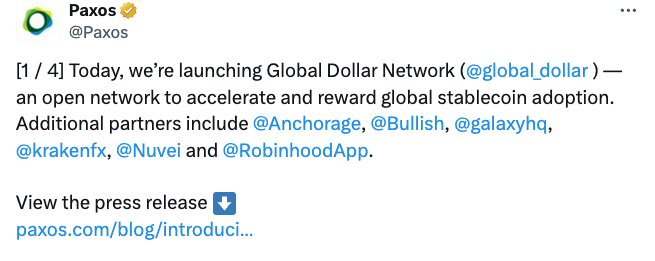

Major banking firms launched the Global Dollar Network, a regulated platform designed to accelerate stablecoin adoption worldwide.

Crypto and traditional banking firms, such as Paxos, Galaxy Digital, Kraken, and Robinhood, have joined forces to support the newest stablecoin based on the US dollar.

Paxos, a blockchain infrastructure company, announced on November 5 that the new “open network” was intended to hasten stablecoin adoption and usage globally.

“The regulated stablecoin market’s lack of competition has kept the sector from realizing its full potential. In a statement, Kraken co-CEO Arjun Sethi said, “USDG upends this dynamic with a more equitable model that will bring mainstream participants into the ecosystem and accelerate new stablecoin use cases.”

The network is meant to facilitate the widespread use of Paxos’ USDG stablecoin, which the company introduced on November 1.

Although USDG is exclusively accessible on the Ethereum blockchain, Paxos stated that as regulations change, the stablecoin will eventually be accessible on other chains.

The USDG stablecoin, which Paxos plans to issue from Singapore, is “substantially compliant” with the Monetary Authority of Singapore’s future stablecoin framework, which was set up in August 2023, according to the company.

Custodians, exchanges, and fintech companies are among the qualified businesses that will be invited to join the Global Dollar Network.

The company stated that DBS Bank, Singapore’s biggest bank, will reserve and oversee the stablecoin’s US dollar backings. Users can exchange their tokens for currency because USDG is backed 1:1 with the US dollar in dollar deposits, short-duration US government securities, and other cash equivalents.

Regarding the USDG launch, Ronak Daya, head of product at Paxos, stated that the DBS alliance will make enterprise-level stablecoin adoption possible.

Additional digital asset offerings from Paxos include Pax Dollar (USDP), PayPal USD PYUSD $0.9986, and Pax Gold (PAXG).

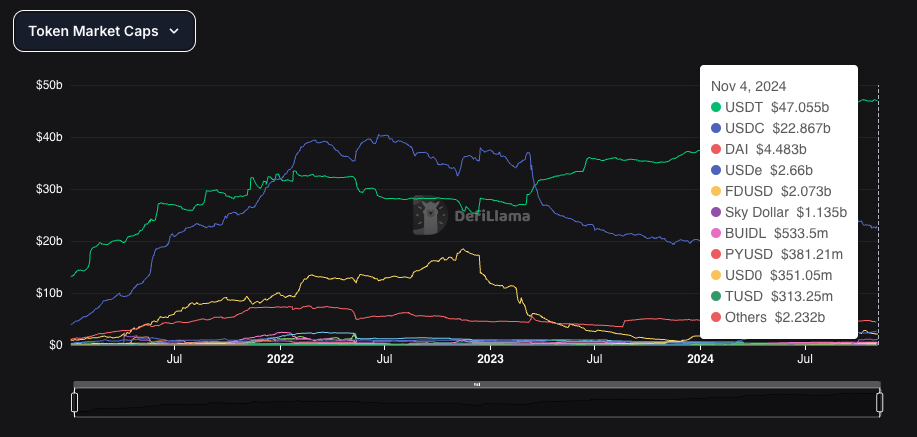

According to DefiLlama data, the two leading stablecoin issuers, Tether USDT$0.9993 and Circle’s USD Coin USDC$1.00, control 56% and 27% of the stablecoin supply on Ethereum, respectively, and will dominate the market in which the USDG stablecoin and its Global Dollar Network will debut.