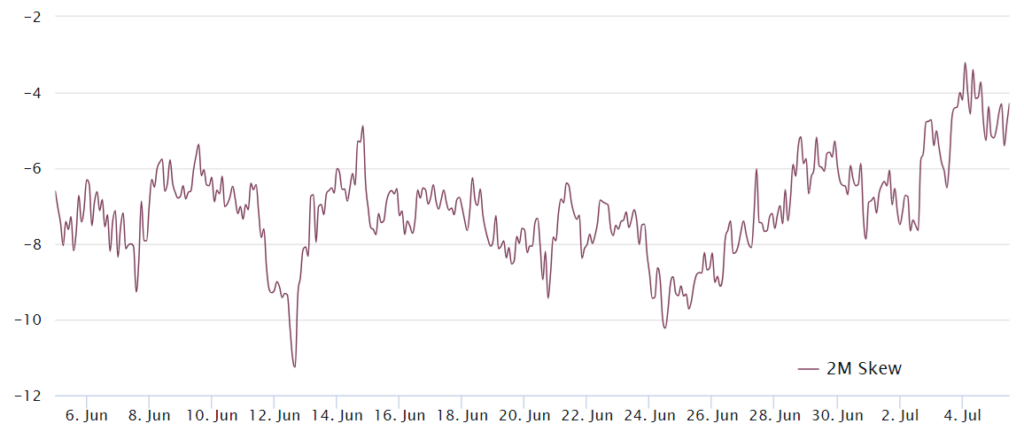

It is beneficial to examine the Ether options market to determine whether the demand for hedging has increased in response to the recent price correction. The ETH options skew metric typically exceeds 7% when traders anticipate a price decline. In contrast, a less than -7% skew frequently indicates periods of optimism.

Over the past week, the Ether options deviation has remained relatively stable at -5%. Moreover, it last entered bullish territory on June 26, suggesting that the neutral sentiment that has prevailed for over a week has been dominant. However, the absence of a disproportionate demand for downside protection during Ether’s price decline below $3,000 has been a positive development.

Ether derivatives have demonstrated relative resilience despite a 15% correction. This does not inherently imply that ETH will rapidly reclaim the $3,300 support level; however, it does indicate that professional traders are not rushing to hedge against additional price drops or bracing for further declines.