First Digital CEO has expressed optimism that Hong Kong will speed up the country’s crypto regulation and other digital assets.

Hong Kong has only two licensed virtual asset trading platforms: Hash Blockchain and OSL Digital Securities.

The city is striving to establish itself as a global hub for cryptocurrency. Numerous additional cryptocurrency exchanges are still anticipating the issuance of complete operational licenses in the city.

In an exclusive interview with Cointelegraph, Vincent Chok, CEO of First Digital, explained that Hong Kong’s current regulatory approach to trading is more conservative and delayed than some other jurisdictions, as it prioritizes investor protection. Nevertheless, he emphasized:

“We hope to see regulation move faster to ensure it does not fall behind the industry’s fast pace of development.”

Starting on June 1, operating an unlicensed virtual asset trading platform (VATP) became a criminal offense in Hong Kong. In the interim, the Securities and Futures Commission of Hong Kong issued an “alert list” identifying “suspicious virtual asset trading platforms” or unlicensed entities operating in the city. SFC stated that these entities may be planning to target investors in Hong Kong.

Hong Kong is not prepared to regulate USD-backed stablecoins

First Digital Trust, on the KPMG and HSBC list of Emerging Giants in Asia Pacific for 2022, thinks that Hong Kong still needs to prepare to regulate USD-denominated stablecoins, unlike Dubai, which has a more global approach.

Chok stated, “We anticipate that Hong Kong will implement regulations for USD-denominated stablecoins soon.”

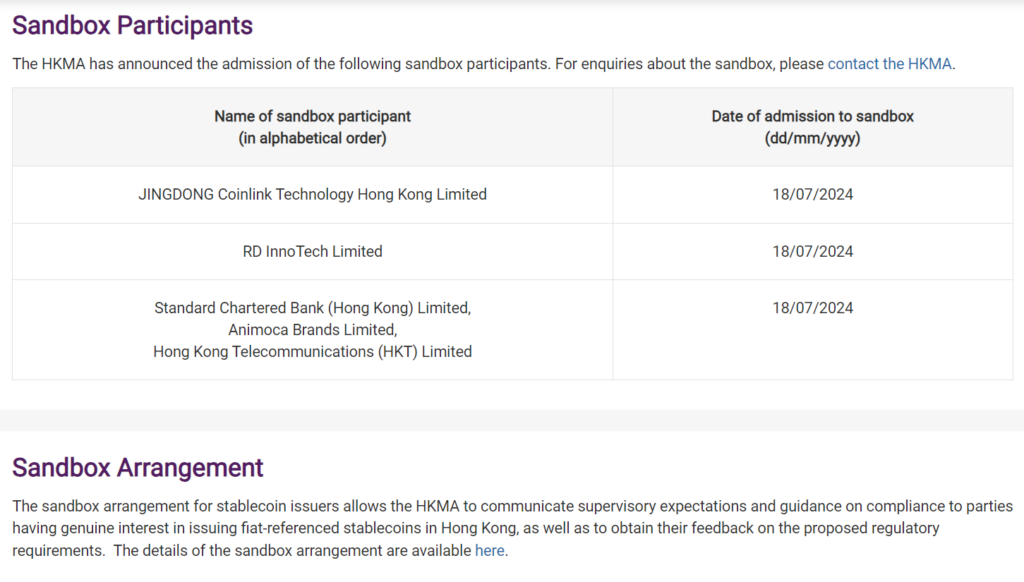

Source: Hong Kong Monetary Authority

Jingdong Coinlink Technology Hong Kong Limited, a subsidiary of JD Technology Group, disclosed its intention to introduce a 1:1 stablecoin equivalent to the Hong Kong dollar (HKD) on July 24. Recognized as one of the participants in The Sandbox program by the Hong Kong Monetary Authority (HKMA).

Lenders are quick to provide crypto custody services

Additionally, Chok does not anticipate that banks will expedite the provision of digital asset custody services soon. He stated, “There is more liability than their risk appetite.”

Additionally, Chok asserts that numerous organizations with established trust structures that provide crypto custody services have already intervened to address this deficiency.

The United Arab Emirates, on the other hand, recently granted Standard Chartered the ability to provide crypto custody services. The bank announced on September 10 that it would commence its digital asset custody service with Bitcoin and Ether.

The bank has commenced its custody services in collaboration with Brevan Howard Digital, the cryptocurrency division of the hedge fund Brevan Howard.

Hong Kong Sets a new standard for financial system integration by incorporating Web3 technology

The city is progressing in other aspects of Web3, such as tokenizing real-world assets and applications in central bank digital currencies (CBDCs). However, the sluggish licensing regime for digital asset trading services could be more active.

“It is intriguing to observe that the BTC and ETH exchange-traded funds in Hong Kong offer a distinctive ‘in-kind’ subscription mechanism that enables direct subscription and redemption using BTC and ETH.” Chok stated, “This innovative structure provides investors with a straightforward and adaptable investment process.” He elaborated, saying:

“Hong Kong’s Trust and Company Service Provider licensing also allows for trust structures to hold digital assets, which is a favorable and unique feature compared to other jurisdictions. This robust regime not only paves the way for custody services but also sophisticated services associated with it such as legacy management.”

Initiatives, including the HKMA’s Project Ensemble regulatory laboratory, facilitate tokenizing real-world assets and interbank settlement using tokenized money.

The HKMA unveiled the Project Ensemble simulator on August 28. This initiative investigates the tokenization of real-world assets and interbank settlements through a wholesale central bank digital currency (wCBDC). HKMA stated that the project’s objective is to examine the technical interoperability of tokenized assets, tokenized deposits, and a wCBDC.

The culmination of numerous prior initiatives is Project Ensemble. These include settlement experiments involving the HKMA’s pilot e-HKD CBDC for transactions between HSBC and Hang Seng Bank and tokenized deposit settlements with HSBC using Ant Group technology.