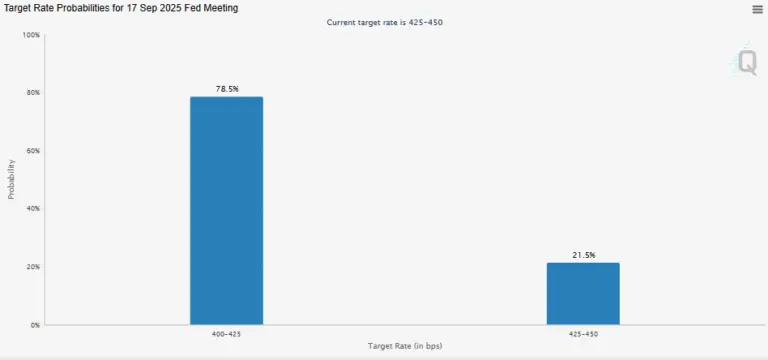

A Fed rate cut is likely in September with 78.5% odds, as CME FedWatch sees a 25-bps drop as a key economic moment.

With market forecasts strongly favoring a 25 basis point rate drop, the Federal Reserve’s September interest rate decision is expected to be a pivotal point for the economy.

The probability of a Fed rate cut has increased to 78.5% as a result of worries about economic growth raised by the dismal July jobs report.

In September, Will Fed Cut Interest Rates?

The US Fed’s September action is the focus of attention, following its recent decision in July to maintain the interest rate at 4.25% to 4.5%.

Traders are placing bets that the Fed will act quickly to address the new weakness because job creation numbers have been continuously below projections.

The likelihood of a 25 basis point drop is currently higher, according to CME Group’s Fed futures.

The crypto community on the X platform is optimistic about the increased likelihood of a rate drop next month due to the disappointing nonfarm payroll data, based on insights from the CME Group’s Fed futures data.

It’s interesting to note that the Fed rate cut odds decrease were 89.1% earlier today, suggesting that one is likely.

But the likelihood of a Fed rate cut in September 2025 has decreased to 78.5%, reducing the current spike.

The Fed has only a 21.5% chance of keeping interest rates the same.

Notably, the Fed has held interest rates steady at 4.25% to 4.50% for five straight meetings since December 2024.

However, a dismal July 2025 jobs report drastically altered market expectations.

The probability of a Fed rate cut in September was about 39% before the publication, but it jumped to almost 80% after that.

This sharp change demonstrates how sensitive the market is to fresh economic information and how it could affect monetary policy choices.

According to CoinGape, even with today’s drop, the likelihood of a rate cut is still much higher than the 39% chance observed only a week ago.

At the September FOMC meeting, the likelihood of the Fed maintaining interest rates at their current level was a higher 60.8%.

Is Half-Point Rate Cut Coming?

According to BlackRock CIO Rick Rieder, a hypothetical 50-basis-point interest rate decrease in September is feasible, even if the CME Group’s FedWatch tool indicates that a 25-basis-point cut is likely.

The US Bureau of Labor Statistics stated that nonfarm payrolls grew by 73,000 in July, far less than the anticipated 147,000, as CoinGape reported on August 1.

By the end of 2025, according to Rieder, the US Fed will relax monetary policy.

In reaction to inflationary pressures and patterns in consumer spending, he projects two to three Fed rate cut in 2025.

This prediction is consistent with the institutional market outlook of BlackRock, which predicts that rate decreases will resume in the fourth quarter.

It is anticipated that the Fed will take a more accommodating approach, giving economic expansion and full employment priority.