The 11% decline in Ethereum (ETH) price has caused a further decline to $3,000 due to the forced liquidations of Ethereum whales to satisfy their debt.

The Ethereum whale entities and the Ethereum Foundation have both participated in a selloff, resulting in an 11% decline in the price of Ethereum (ETH) to below $3,300 within the past 24 hours. Today, ETH has experienced significant liquidations of long positions, falling below the critical support of $3,500. Analysts anticipate that the next support will be around $2,800.

A Significant Amount of Ethereum Whales Are Being Sold Off

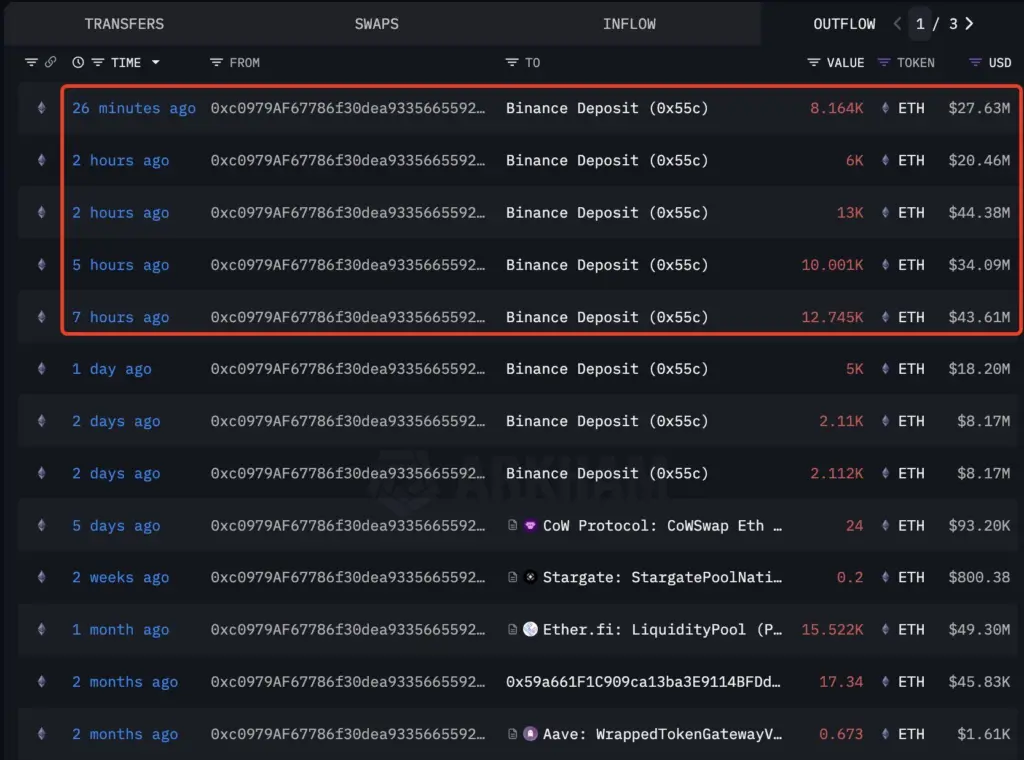

Amid the broader crypto market crash, Ethereum whale entities have resolved to a significant selloff, resulting in negative sentiment towards the asset. Lookonchain, a blockchain analytics platform, reported that a whale deposited 22,746 ETH, valued at $77.7 million, to Binance earlier today and subsequently withdrew stablecoins to settle debts on Aave and Spark.

A total of 31,968 ETH, valued at $122.3 million, has been deposited into Binance by this same whale over the past two days. In another instance, a distinct whale transferred 49,910 ETH, valued at $170 million, to Binance within the last eight hours. Subsequently, the whale withdrew $137.8 million in stablecoins.

Therefore, the ongoing volatility in the cryptocurrency market has resulted in many Ethereum liquidations, as investors are compelled to settle their debts. The current price of ETH has been corrected by over 17.5% since the rejection at $4,000.

The Ethereum Foundation sold an additional 100 ETH from its holdings just two days prior, when ETH was trading at $4,000. This demonstrates that the Foundation’s strategic sale is at the highest level.

According to data, the Ethereum Foundation has executed 32 trades in the past year, resulting in the sale of 4,466 ETH for a total of approximately $12.6 million. The data from Arkham Intelligence indicates that 15 of these trades were executed at or near market peaks. This is particularly noteworthy.

Apart from the Ethereum whale selloff, the spot Ethereum ETFs experienced $60 million in outflows on Thursday, following several days of consecutive inflows. The majority of the outflows, which totaled $58 million, were attributed to Grayscale’s ETHE.

Is it possible for the price of ETH to plummet to $2,800 once more?

According to crypto market analysts, Ethereum’s price is anticipated to decline by $2,800 and possibly lower in anticipation of re-accumulation. Renowned crypto analyst Caleb Franzen shared an inverse head-and-shoulders pattern for Ethereum. This pattern indicates that Ethereum is on a downward trajectory and is expected to reach another low of $3,000, after which it could rebound to $4,000.

He observed, “Now that we are being rejected at the YTD highs, all I see is the opportunity to produce the final phase of the inverse head and shoulders setup.”

Ethereum has significantly underperformed other altcoins this year in 2024, which has put investors’ patience to the test. Nevertheless, the Ethereum bulls think the rapid ascent to an all-time high will occur once ETH surpasses $4,100. Ted Pillows, a prominent cryptocurrency analyst, observed:

“$4K seems like the new $1.4K for Ethereum. In the 2020-21 cycle, ETH got rejected from $1,400 several times before a successful breakout. Right now, the same thing is happening with the $4K level, but there’ll be a breakout soon. Once $ETH closes above $4.1K, a new ATH will happen in no time”.

Deribit’s Ethereum options data indicates that Ethereum is not entirely doomed, despite the Ethereum whale selloff. 173,000 ETH options expired recently, with a notional value of $590 million. The options had a Put/Call ratio of 0.5, suggesting a more significant number of bullish call positions than bearish puts. The maximum pain price, which is the point at which the majority of options lose their value, is $3,750, which is a significant area of interest for traders and market participants.

At the time of publication, the Ethereum price was trading at $3,264, an 11.21% decrease, and its market capitalization fell below $400 billion. The open interest decreased by 10.53%, falling below $25 billion, according to the Coinglass data. The 24-hour liquidation has also increased to $226 million, with $198 million in long liquidation.