Eighteen months after a flash loan assault destroyed millions of dollars in the decentralized finance protocol, Euler Finance introduced a modular credit layer.

A development kit for implementing ERC-4626 vaults with configurable lending risk management features, called Euler v2, has been made available by Euler Labs.

The credit layer, or Euler v2, is a development kit that enables users to create and manage loan risks in ERC-4626 vaults. According to Michael Bentley, CEO of Euler Labs, “The solution allows users to choose between risk-isolated lending pairs or cross-collateralized vault clusters, as well as passive lending or fixed-parameter vaults.” As per his statement:

“Euler v2 is built to be as adaptable as possible. Its modular design allows for the creation of markets with various risk parameters and collaterals, some of which are more resistant to volatile market conditions.”

On Euler v2, vaults can store natively minted synthetic assets, tokenized real-world assets (RWAs), and non-fungible tokens (NFTs). Vaults are agnostic about governance, risk management mechanisms, and asset price.

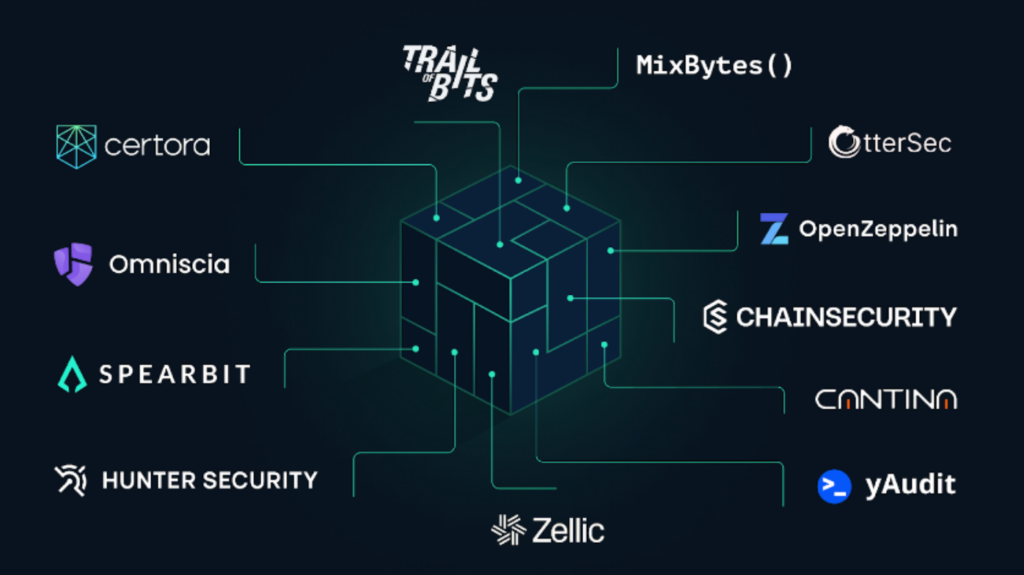

The protocol states that twelve distinct cybersecurity firms have audited Euler v2, producing thirty-one audit reports. Additionally, the protocol hosted a public bug bounty of $1.25 million following the audit, but no medium- or higher-severity vulnerabilities were found. According to an earlier statement, $4 million has been used to secure Euler before its debut.

Users should conduct due diligence before interacting with any vault and review the specifics of each market, as each one has its own set of hazards. Bentley clarified, “You should be controlling your own risk if you use an ungoverned vault.

In March 2023, a flash loan attack using Euler v1 gained $195 million; however, the attacker later repaid all of the money. An attacker can manipulate asset prices in a single transaction by taking out a big, uncollateralized loan and repaying it immediately in a flash loan hack. The transient pricing fluctuations benefit the attacker.

The hacker employed two accounts in Euler’s attack: the first took advantage of a “donate” mechanism in the protocol to intentionally lower the collateral value of the account and cause a default. Then, using Euler v1’s liquidation discounts, the second account liquidated the first, gaining more assets than were lost.

“DeFi poses significant dangers, and the audit of Euler v1 was thorough. After his exploit the previous year, Euler emerged sharper and more determined. Regarding the security incident, Bentley stated, “We recovered all user assets and got them back into the hands of those who lost them, which was a remarkable feat.”

DefiLlama data indicates that Euler has about $343,000 in borrowed funds and $3.5 million in total value locked up. Over the last three years, the protocol has raised more than $40 million from several investors.