Fed’s Bowman urges September rate cut, citing weak job growth of 73,000 in July and revised lower payrolls.

The U.S. labor market is softening, and Fed Governor Michelle Bowman is advocating for a rate cut in September. A reduction in the Federal Reserve’s interest rate is substantial, given its potential benefits on the cryptocurrency market. Recent data indicate that FOMC rates will likely decrease at the September meeting.

Michelle Bowman Urges the Federal Open Market Committee (FOMC) to Implement a Federal Funds Rate Cut in September

The Fed Governor encouraged her fellow FOMC members to commence the process of reducing rates at the September meeting, which is scheduled to take place between September 16 and 17. Bloomberg reported this information. She asserted that this action would prevent further deterioration of labor market conditions. Bowman further stated that this action will prevent the necessity of implementing more substantial reductions in the event of a decline in the labor market.

As previously stated, the July nonfarm payrolls in the United States increased to 73,000, significantly lower than anticipated. The downward revisions of May and June figures exacerbated further concerns regarding the labor market’s softening. Since then, the probability of a September Federal Reserve rate cut has increased significantly, reaching 94%.

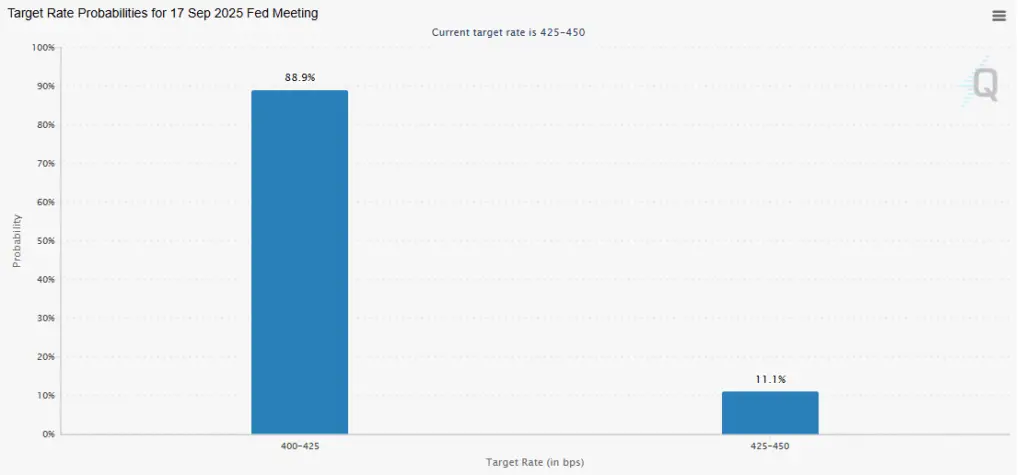

The odds are presently at 88.9%, according to CME FedWatch data, suggesting that the FOMC is likely to reduce rates. This is a positive development for the cryptocurrency market, as rate decreases increase liquidity and risk-on sentiment.

In the interim, it is essential to note that Michelle Bowman and her colleague, Fed Governor Chris Waller, were the sole individuals to vote in favor of a 25-basis-point (bps) Fed rate cut at the July FOMC meeting. It appears that additional FOMC members are inclined to support a rate reduction.

Neel Kashkari, the President of the Minneapolis Federal Reserve, indicated that the time may be ripe to begin reducing rates. Mary Daly, the President of the Federal Reserve Bank of San Francisco, had also recently expressed a comparable sentiment.

Bowman anticipates three cuts this year

The Fed Governor also expressed her support for three Fed rate cuts this year, which implies that she could vote in favor of a cut at the remaining three meetings this year, which are scheduled for September, October, and December. She observed that the labor market data is weak, corroborating her assertion that multiple rate decreases should exist. Daly also indicated that it may be necessary to implement three cutbacks.

In the interim, Bowman downplayed the level of concern regarding the inflationary effects of the Trump tariffs. The Fed Governor reiterated that tariff-driven price rises were unlikely to increase inflation, as Fed Chair Jerome Powell suggested. She believes the primary focus should be on the labor market’s deficit, as inflation continues to decline toward the target of 2%.

Kashkari also acknowledged that the Trump tariffs have not had the anticipated significant impact on inflation and that it may be more prudent to reduce rates rather than wait to determine the long-term effects of the tariffs. For some time, the Federal Reserve has been following a wait-and-see strategy before implementing a rate cut. However, the labor market’s weakness may necessitate a change in this approach at the September meeting.