EU officials warned Thursday that electric vehicle (EVs) imports from China will be taxed up to 37.6% from Friday, escalating trade tensions with Beijing

Nevertheless, there is a four-month period during which the tariffs are only provisional, and the two parties are anticipated to engage in extensive negotiations.

The European Commission’s provisional duties, which range from 17.4% to 37.6% without backdating, are intended to avert a potential deluge of low-cost electric vehicles (EVs) that are subsidized by the state, as stated by its president, Ursula von der Leyen.

The tariffs are nearly identical to those the Commission announced on June 12. Companies identified minor calculation errors in the initial disclosure, prompting the executive to make minor adjustments.

At that time, Beijing declared it would implement “all appropriate measures” to protect China’s interests.

These could encompass retaliatory tariffs on the export of products such as pork or cognac to China.

Roughly four additional months are remaining in the EU’s anti-subsidy investigation.

The Commission, the EU’s executive arm, could propose “definite duties” after the process, which would typically apply for five years. EU members would then deliberate on these proposals.

On Thursday, China’s commerce ministry announced that the two parties have engaged in numerous technical discussions regarding tariffs.

“There is still a four-month window before arbitration, and we hope that the European and Chinese sides will move in the same direction, show sincerity, and push forward with the consultation process as soon as possible,” He Yadong, a ministry representative, stated.

The EU announced on Thursday that BYD, Geely (GEELY.UL), and SAIC will be subject to duties of 17.4%, 19.9%, and 37.6%, respectively. These are in addition to the standard 10% duty on car imports in the EU.

Western carmakers Tesla and BMW, which the EU considers to have cooperated with the anti-subsidy investigation, will be subject to 20.8% tariffs, while those that did not cooperate will be subject to a rate of 37.6%.

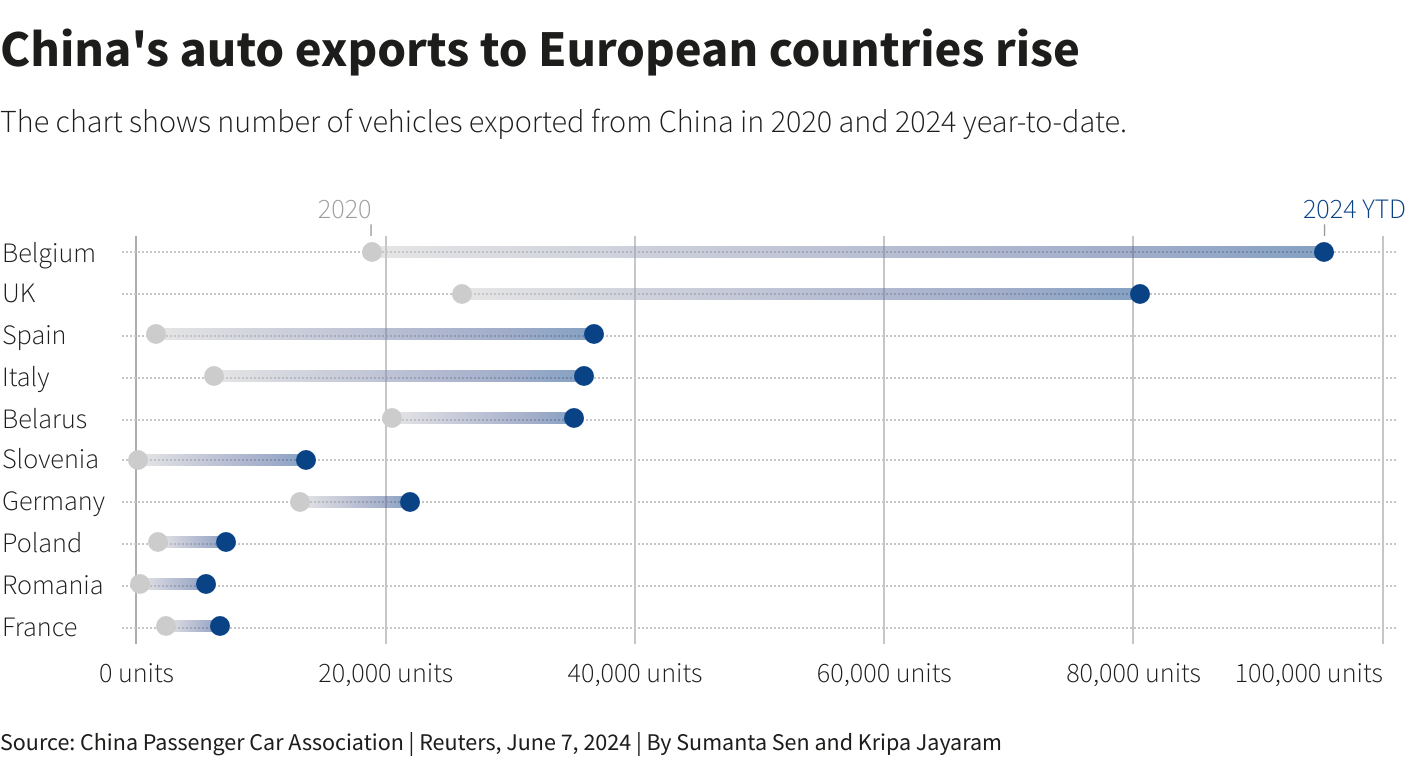

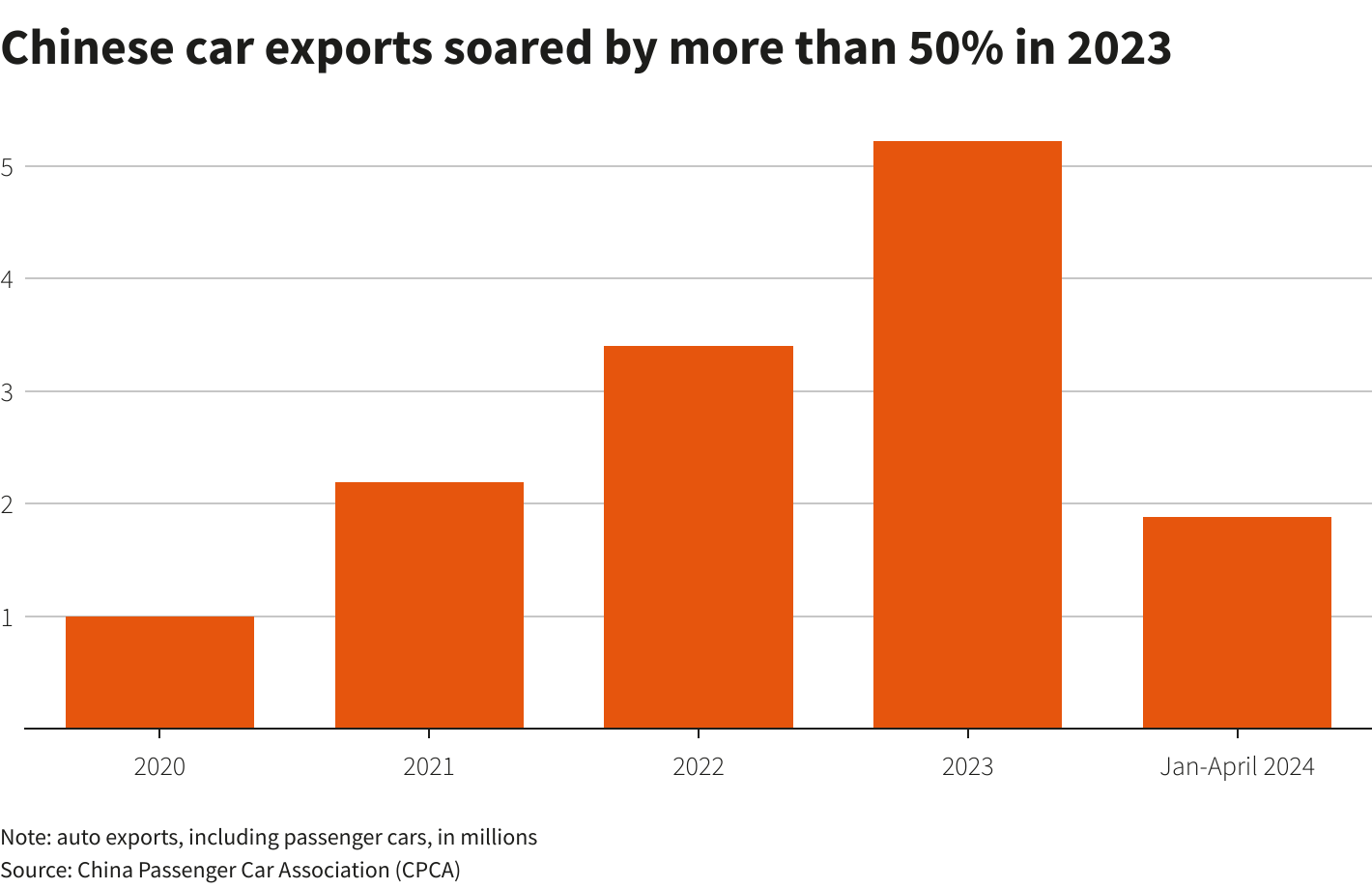

According to the Commission, the proportion of Chinese brands in the EU market has increased from less than 1% in 2019 to 8%, which is anticipated to reach 15% by 2025. According to the source, the prices are generally 20% lower than those of EU-made variants.

European policymakers are eager to prevent a recurrence of the solar panel crisis of a decade ago, in which the EU implemented only limited measures to restrict Chinese imports, resulting in the bankruptcy of numerous European manufacturers. In October last year, the European Union initiated an anti-subsidy investigation into Chinese electric vehicles (EVs).

The tariffs will have only a modest impact on the preponderance of Chinese firms, according to the Chinese Passenger Car Association.

The rates are significantly lower than the 100% tariff that Washington intends to impose on Chinese electric vehicle imports beginning in August.