BitMEX co-founder Arthur Hayes suggests the recent Fed rate cut by the US Federal Reserve was likely driven by politics and could impact markets and inflation.

According to the former head of BitMEX, Kamala Harris, a presidential contender, has benefited from actions taken by the Fed.

Speaking to Cointelegraph at Token2049 in Singapore on September 18 at Token2049 in Singapore, Hayes discussed his observations on the Fed’s latest move and speculated that it might be a part of an attempt to strengthen support for the Democratic Party:

“I have a macro view that Jerome Powell [Federal Reserve chair] and Janet Yellen [Treasury secretary] want to juice financial markets to help Kamala Harris win the election.”

The US Federal Reserve lowered interest rates by 50 basis points on September 18, a move that experts and investors highly anticipated.

According to Hayes, this might significantly impact the conventional and cryptocurrency markets, as well as possible long-term repercussions for inflation and financial stability.

He drew attention to a discrepancy between the fed rate reduction and the state of the US economy, pointing out that while unemployment is still low by historical standards, the US economy is seeing robust GDP growth.

He contended that government borrowing costs should be reduced to ease worries about careless spending:

“I believe that they’re trying to get markets to go even higher, to make people feel even wealthier as they go into the ballot box in November, and inflation is going to accelerate after this point.”

He commented, “I think it’s the calm before the storm,” regarding the cryptocurrency market’s response to the reduction, which saw a 4% increase and foresaw a delayed response after the regular financial markets closed on Friday.

“What seems to happen is you get the initial reaction and then the real reaction is going into the close on Friday for TradFi markets, and then crypto follows up either up or down over the weekend.”

Since the Fed’s decision, the cryptocurrency markets have increased by $100 billion, with Bitcoin BTC$61,982 recovering its three-week high of $62,500 in early trade on September 19.

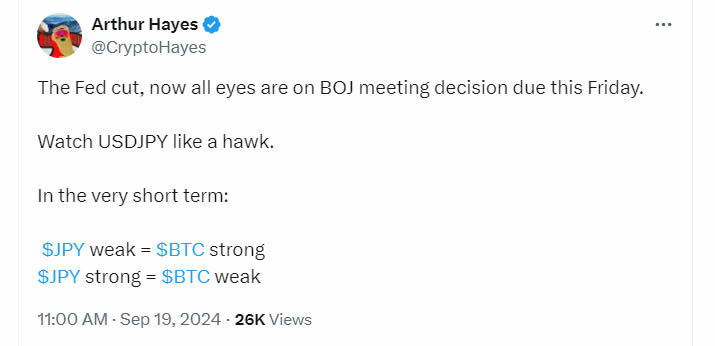

Hayes stated in a September 19 X post that the Bank of Japan is the focus of attention right now since it will decide on interest rates on Friday, September 20. He stated that a stronger Bitcoin will follow a lower Japanese yen.

However, he said that shortly, the values of Bitcoin and other assets might be under pressure due to a strengthening yen and the unwinding of yen carry bets.

In the meantime, Hayes criticized the Fed for lowering rates amid rising US dollar issuance and rising government spending, calling it a “colossal mistake,” in a keynote address at the Singapore crypto convention.

Hayes stated earlier in September that fed rate reductions will only benefit cryptocurrency if investors shift their money from US Treasury bills to reverse repos with greater yields.

It was not realized that he had lately anticipated a significant decline in Bitcoin prices below $50,000. A few days later, having closed and made money on a short position, Hayes forecasted a Bitcoin surge.