The recent price correction has resulted in a $1 million loss for the Ethereum whale, as the price of ETH cannot surpass critical resistance levels.

The Ethereum billionaires have maintained their ETH dumping as the ETH price continues to struggle to surpass $3,500 to establish the subsequent phase of the rally. Additionally, investors are exercising caution as the supply of ETH approaches the levels that existed before the Ethereum Merge. In conjunction with Bitcoin, ETH continues to exhibit signs of frailty, suggesting that there is potential for an additional decline in pricing.

The Ethereum whale has recorded a loss of more than $1 million

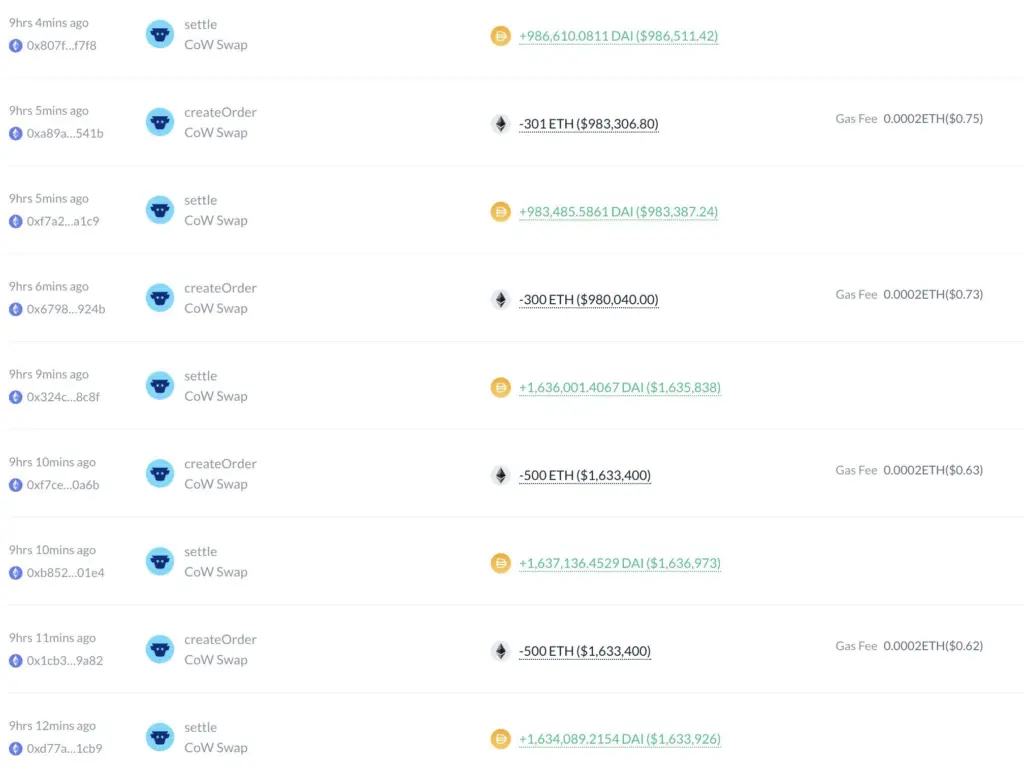

Ethereum billionaires have initiated liquidating their assets at a loss, which is a significant development. Nine hours ago, three wallets—possibly under the control of the same entity—sold 10,070 ETH for 33 million DAI at an average price of $3,280 per ETH, resulting in a $1 million loss.

This whale has withdrawn a total of 24,029 ETH, valued at $81.3 million, from the crypto exchange Binance three weeks ago using 10 newly created wallets, according to the blockchain data provided by LookOnChain. Nevertheless, the whale currently holds 13,959 ETH, equivalent to $45.48 million, in all these wallets.

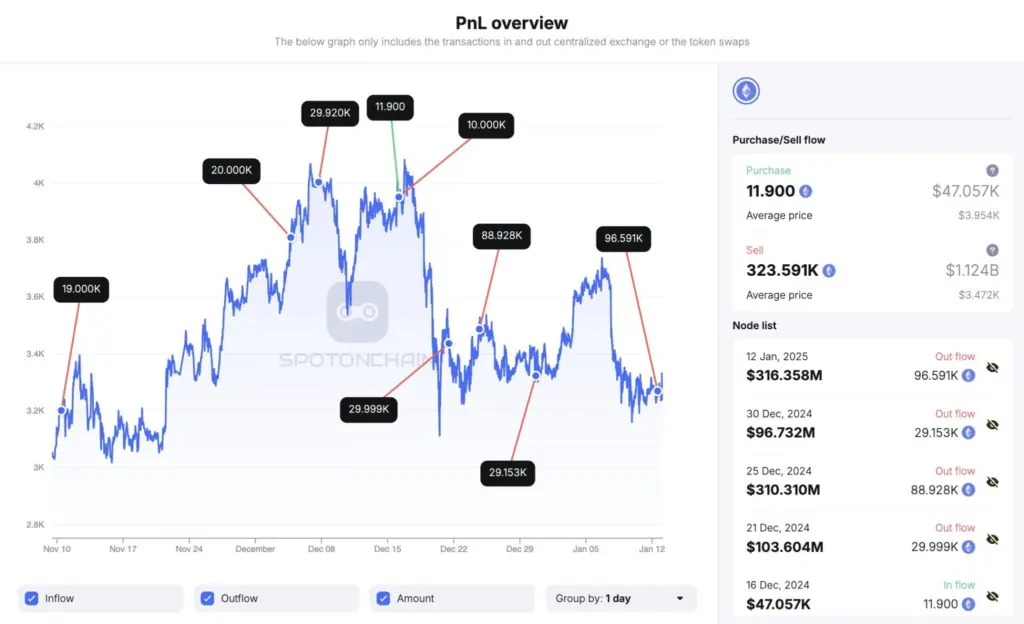

Additionally, Justin Sun, the founder of Tron, deposited $320.4 million in Ethereum to the crypto exchange HTX within the past 13 hours, according to data from Spot On Chain. Sun has deposited 323,591 ETH worth $1.124 billion to HTX since November 10, 2024, with an average of $3,472. Most of these ETH were accumulated at $3,036 during the first half of 2024.

The supply of ETH has reached the pre-merger levels

A prominent crypto analyst, Benjamin Cowen, predicted that the Ethereum supply will likely reach pre-merge levels within the next few weeks. Ethereum’s supply is currently at 45K ETH per month and is only 32K ETF from the pre-merge levels.

Although the demand for ETH momentarily increased following the initiation of rate cuts, it has since remained modest. Consequently, Ethereum’s supply has been inflationary for the past decade, reversing the deflationary trends initially anticipated following the merger.

Is there a forthcoming price action for ETH?

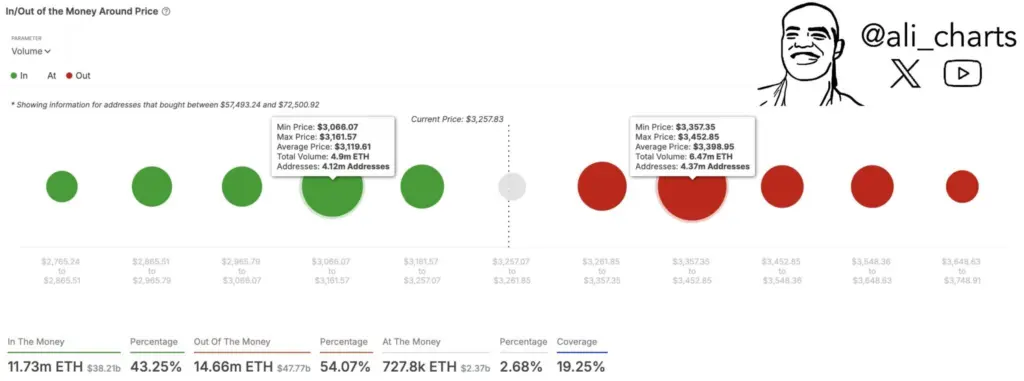

Ethereum’s price is experiencing downward pressure, with an additional 2.6% decline in the past 24 hours. It is currently trading at $3,186.04 and has a market capitalization of $383 billion. Ali Martinez, a prominent crypto analyst, observed that the most critical resistance zone for Ethereum (ETH) is between $3,360 and $3,450.

Key support levels for the price of ETH have been identified between $3,066 and $3,160 on the downside, which serves as essential benchmarks for traders navigating the market.

Crypto market analysts remain optimistic about Ethereum’s prospects for 2025 despite the significant Ethereum selloff by billionaires. A well-known crypto analyst, Altcoin Sherpa, has suggested that ETH’s price may adhere to a famous market cycle pattern. The analyst emphasizes three critical phases:

Red Zone: Denotes liquidations.

Yellow Zone: This indicates a rapid “V-shaped” recovery, ultimately leading to a lower maximum on shorter timeframes (LTF).

Yellow Circle: Indicates a potential upward trend, which a retest of previous lows may follow.

Some market analysts have predicted that Ethereum could surpass $10,000 by mid-2025. Nevertheless, the general sentiment regarding this must shift toward optimism due to a decrease in Ethereum whales’ selloffs.